- Ether is stable above $1,200 as buyers get ready for the utmost upswing to $1,400.

- The IOMAP model reveals that Ethereum has little overhead pressure that could prevent a potential uptrend.

Ethereum has not moved much since Friday. However, support at $1,200 has remained intact. At the time of writing, the largest altcoin is trading at $1,220. The least resistance path seems upwards, but a consolidation period is expected before Ethereum resumes the uptrend to $1,300 in the coming week.

Ethereum nurtures an uptrend within a parallel ascending channel

Despite the stalling after breaking above the resistance at $1,200, ETH has generally been trending upwards within a parallel ascending channel. Recovery is set to continue if Ethereum closes the day above $1,200. Besides, the price action to $1,400 will be validated following a break of the middle boundary resistance.

ETH/USD 4-hour chart

On the other hand, it is worth keeping in mind that the moving average convergence divergence, or MACD, adds credence to the optimistic outlook.

This technical indicator, which follows the path of a trend and calculates its momentum, appears to be turning bullish. As the 12-day exponential moving average crossed above the 26-day exponential moving average, the odds for a bullish impulse are likely to rise in the coming sessions.

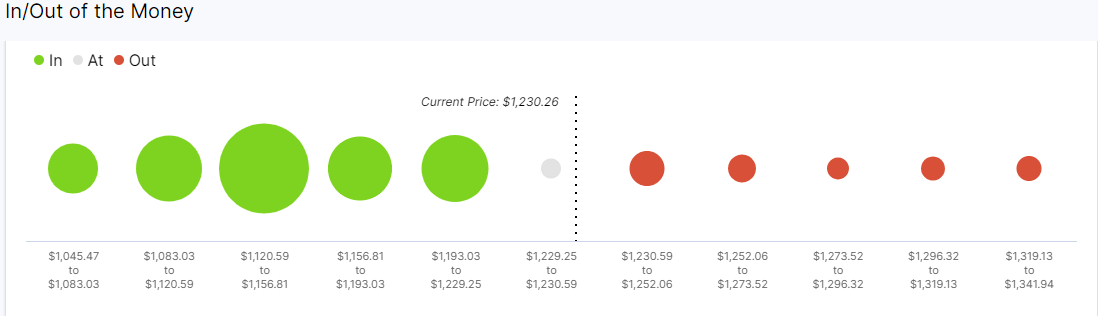

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals no supply barrier that will prevent the second-largest altcoin by market cap from achieving its upside potential.

Based on this on-chain metric, there is only one central area of interest between $1,230 and $1,252 filled by a high number of investors who had previously purchased Ether around this price level. Here, roughly 118,000 addresses are holding nearly 386,200 ETH.

This area may have the ability to absorb some of the buying pressure seen recently. Holders who have been underwater may try to break even on their positions, slowing down the uptrend. But if Ether can slice through this hurdle, it would likely climb to $1,400.

Ethereum IOMAP chart

On the flip side, the IOMAP cohorts show that Ether sits on top of stable support. Nearly 164,000 addresses bought roughly 8.3 million ETH between $1,121 and $1,156. This crucial area of interest suggests that bears will struggle to push prices down. Right now, the odds favor the bulls.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20-%202021-01-17T165343.184-637464884324759766.png)