Ethereum Price Prediction: ETH scarcity will drive the digital asset to $2,000

- Ethereum price is fighting to stay above $1,300.

- The scarcity of the digital asset continues to increase as a lot of coins have been locked.

- ETH faces very little resistance to the upside and can quickly establish a new all-time high.

Ethereum price has been under consolidation after establishing a new all-time high at $1,475 which wasn’t quite convincing. ETH dropped to $1,207 but has rebounded and it’s currently trading at $1,338.

Ethereum price can reach $2,000 as its scarcity continues to increase

Despite the massive increase in price experienced by Ethereum since August 2020, the number of ETH coins inside exchanges has declined significantly. This percentage has dropped from 26.2% of the circulating supply to only 20.7% currently.

Ethereum supply on exchanges

This metric shows that investors are withdrawing their coins from exchanges to either lock them into DeFi protocols or to hold. The Eth2 deposit contract holds 2.85 million ETH and there are currently 7.09 million ETH locked in DeFi projects, which means close to 10 million Ethereum are locked, representing close to 10% of the circulating supply.

ETH Holders Distribution

Similarly, the number of large holders with 10,000 to 100,000 ETH coins ($13,000,000 to $130,000,000) has increased from 961 on October 2020, to 1,080 currently. Again indicating that whales are interested in accumulating ETH despite its price growing.

