Ethereum Price Prediction: Get ready for a Wall Street discount

- Ethereum price breaches target one at $1800, which was mentioned in July’s market bottom thesis.

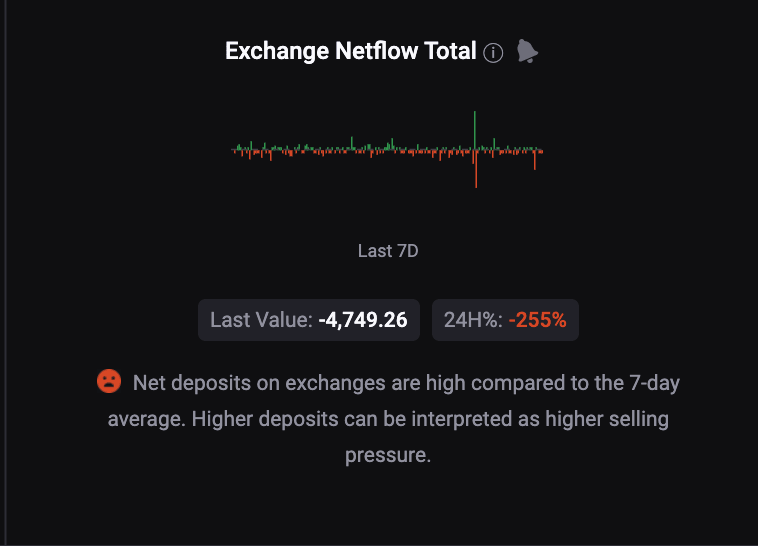

- ETH price shows an influx of deposits on all exchanges.

- The midterm bullish forecasts are dependent on $1250 holding as support.

Ethereum price shows significant smart money interest. A sharp liquidation could occur before prices move higher.

Ethereum price is preparing for a big move

Ethereum price has displayed applause-worthy strength throughout the last few weeks. Since early June forecasts have called for a potential market bottom with bullish targets between $1800 and $2200.

“If the bears can breach $1536, a spike into $1800 could occur,” was forecasted in July.

ETH/USDT Historical Lows

Ethereum price has validated the early bullish claims as it made its furs contact with the $1800 barrier on Monday August 8, 2022.

Ethereum price currently auctions at $1712 as profit taking near the anticipated target zone unfolds. Although technicals suggest significant strength in the market, a smart money liquidation should be on every trader's radar targeting $1600 and potentially $1540.

CryptoQuant’s On-chain analysis indicators confound with the short-term bearish potentiality. According to the Exchange Net Flow Total indicator, Ethereum price witnessed a massive influx of deposits causing a 255% imbalance in the last 24 hours. According to CryptoQuant, the indicators can be used to gauge selling pressure in the market.

Cyrypto Quant Exchange Netflow Total

CryptoQuants indicators suggest significant smart money involvement around the decentralized smart contract token. Ethereum price could continue rallying higher towards $1900 and potentially $2200 in the weeks to come but the Invalidation level is crucial, ETH price should under no circumstances fall below $1250. In doing so, the macro count would become problematic while dually prompting a demise towards $400, resulting in a 75% decrease from the current Ethereum price.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.

-637956625687028219.png&w=1536&q=95)