- Ethereum price recovered part of the 10% fall from the last week in the last 48 hours to trade at $1,582.

- Buyers are likely to take charge of the price momentum as indicators suggest a rise to $1,700.

- If the bullish momentum fails, a fall below $1,500 would invalidate the bullish thesis.

Ethereum price is pretty much following the king coin Bitcoin’s lead to chart a rise in the last two days. The sudden drop in price suggested a reversal in trend could be incoming, and it did, except not in favor of the bears.

Ethereum price aims for highs

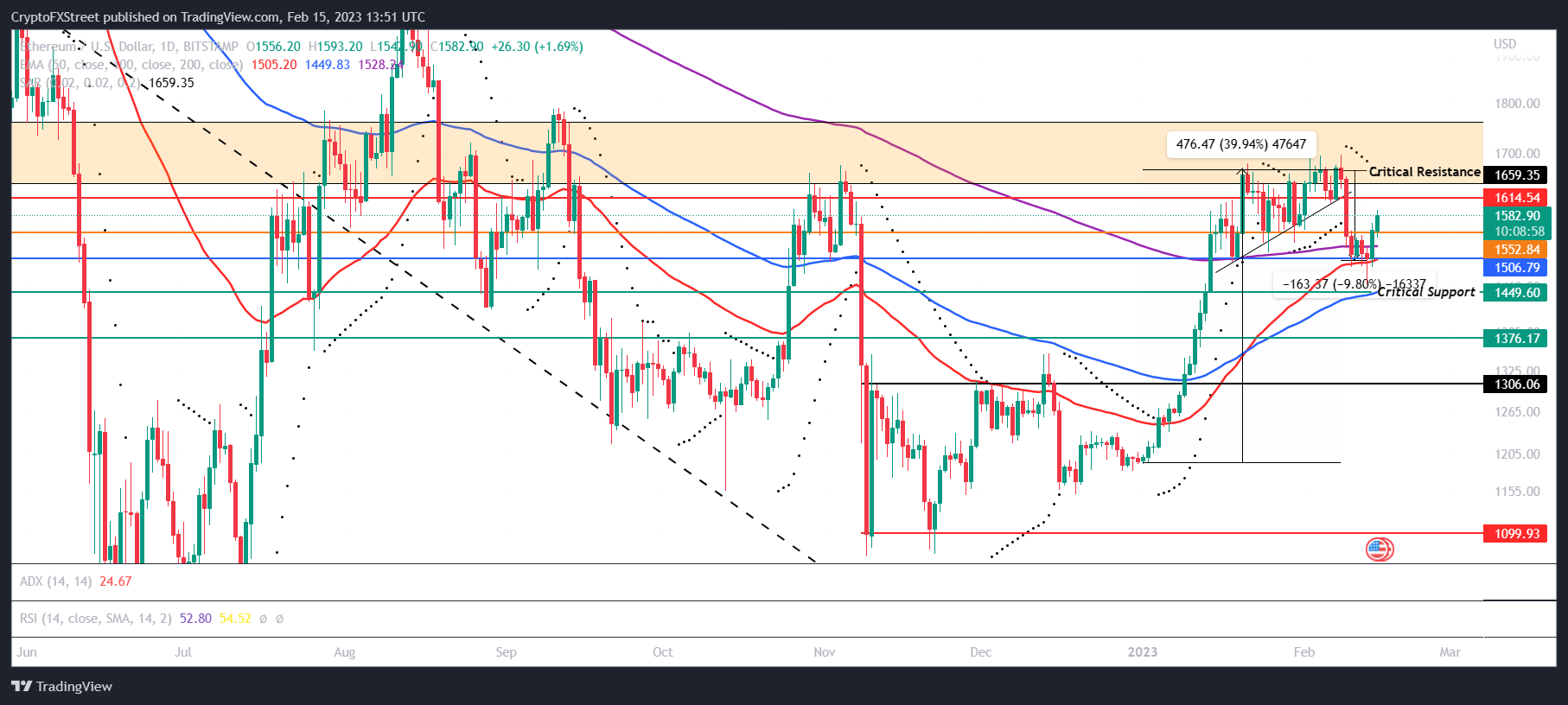

Ethereum price registered a 4.5% increase in value over the previous 48 hours to recover part of the 9.8% loss noted in the last week. Trading at $1,582, ETH is rising back to retest the month-long resistance level at $1,675.

The sudden change in trend from bearish to bullish was unexpected as the Consumer Price Index (CPI) figures came in higher than forecasts. The year-on-year inflation rate came up to 6.4%, while the core CPI stood at 5.6%. But as Bitcoin rose to $22,600, Ethereum price followed suit and is nearing the $1,600 mark.