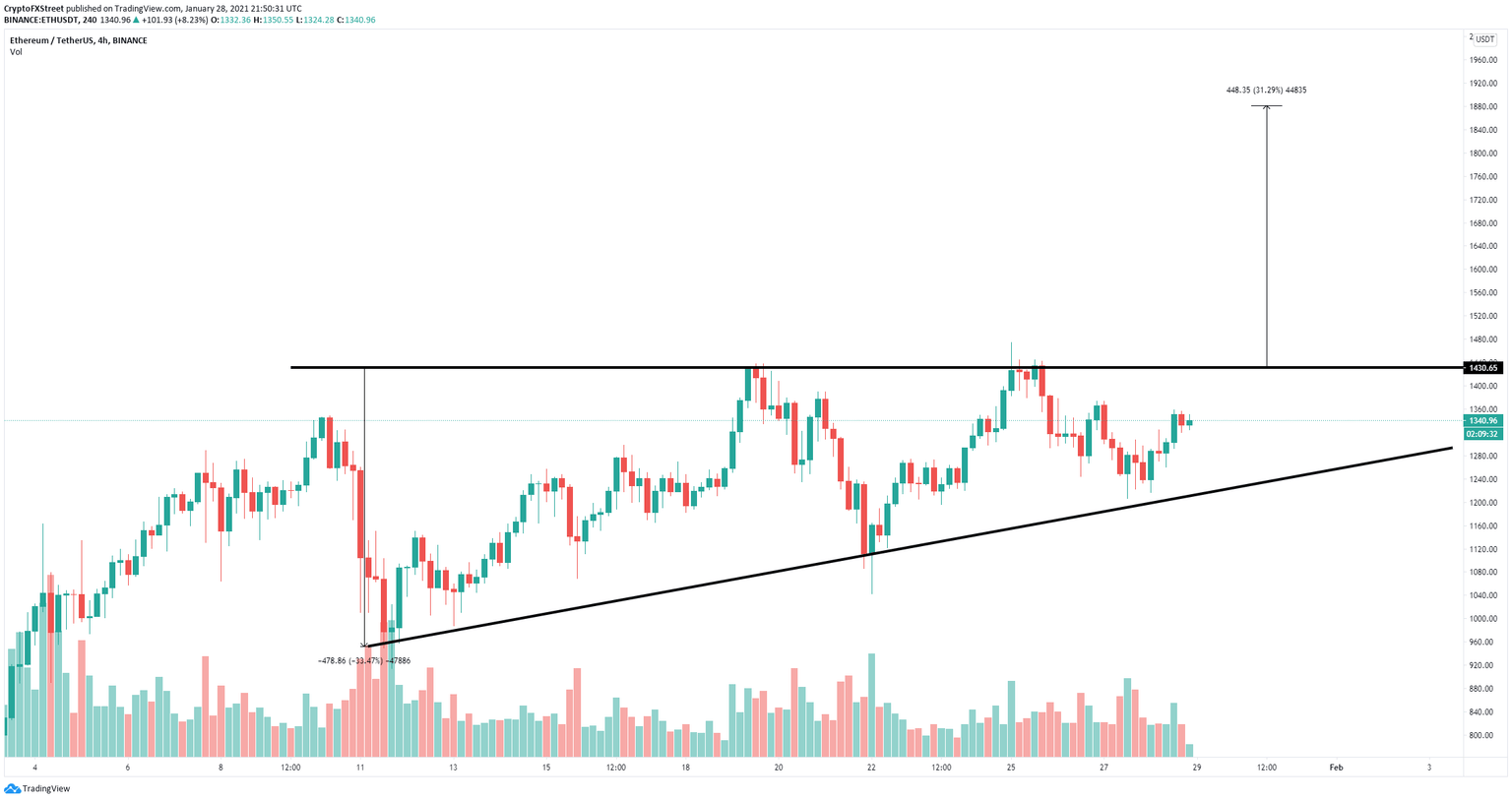

ETH/USD 4-hour chart

On the 4-hour chart, Ethereum has established an ascending triangle pattern with the resistance trendline located at $1,430. A breakout above this point can drive ETH up to $1,900 or higher.

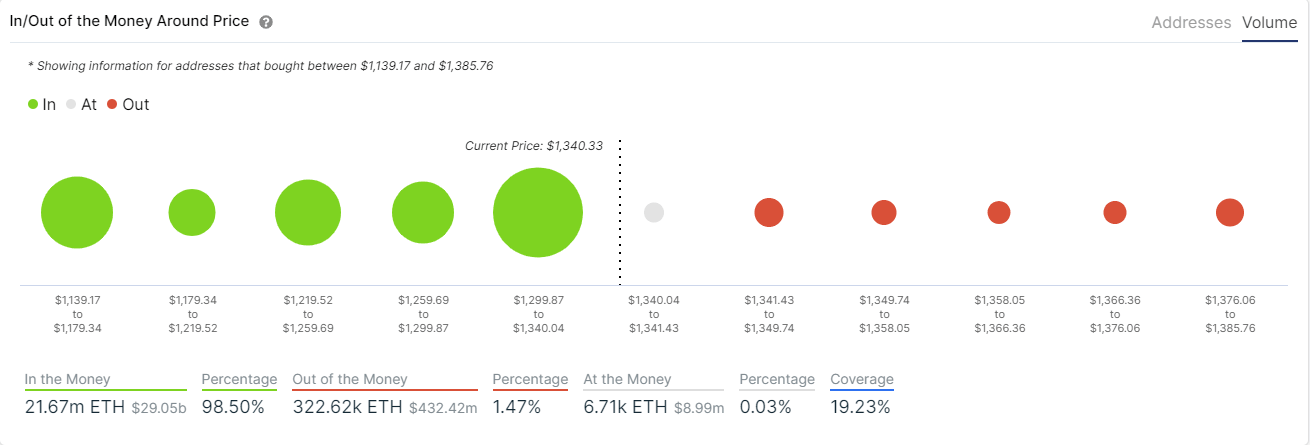

ETH IOMAP chart

The likelihood of Ethereum cracking that resistance level seems quite high according to the In/Out of the Money Around Price (IOMAP) chart which shows very weak resistance above $1,340, but a lot of support between $1,300 and $1,340 with a volume of almost 9 million ETH, purchased by 464,000 addresses.

