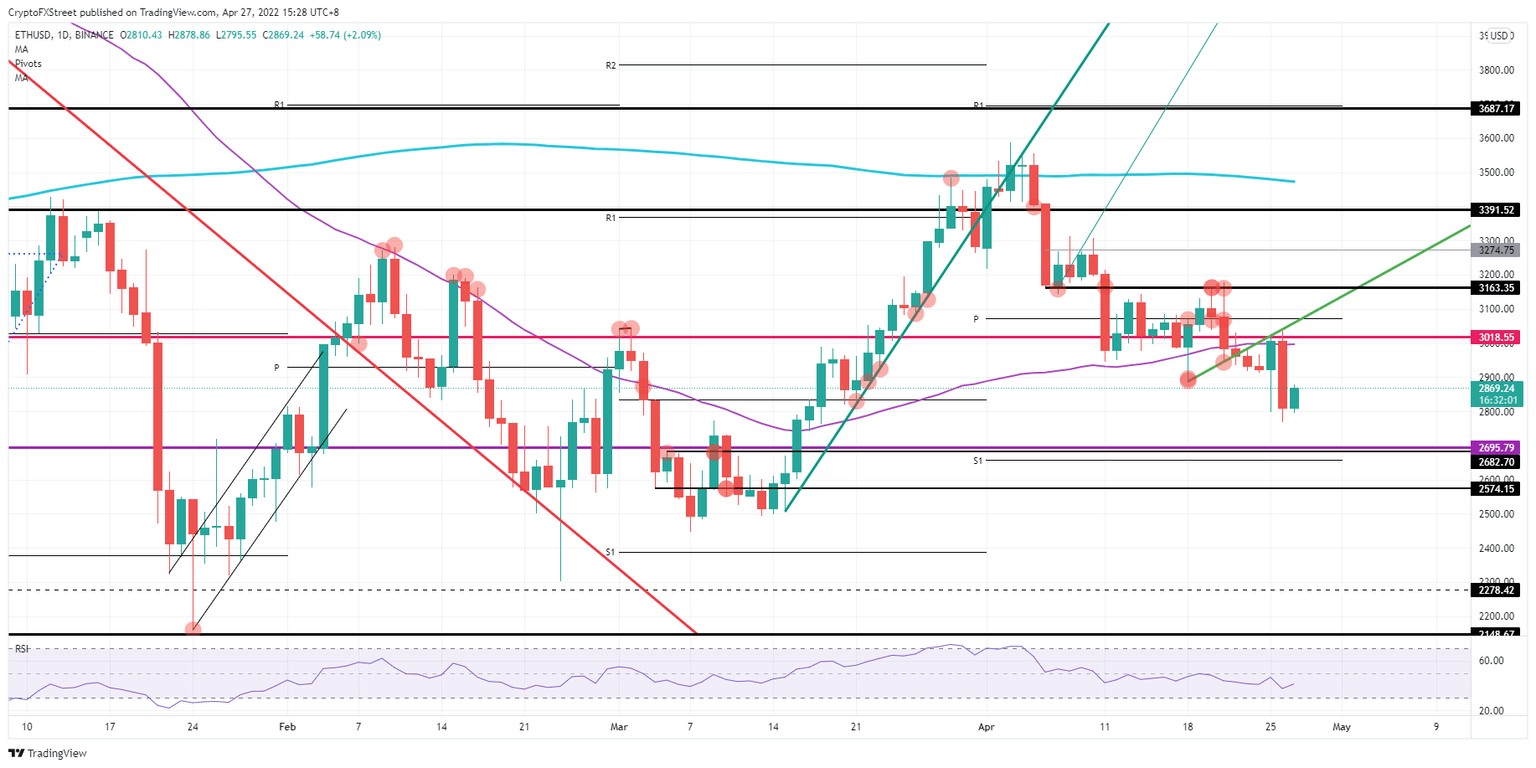

Ethereum Price Prediction: ETH to return to $3,000

- Ethereum price sees investors shaking off disappointing earnings from Google.

- ETH price sees bulls enjoying the discount at $2,800 to build up a long position again.

- Expect to see a rally further towards $3,018 if this rally can continue into Thursday.

Ethereum (ETH) price was not in good shape on Tuesday as it tanked over 6% to the downside and breached below $2,800. But bulls were waiting to rush in and buy ETH at a lucrative discount. The ETH price is up 2.5% in early trading and looks set to swing back to $3,018.55, paring back the incurred losses from Tuesday.

Also read: TELL Stock News: Tellurian drops lower as broader markets sink further into despair

ETH price set to pop 20% in earnings

Ethereum price got a cold shower as Alphabet, Wall Street's favourite tech stock, printed disappointing earnings with Youtube losing market share to Tik Tok. Investors were quick to rebalance and reevaluate the situation, in the end shaking off the news this morning as the earnings are still quite solid, and no significant reports were put out on any losses to come.

ETH price is thus ripe for the picking as it underwent that spillover correction from the disappointment from Alphabet, trading in the ASIA PAC open at a lucrative discount just below $2,800.00. Bulls quickly scooped up parts of the price action and are set to pair back in full the incurred losses of Tuesday, pushing the price back to $3,018.55. From there, it is a small jump to $3,163.35. If earnings in the coming days are reporting positive news, expect even an explosion on the buy-side towards $3,391.52, bearing 20% profit.

ETH/USD daily chart

With facebook earnings set to come out this evening, a turnaround could easily be on the cards. Should Facebook surprise to the downside with trimmed numbers on users and less revenue from its publicity earnings, expect a big drop in the Nasdaq that will drag cryptocurrencies to new depths. ETH price will drop to $2,695.70 and next $2,574, amounting to a 10% loss.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.