Ethereum Price Prediction: ETH prepares for new all-time highs

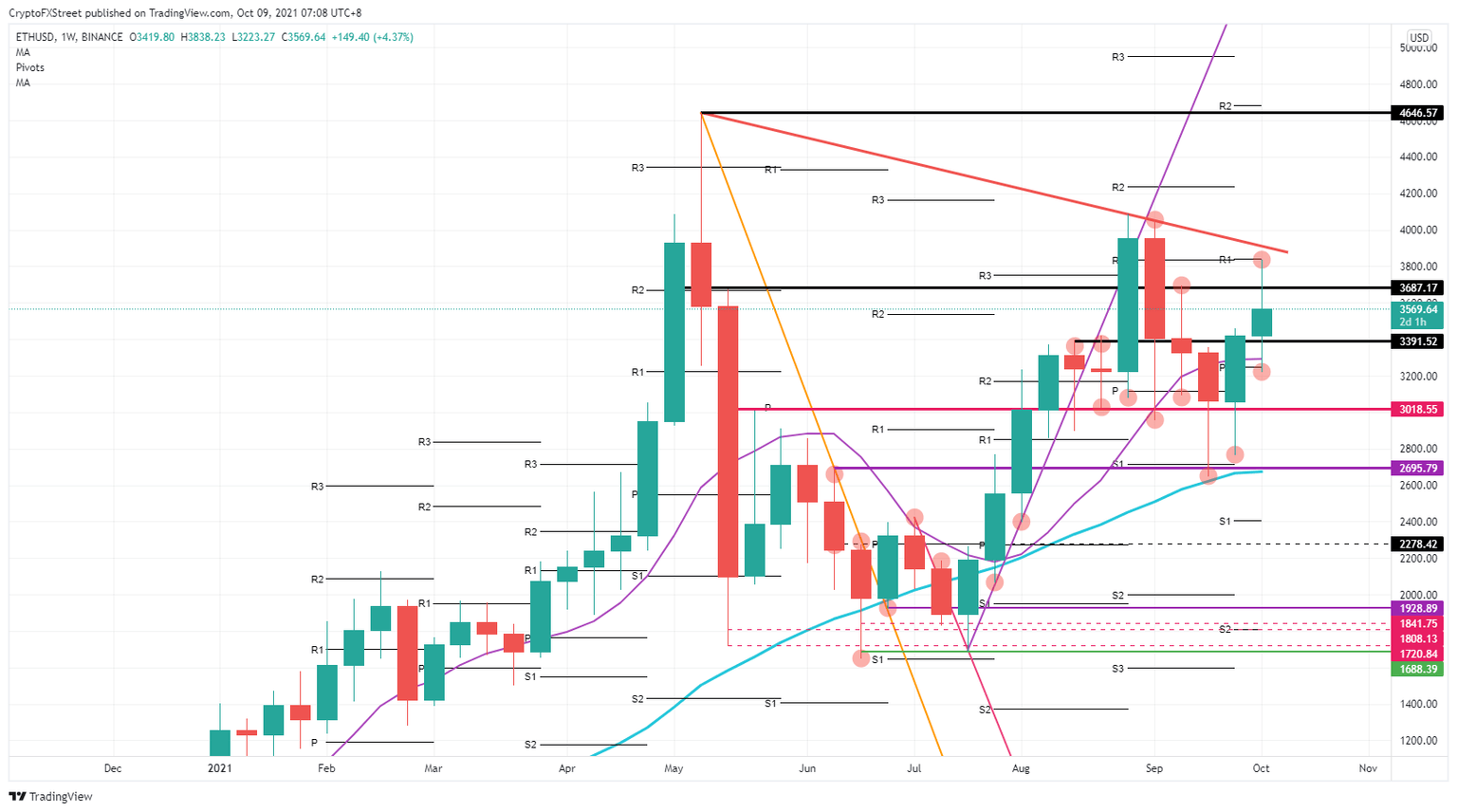

- Ethereum price action offered bulls a solid entry point this week with the monthly pivot and the 55-day SMA.

- ETH price was capped by profit-taking around the monthly R1 resistance level and a medium-term red descending trend line on the topside.

- Bulls are building up momentum for the break higher with possible new all-time highs next week.

Ethereum price action saw bulls flocking it at $3.250, around the 55-day Simple Moving Average (SMA) and the monthly pivot, as favorable tailwinds hovered in cryptocurrencies. For the second week in a row, ETH price action broke above a few significant resistance levels and is building momentum for another leg higher with a possible new all-time high in Ethereum price action.

ETH price action targets $4.646 when bulls push Ethereum above the descending top line

Ethereum price action added some more buyers to the uptrend it started last week. Both the 55-day SMA and the monthly pivot line offered bulls a good entry point to step in and sit tight for some solid profits. Some profit-taking happened near the monthly R1 resistance level at $3.846 and made price action fade by the end of this week. But the rally has more room to go.

The fade is considered a new discount in ETH price action, with buyers defending $3.391 and want to close the week above $3.687. Once from there, a squeeze will happen against the red descending trend line from May and be tested in August and September. A break above would be the queue for buyers who want to have a better incentive to join ETH price action, instead of risking getting stopped out so close to that descending resistance.

ETH/USD weekly chart

Ethereum price action will consolidate with a squeeze against the red descending trend line and break above it. This will add new buying volume to the uptrend and wil try to at least retest $4.646. A new all-time high would be a critical headline in the media that would lift Ethereum price action even further, with Bitcoin hitting $60.000 in tandem.

ETH price could see the favorable tailwinds turning into headwinds as price action could start to fade further. Bulls will start to back off and wait for more lucrative discounts as they consider ETH price overvalued. Expect bears to go in for the kill quickly and cut short ETH price action towards $2.695. If bears can break the 200-day SMA just below, it could spell the beginning of a downtrend towards $2.000.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.