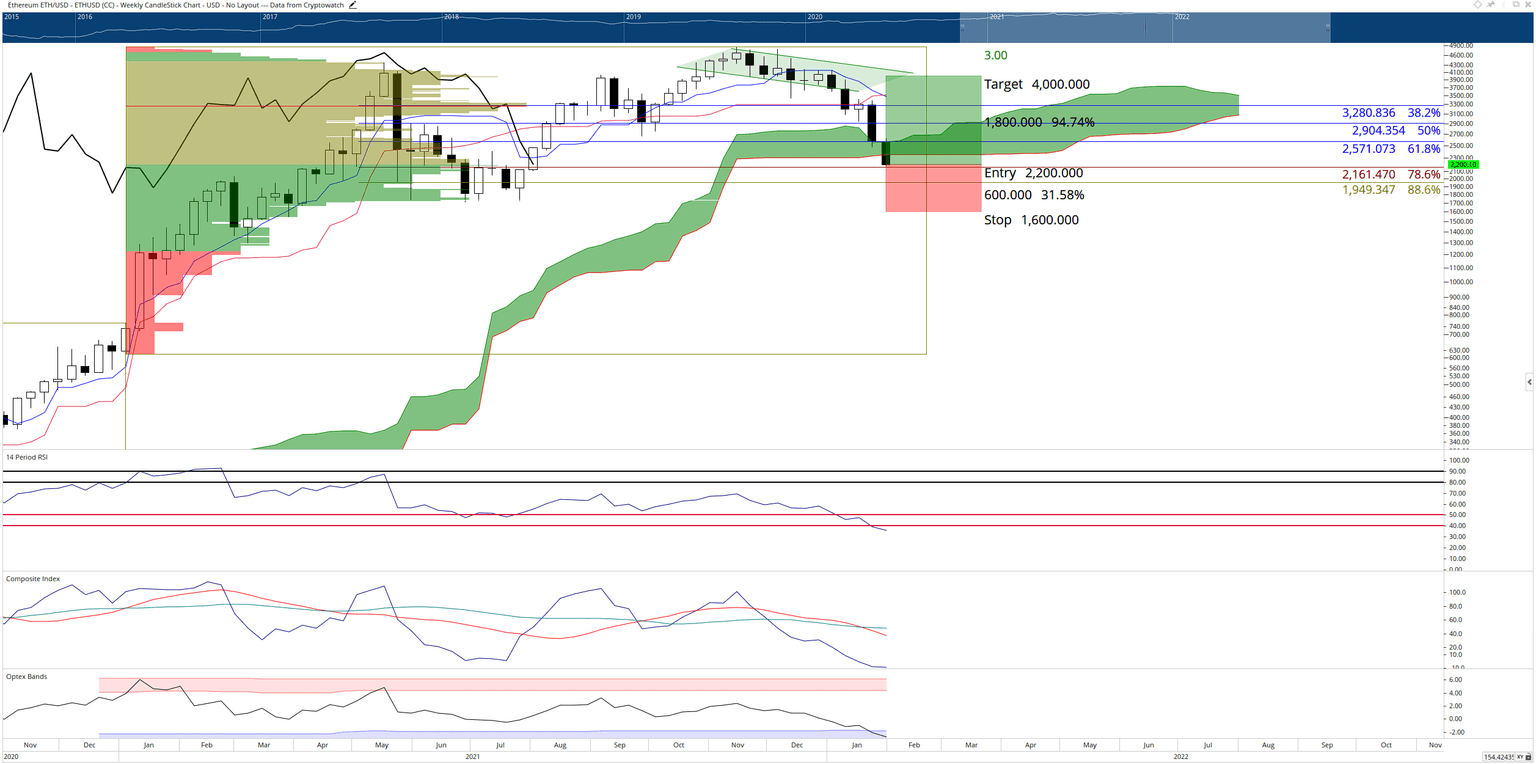

Ethereum Price Prediction: Ethereum could drop to $1,800

- Ethereum price is now down over 50% from the all-time high.

- ETH is close to fulfilling one of the strongest bearish entry conditions in the Ichimoku Kinko Hyo system.

- Any support could trigger a tremendous rally.

Etheruem price action, like the rest of the cryptocurrency market, has been overwhelmingly bearish. Since last Monday, ETH has fallen more than 34% and is currently more than 50% below the all-time high.

Ethereum price must hold the $2,200 value area, or it risks a total capitulation move

Ethereum price has one sliver of support left, preventing a significant sell-off. The only Ichimoku condition keeping Ethereum afloat is the Chikou Span remaining above the body of the candlesticks. If there is a weekly close at $2,100 or lower, all the conditions needed for an Ideal Bearish Ichimoku Breakout short entry will be fulfilled.

However, there are some signs that the current sell-off of Ethereum price may reverse and that any further selling is likely to be considered a ‘false’ move. The Composite Index oscillator has moved into new two-and-a-half-year lows, trading at the same level back in September 2019. At the same time, the Relative Strength Index has fallen just below the final oversold level in a bull market at 30 – it can still move higher during the week and close above 30.

In particular, one oscillator reading best displays the overdone nature of this recent sell-off. The Optex Bands oscillator has fallen into oversold conditions for the first time in its history on the weekly chart. Additionally, the Optex Bands oscillator has also fallen to a level seen since the week of November 9, 2019. In other words, from the perspective of the Optex Bands oscillator, Etheruem price is hugely oversold.

ETH/USD Weekly Ichimoku Kinko Hyo Chart

Failure to hold above $2,100 on the weekly chart would likely trigger a move to the 50% Fibonacci retracement at the $1,800 value area. In addition, a high volume node in the Volume Profile also exists at 1,800, lending more strength to that support zone.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.