Ethereum Price Prediction: ETH under pressure, but not enough to prevent $2,400

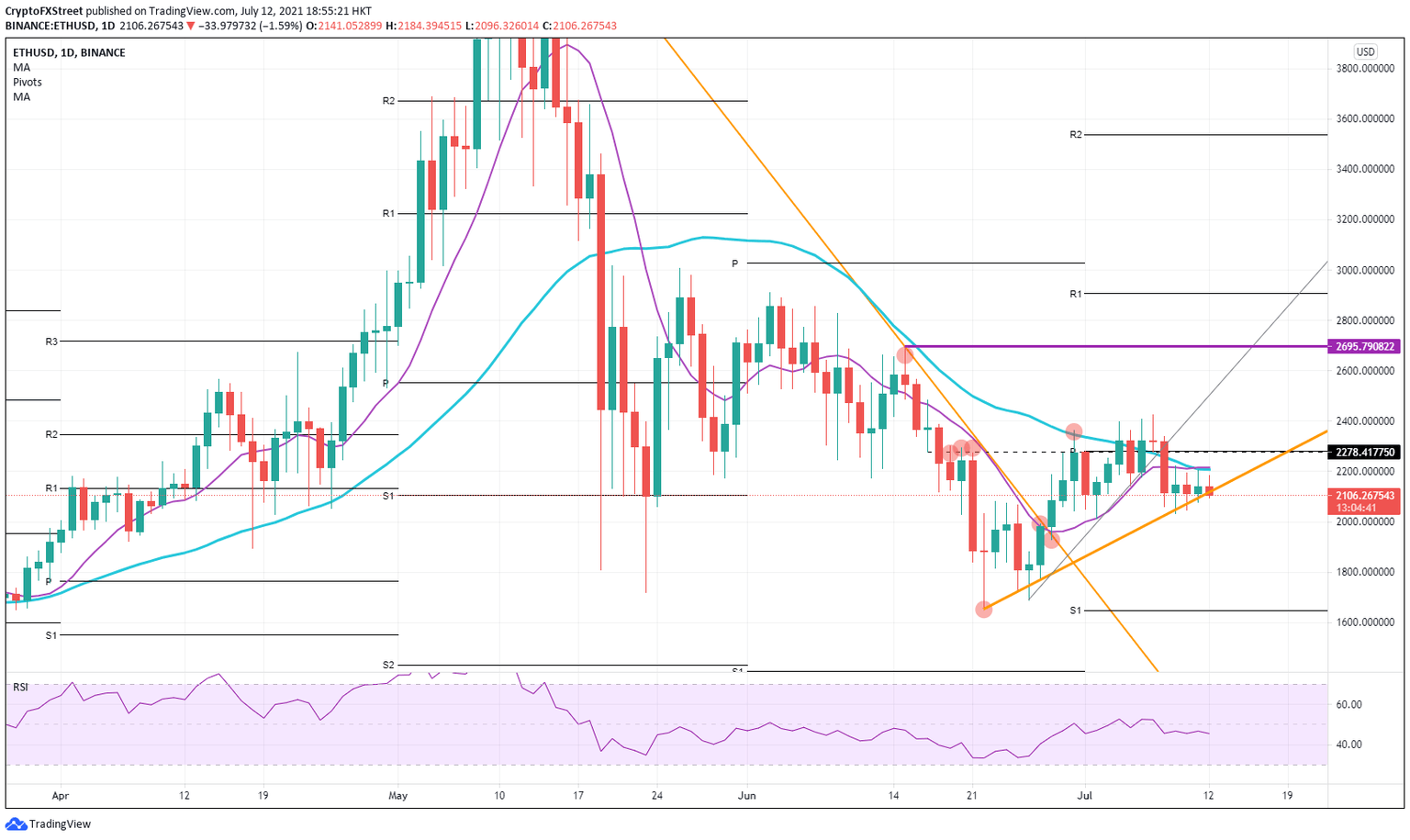

- Ethereum price is under the pressure of both the 55 and 200-day Simple Moving Averages.

- Price action is being squeezed against the orange ascending trend line.

- With risk-on sentiment in the markets, tailwinds should lift ETH above the $2.200-marker.

Ethereum price is struggling to hold gains this morning in a push from sellers to squeeze prices further to the downside. ETH made a 50% recovery from the sell-off in the markets that occurred on Thursday. Since then, it has been trading sideways for four consecutive days.

Ethereum price tailwinds still there for the push toward $2,400

With earnings season just around the corner, Ethereum price is under selling pressure today after the recovery from the past weekend. Prices fell on Thursday in a general risk-off market with safe havens on the rise and risky assets like cryptocurrencies on the chopping block.

Ethereum price paired back 50% of the losses on Friday, but the converging Simple Moving Averages (SMAs) are putting a temporary cap on it.

Sellers are eagerly using this level around $2,200 as an entry point to go short. ETH price is getting squeezed in from the upside by the sellers, and on the downside, it has the ascending orange trend line where buyers are pushing the price back up.

Once Ethereum price can reclaim ground above the SMAs, the road is clear toward $2,400. Any upside will be helped by the tailwind and risk-on sentiment in the markets. But it is vital that the ascending orange trend line holds and keeps pushing price action to the upside.

Should buyers be able to overtake the buying sentiment on the trend line, then a short looks good with profit-taking at $2,000. A possible retest of $1,654 is possible, should market sentiment stay in negative territory for a few consecutive days.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.