Ethereum Price Prediction: Get ready for a Wall Street discount pt.2

- Ethereum price has fallen 17% in nearly free-fall fashion, key levels have been identified.

- ETH price has breached through both the 8-and 21-day simple moving averages.

- The safest invalidation of the downtrend scenario is if the bulls can accomplish a second attempt at the $2,030 level.

Ethereum price profit-taking consilidation has morphed into a in an all-out seller's frenzy. Still a potential knife-catching opportunity could present itself at lower targets..

Ethereum price heads south

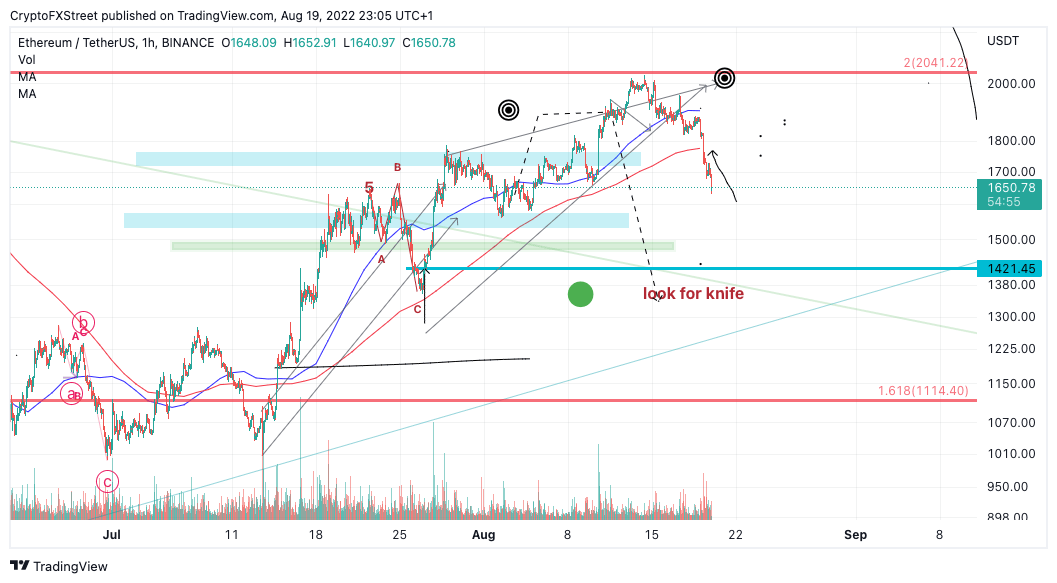

Ethereum price has finally revealed its cards as the bears have flexed a 17% decline. In doing so, the bears have successfully breached through an ascending wedge, a major confluence signal for sidelined bears to enter the market.

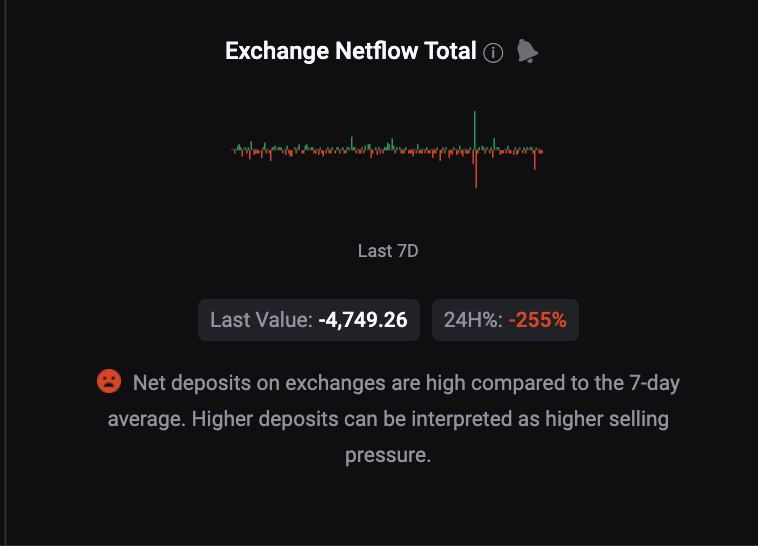

In part 1, while Ethereum treaded turbulently near $1,900, On-chain analysis was used to make sense of the staggard upward progression. Crypto Quant’s Exchange Netflow Total displayed a massive downtick on exchanges. A warning was issued that a massive liquidation was on the way, but unlikely to occur until liquidity levels were tagged near $2,020.

The Ethereum price rallied into a high at $2,030 on Saturday 8/12 before it commenced the anticipated demise. Ethereum price currently auctions at $1687 as the bears have successfully reached through the 8-the 21-day moving averages. A pull back into the breached barriers could occur throughout the weekend. However, auction market theory would suggest a retracement into the liquidity levels at $1571 and $1450 as a high possibility of occurring one way or another. The Volume Profile Indicator confounds the bearish outlook as a ramping influx of selling pressure has been displayed on the 1-hour time frame.

BTC/USDT 1-Hour Chart

The safest invalidation of the downtrend scenario is if the bulls can accomplish a second attempt at the $2030 level. However, bulls looking to take a risk could look to catch a knife in the 1370-$1420 zone in the coming days with an invalidation marker at $1270. The pullback targets could be as high as $1,984.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.