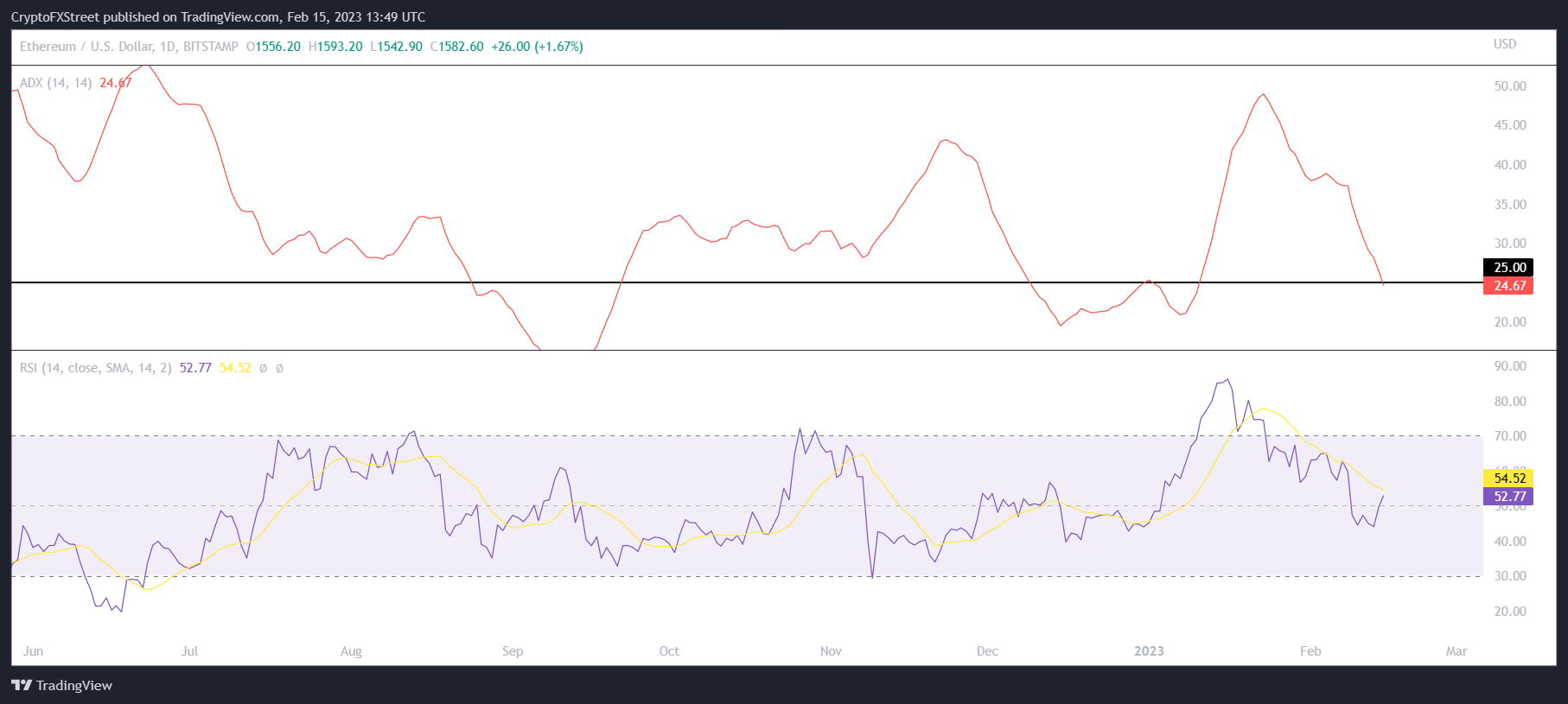

Going forward, price indicators are suggesting Ethereum price could note an uptick, with the Average Directional Index (ADX) slipping below the 25.0 threshold. The indicator is a measure of the strength of the active trend, which in the case of Ethereum, is a downtrend.

This is visible on the Parabolic Stop and Reverse (SAR) indicator, as the presence of black dots above the candlesticks highlights a downtrend. Thus the conclusion is that the downtrend is losing strengt. ETH price, meanwhile, is noting the start of an uptrend over the next few trading sessions.

The Relative Strength Index (RSI) suggests a similar bullish outlook as the indicator climbed back above the 50.0 mark. The presence of the RSI in the bullish neutral zone would likely support a bounce as the neutral line would act as support.

Ethereum RSI and ADX

Thus if Ethereum price follows this path, a breach of the resistance at $1,614 is certain. Flipping the same into support would push ETH to test the month-long critical resistance at $1,675. The altcoin closing above this level would enable a rise toward $1,700, marking a five-month high.

ETH/USD 1-day chart

But if the market reacts negatively and ETH loses its immediate support at $1,552, a drop to $1,506 is likely. Failure to bounce off of this support would push the price to test the critical support at $1,449, and a daily candlestick below this level would invalidate the bullish thesis, resulting in a dip to $1,306.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple's XRP holds symmetrical triangle support as SEC acknowledges Bitwise XRP ETF filings

Ripple's XRP is down 3% on Tuesday despite the Securities and Exchange Commission (SEC) acknowledgment of Bitwise XRP ETF. Unchained Crypto noted that XRP ETF could underperform due to key fundamental issues.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP could decline on FTX repayments pressure

Bitcoin (BTC) price has been consolidating between $94,000 and $100,000 for two weeks. Ethereum (ETH) and Ripple (XRP) faced a pullback earlier this week. BTC, ETH and XRP prices could decline further as FTX repayments could raise selling pressure.

Bitcoin stretches losses as CME premiums dip, Strategy aims to purchase $2 billion worth of BTC

Bitcoin (BTC) continued its downward trend on Tuesday as K33 Research's weekly report indicated growing declines in BTC CME premium and yields. BTC has shown a directionless movement since the presidential election, which suggests waning interest among investors.

How will Dogecoin price react to Elon Musk investigating the US SEC?

Dogecoin price hit $0.25 on Tuesday, plunging 10% in 48 hours as the market reacted to regulatory squabbles between Elon Musk-led D.O.G.E and the US SEC.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.