- Ethereum bulls are struggling to build upon the support at $400 even as the hurdle at $410 stays put.

- A massive bearish cloud hovers over ETH/USD, especially with the formation of a bearish pennant pattern.

Ethereum appears to have found bearing above $400 following a devastating slump from highs close to $450. Tentative support at $430 and $420 failed to rise to the occasion following a BTC-triggered selloff on Wednesday. The largest cryptoasset tanked from levels above $12,200 and extended the free-fall to areas marginally above $11,500. Ether followed closely in Bitcoin’s footsteps, this time plunging slightly under $400.

ETH/USD has already made a shallow recovery above $400. However, the comeback above $400 is limited under $410. The daily chart brings into the picture a bearish pennant pattern that suggests that ETH is not yet done with the levels under $400.

Ethereum currently trading at $409, after sliding below the pennant pattern. Bulls need to work first and send the price above $410 resistance. This would allow them to shift attention back to $420 and $430 levels respectively, in turn, aiding in averting the potential declines that eye $350 on the downside.

For now, ETH seems to be slightly in the hands of the bulls and slightly in the hands of the bears. The RSI has held above the midline, encouraging buyers not to exit the market. On the flip side, the MACD is grinding lower towards the mean line. Moreover, a vivid bearish divergence from the MACD reinforces the bearish grip. It is essential that bulls defend the support as if their lives depend on it.

ETH/USD daily chart

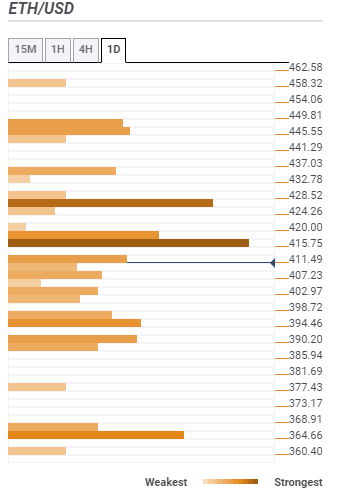

Ethereum confluence levels

Resistance one: $415 – This zone is home to the Fibo 61.8% one-day, Fibo 38.2% one-week, the Bollinger Band 15-minutes upper curve and the SMA ten 4-hour.

Resistance two: $420 – Highlighted by the SMA 200 15-minutes and SMA 50 one-hour.

Resistance three: $428 – Home to the pivot point one-day resistance one, the SMA five one-day and the Fibo 23.6% one-week.

Support one: $407 – As highlighted by the Bollinger Band 15-minutes lower curve, the Fibonacci 38.2% one-day and the previous low 1-hour.

Support two: $402 – The Bollinger Band 4-hour lower curve and the Fibonacci 23.6% one-day.

Support three: $390 – Highlighted by the pivot point one-month resistance one.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

(86)-637334921862982651.png)