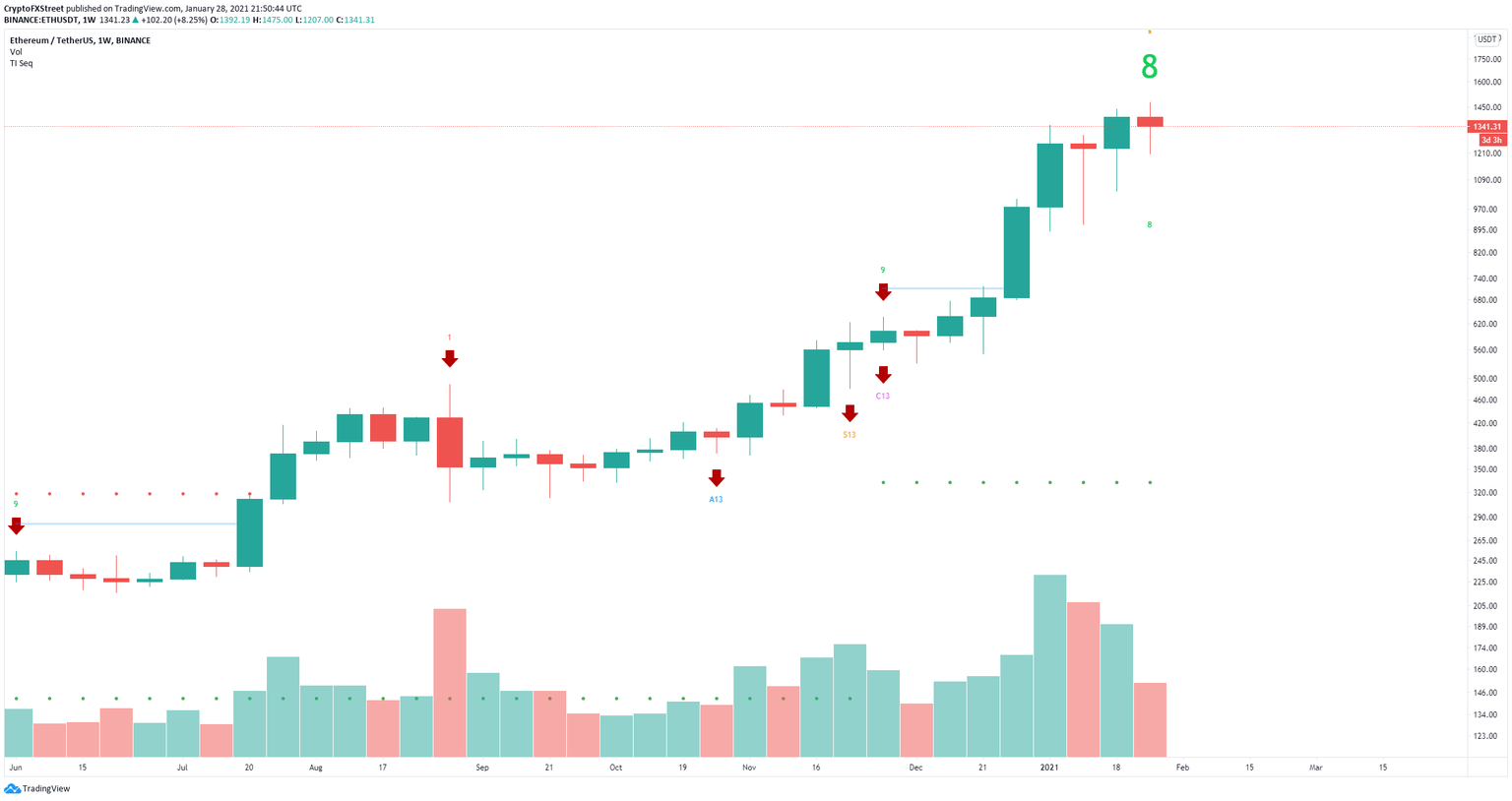

ETH/USD weekly chart

Nonetheless, the TD Sequential indicator is close to presenting a sell signal on the weekly chart. This could stop the bulls from pushing Ethereum to new all-time highs driving it to re-test the psychological level at $1,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B22.37.21%2C%252028%2520Jan%2C%25202021%5D-637474675366953321.png&w=1536&q=95)

%2520%5B22.40.57%2C%252028%2520Jan%2C%25202021%5D-637474675396955946.png&w=1536&q=95)