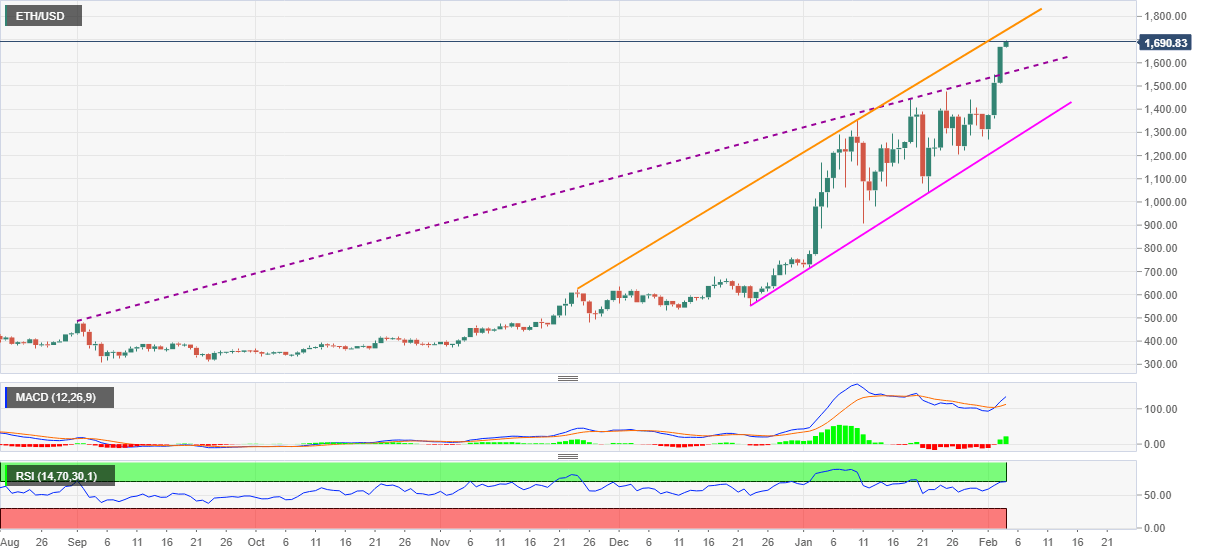

- Ethereum bulls ignore overbought RSI amid fears of mission out the rally.

- 10-week-old resistance line guards immediate upside ahead of the $2,000 threshold.

- Ascending trend line from September stops ETH sellers, for now.

ETH/USD bulls are unstoppable while refreshing the record top around $1,700 during early Thursday. The altcoin is on a four-day uptrend after the previous day’s rally that crossed a key resistance line.

Although overbought RSI conditions may probe the ETH/USD bulls around a short-term trend line resistance near $1,750, the bulls are en route to the $2,000 psychological magnet before catching a breather.

It should also be noted that chatters of the cryptocurrency pair’s rally towards the $5,000 level, with the $3,000 acting as an intermediate halt, are also famous in the market.

Meanwhile, the counter-trend traders are looking for a downside break of the $1,600 to retest the previous resistance line from September, at $1,550.

Though, ascending trend line from December 23, at $1,251 now, will be the ultimate test for the ETH/USD sellers.

To sum up, Ethereum buyers are in full mood to flash the $2,000 despite multiple challenges.

ETH/USD daily chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Michael Saylor predicts Bitcoin to surge to $100K by year-end

MicroStrategy's executive chairman, Michael Saylor, predicts Bitcoin will hit $100,000 by the end of 2024, calling the United States (US) election outcome the most significant event for Bitcoin in the last four years.

Ripple surges to new 2024 high on XRP Robinhood listing, Gensler departure talk

Ripple price rallies almost 6% on Friday, extending the 12% increase seen on Thursday, following Robinhood’s listing of XRP on its exchange. XRP reacts positively to recent speculation about Chair Gary Gensler leaving the US Securities and Exchange Commission.

Bitcoin Weekly Forecast: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin (BTC) surged up to 16% in the first half of the week, reaching a new all-time high of $93,265, followed by a slight decline in the latter half. Reports suggest the continuation of the ongoing rally as they highlight that the current trading level is still not overvalued and that project targets are above $100K in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.