Ethereum Price Prediction: ETH could rise 15% after the recent sell-off

- Ethereum price crash found support on the SuperTrend indicator’s buy signal from October 21, 2020.

- A decisive one-day close above the $1,675 could see ETH rise by 10%.

- A bearish scenario will come into the picture if Ethereum price slides below $1,450.

Ethereum price went as low as $1,355 during the recent sell-off. However, a closer look reveals that aggressive buyers around the 2018 highs pushed ETH’s one-day close to $1,577. As a result, ETH could see its market value increase shortly.

Ethereum price hints at a reversal

Ethereum price surge during the recent bull run isn’t similar to many altcoins. Instead, ETH formed a series of higher highs and higher lows. Joining these pivot points using trendline reveals an ascending parallel channel.

Despite the 30% sell-off, ETH’s one-day candlestick close on February 23 was above the SuperTrend indicator’s buy signal around $1,560. This daily close is bullish as it keeps the ascending parallel channel intact and respects the buy signal, indicating that the overall bullish trend is still viable.

A sudden spike in buying pressure resulting in a one-day close above the 23.6% Fibonacci retracement level at $1,675 could see ETH’s market value increase. In such a case, the smart contracts platform token could see a 10% upswing to the channel’s middle line at $1,855.

If buyers remain strong here, Ethereum could climb higher and retest its recent all-time high at $2,042.

ETH/USDT 1-day chart

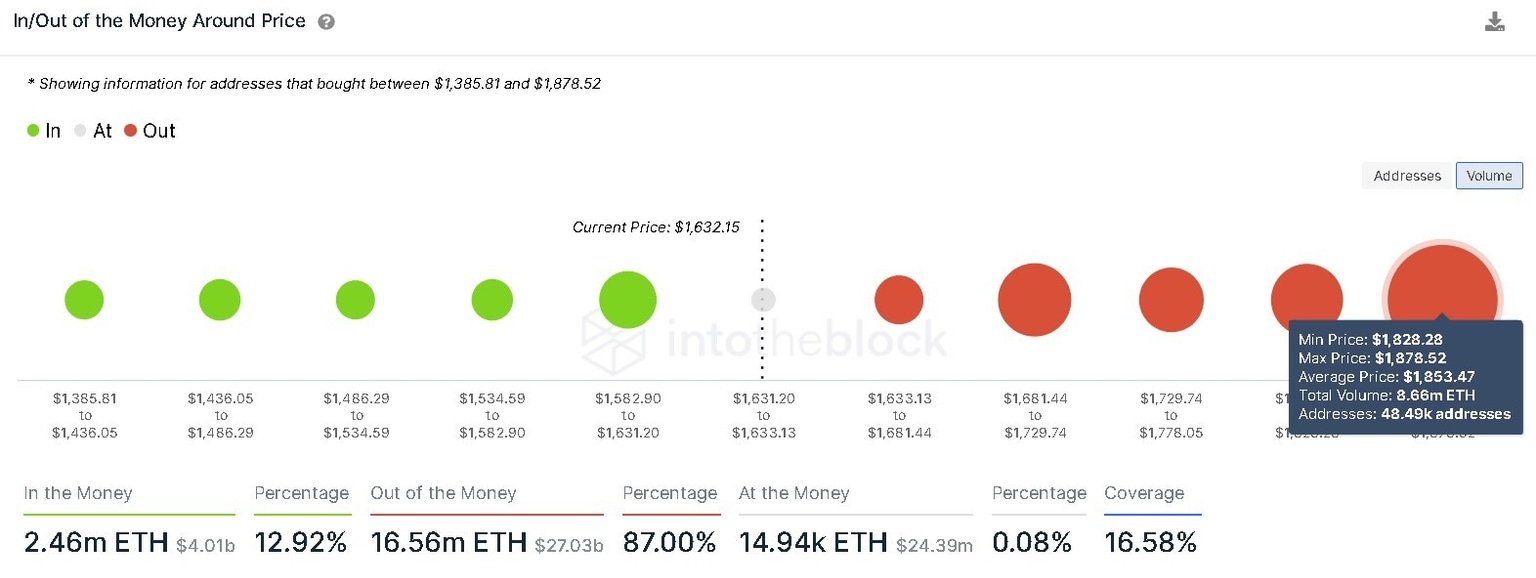

According to IntotheBlock’s In/Out of the Money Around Price (IOMAP) model, 48,500 addresses have previously purchased 8.66 million ETH at an average of $1,853. These investors are “Out of the Money” and might sell their holdings to breakeven. Therefore, Ethereum bulls could face a tough challenge breaching past this level.

Ethereum IOMAP chart

While the SuperTrend’s buy signal is still valid, a close below it could trigger a pullback. The correction could drag ETH down to the 38.2% Fibonacci retracement level at $1,450.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.