Ethereum Price Prediction: ETH/USD rally to $430 overdue – Confluence Detector

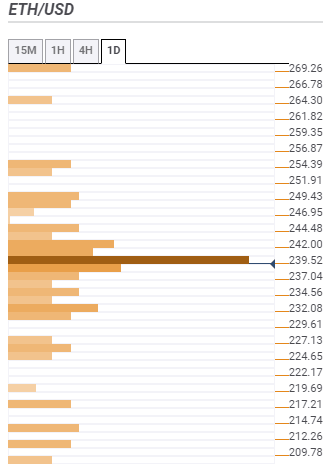

- Ethereum in consolidation as it faces the toughest resistance at $239 as the confluence detector tool.

- ERC-20 tokens market capitalization surpassed that of Ethereum indicating increased blockchain adoption.

- Ethereum is poised for a rally according to a cryptocurrency analyst’s highlighted factors.

Ethereum is still stuck in consolidation under $240. Support is provided by the 50-day SMA and the key ascending trendline. The technical picture is likely to remain unchanged based on applied technical indicators like the RSI, the MACD and the volume indicator.

The MACD is holding tightly to the midline (0.00). It has been pivotal in the same position since the beginning of July. Consequently, the RSI is moving sideways above the average. Unlike the MACD which is flat at the midline, the RSI has a bearish inclination. In other words, sellers are gaining traction in the short term.

ETH/USD daily chart

%20(60)-637304686535556466.png&w=1536&q=95)

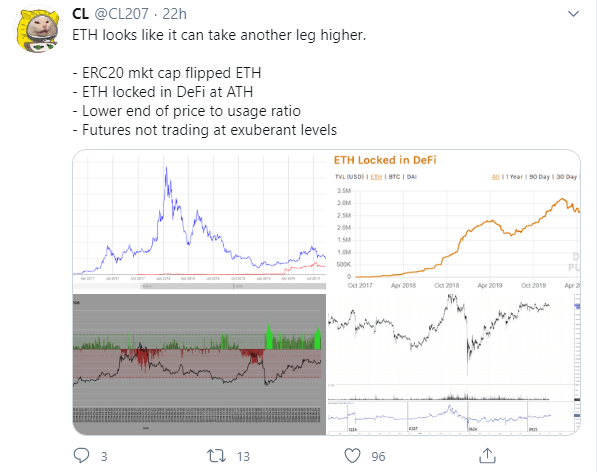

According to a cryptocurrency analyst on Twitter, “ETH looks like it can take another leg higher” in spite of the stalling at $240 and the seller congestion at $245. Some of the factors ‘CL’ the analyst points out in support of a rally include:

- ERC-20 tokens market cap surpasses Ethereum market share: This shows that adoption is on the rise highlighting the importance of Ethereum as a blockchain solution provider.

- DeFi boom: The amount of Ether coins locked in the decentralized finance ecosystem has hit an all-time high of 3.4 million as per the data released by DefiPulse. In other words, over 2.5% of the Ethereum circulating supply is locked in DeFi.

- Ethereum is holding at the “lower end of the price to usage ratio” according to data released by analytics platform, Santiment.

- ETH futures contracts trading is currently at levels just a few percentage points past the spot rate.

Ethereum confluence support and resistance levels

According to the confluence tool, Ethereum is facing a single but strongest resistance at $239.52. The zone is home to multiple technical indicators including the previous high 15-minutes, the SMA five 4-hour, the Fibonacci 38.2% one-day, the Bollinger Band 1-hour middle, the SMA 100 15-minutes and the previous high 4-hour among others. Other miles resistance areas above $240 include $242, $244.48 and $249.43. A far as support is concerned, Ethereum is hanging at the edge of a cliff. Only mild support areas can be observed by the tool. Some of them include $237.04, $234.56 and $232.08.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren