Ethereum Price Prediction: ETH enters new bullish cycle with no significant resistance ahead

- Ethereum price rose above $500 for the first time since July 2018.

- The next target on the upside aligns at $530.

- The RSI suggests there could be a correction before the next leg up.

After closing the previous two days in the negative territory and losing more than $30 during that period, Ethereum turned north on Friday, November 20, and touched its highest level in 28 months at $511. As of writing, the smart contracts giant is up nearly 7% on an intraday basis.

Ethereum price may rise to $530

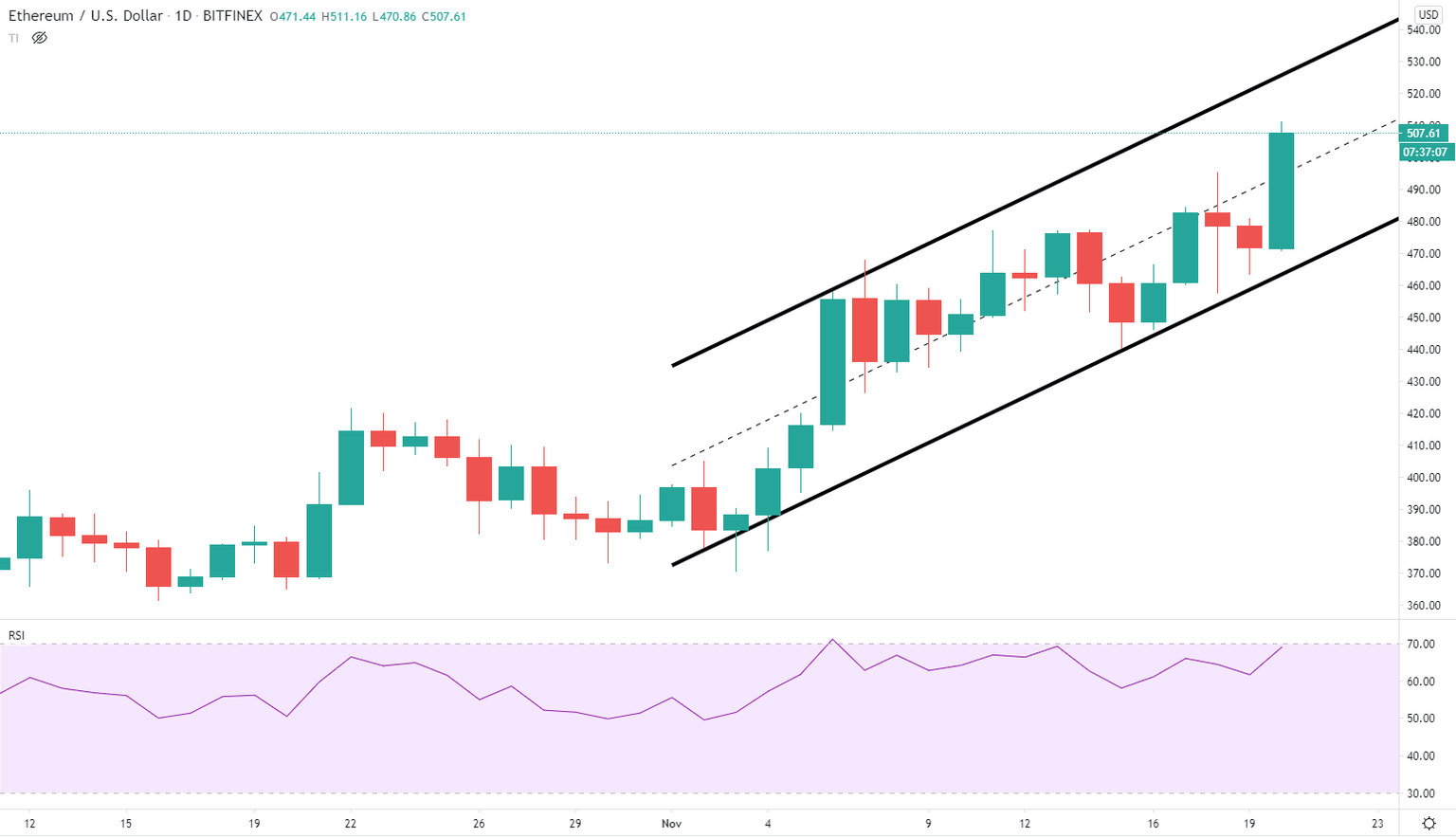

With this recent upsurge, ETH price moved into the upper half of an ascending channel coming from November 1. The resistance line of the channel is currently located near $530, which could be seen as the next target.

ETH/USD Daily Chart

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model confirms $530 as a strong resistance area. According to the on-chain metric, more than 164,000 ETH were bought by nearly 300,000 addresses at an average price of $532.

Ethereum IOMAP by IntoTheBlock

Regardless of the optimistic outlook, the Relative Strength Index (RSI) is about to cross into the overbought territory, suggesting that Ethereum price could struggle to surpass the $530 hurdle and stage a correction. If this were to happen, the IOMAP model shows stiff support at $470, where more than 11 million ETH were acquired by 1.35 million addresses.

This price level coincides with the lower limit of the ascending channel, reinforcing the view that it may serve as a rebound zone towards new yearly highs.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.