Ethereum Price Prediction: ETH still on its way to $3,000, according to technicals

- Ethereum price has hit a new all-time high at $2,584 on April 16.

- ETH had a massive breakout from a key pattern and aims to continue with its uptrend.

- Several on-chain metrics remain in favor of ETH bulls.

Ethereum has enjoyed an impressive rally in the past month even though it was stagnant at the beginning of April. The number of ETH locked away remains extremely high and it’s making the digital asset more scarce than ever.

Ethereum price on its way to $3,000 with no clear resistance ahead

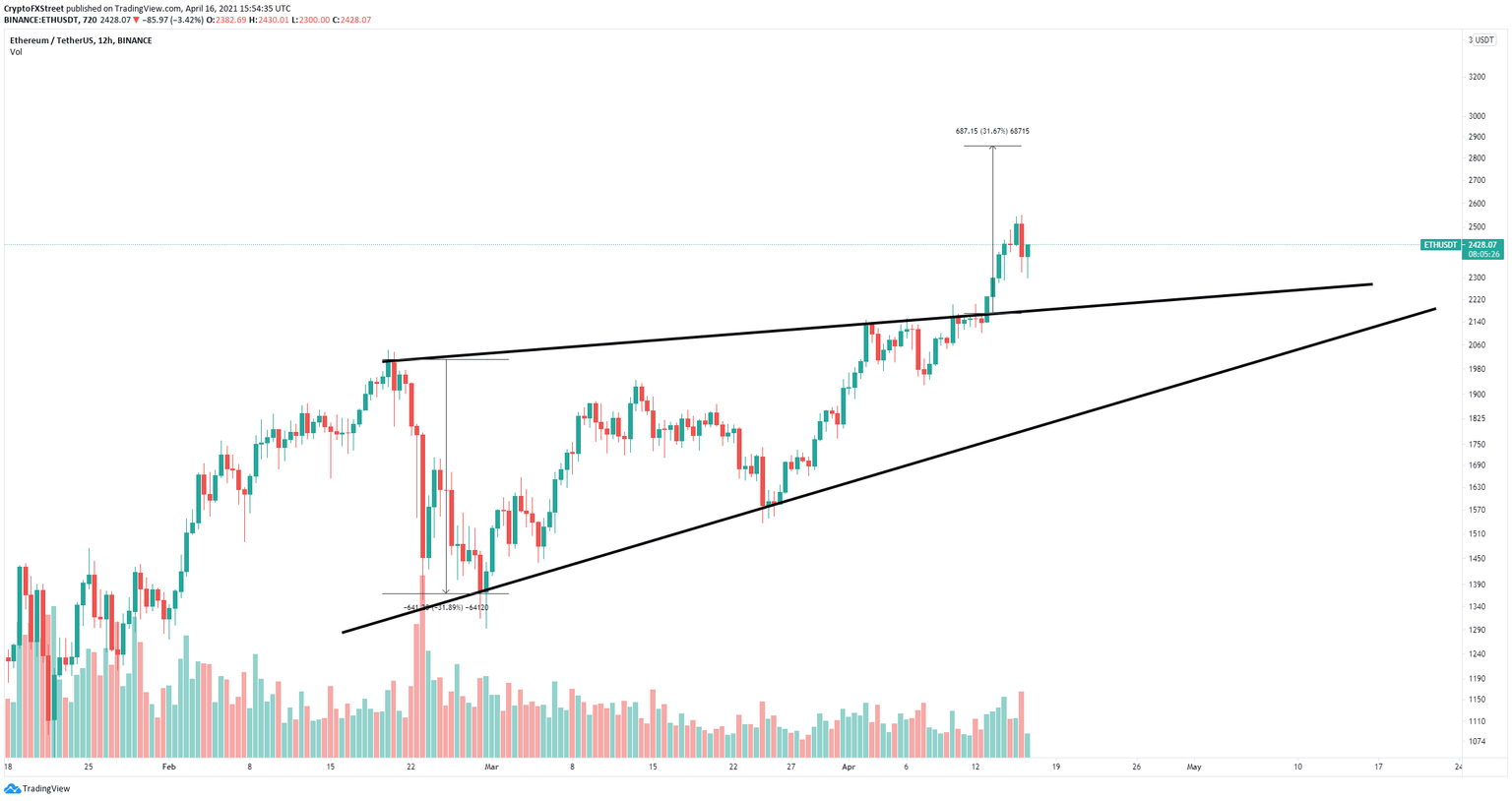

Ethereum had a significant breakout from an ascending wedge pattern on the 12-hour chart on April 13. The long-term price target of this breakout is $2,900 and according to several on-chain metrics, Ethereum faces no resistance ahead.

ETH/USD 12-hour chart

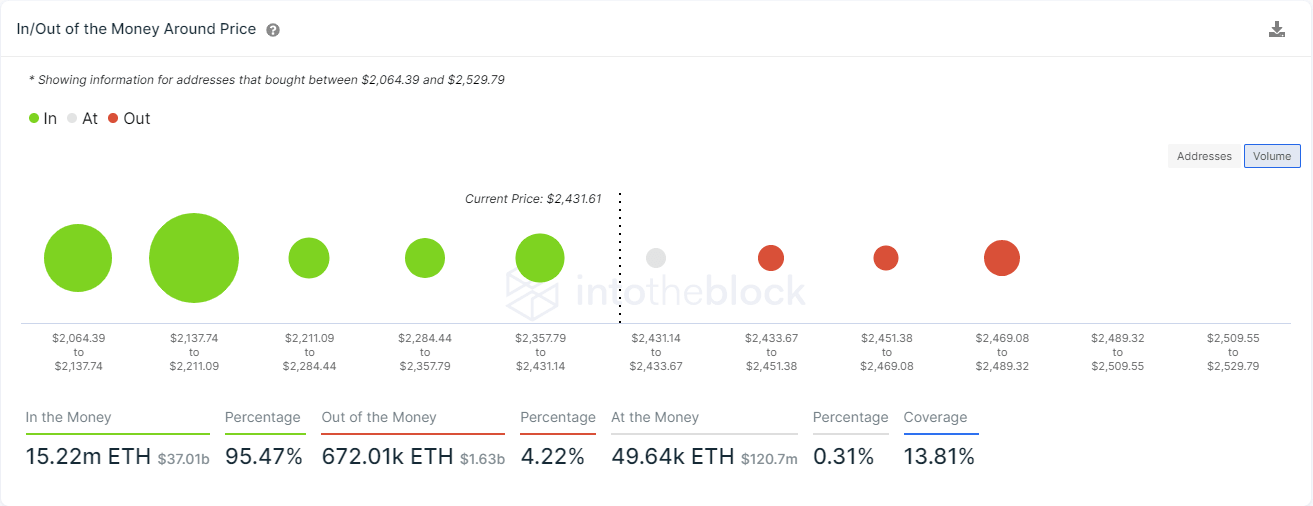

The In/Out of the Money Around Price (IOMAP) chart shows practically no barriers ahead. The most significant area is located between $2,469 and $2,489 where 151,000 addresses purchased over 487,000 ETH.

ETH IOMAP chart

According to the most recent statistics, just in DeFi alone, there is over $60 billion worth of Ethereum locked away, significantly making the digital asset scarcer. Additionally, inside the Eth2 deposit contract, there are currently 3.85 million ETH locked away, worth almost $10 billion at current prices.

ETH locked in DeFi

However, the MVRV Ratio (30d) of Ethereum has hit danger levels at 24% where the digital asset normally experiences a correction.

ETH MVRV (30d)

The IOMAP model shows a significant support area between $2,137 and $2,211 where 282,000 addresses purchased 8.42 million ETH. This would be the long-term bearish price target in the event of a massive correction period.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B18.12.19%2C%252016%2520Apr%2C%25202021%5D.png&w=1536&q=95)

%2520%5B18.13.06%2C%252016%2520Apr%2C%25202021%5D.png&w=1536&q=95)