Ethereum Price Prediction: ETH could 3X based on this indicator

- Ethereum price ascended nine days in a row.

- ETH is likely to take out the November high, 7% above the current market value.

- Based on historical evidence, ETH could decline by 25% and then rally toward all-time highs.

Ethereum price continues to display robust strength in the market. Although disbelief may still linger amongst traders, ETH has the potential to rally considerably based on the technical factors mentioned below.

Ethereum price shows strength

Ethereum price has shown considerable market vitality as the decentralized smart-contract token has produced nine consecutive green daily candles. The newfound uptrend restored 25% of lost market value into the hands of investors since ETH’s last pause at $1,240 occurred.

Ethereum price currently auctions at $1,580, just 7% below November’s monthly high of $1,680. As the bulls prepare for the breach, there are a few factors to keep in mind about the current uptrend.

The 8-day exponential moving average (EMA), an indicator used to gauge short-term market behavior, has been impulsively climbing north, moving just below the current auction’s price. The pacing indicator suggests underlying support for the ETH token.

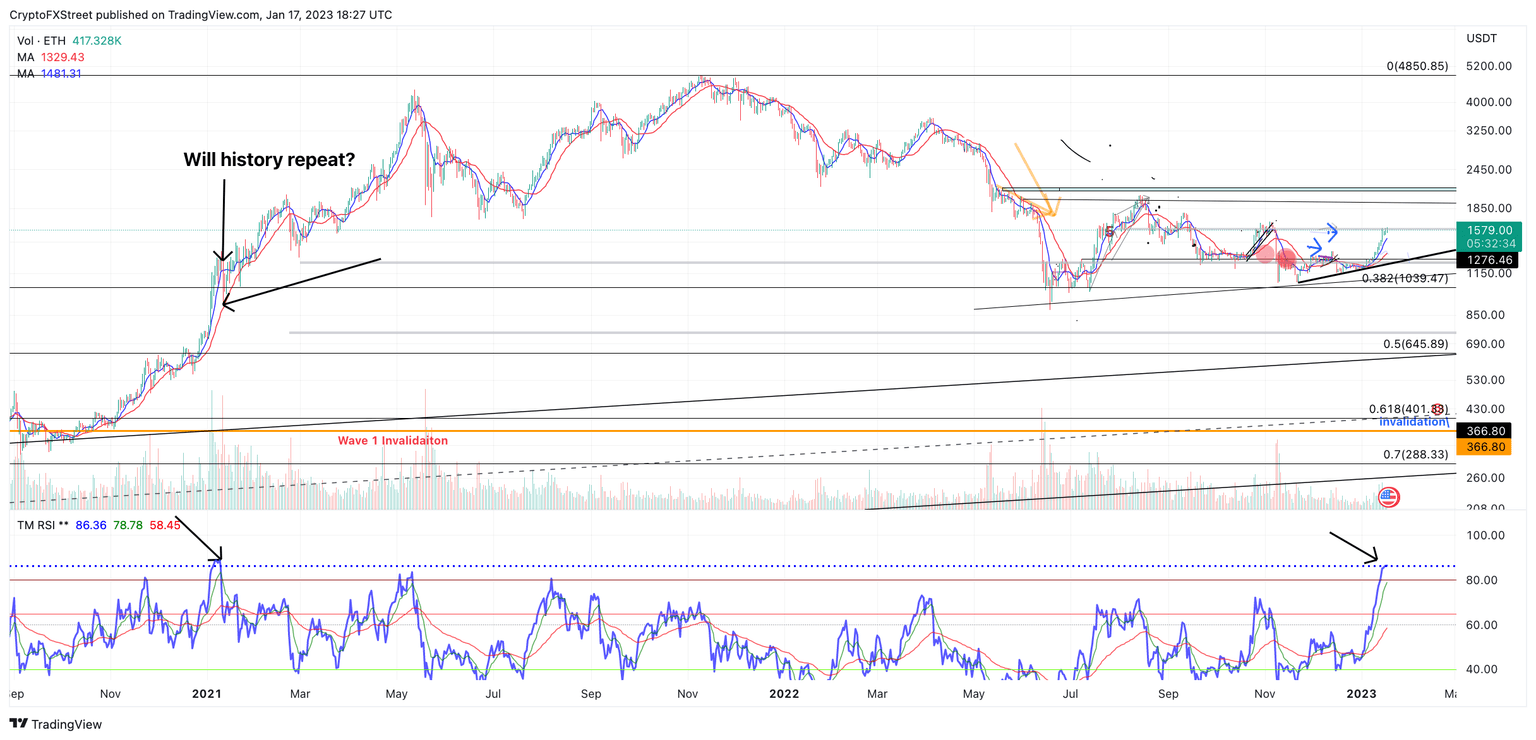

The Relative Strength Index (RSI), an indicator used to gauge market participants' underlying power, shows the ETH price in extremely overbought conditions near the 90 level. The last time Ethereum reached 90 on the RSI was in January 2021 when ETH briefly tagged $1,300, establishing a new all-time high. Following the new all-time high, a shallow pullback into a 21-day simple moving average 25% below at $950 took place. Ethereum would then embark on the unprecedented 3X bull run into $4,000 price zone weeks later.

ETH/USDT 1-day chart

If history repeats itself, ETH could be on its way toward new all-time highs, but traders should be on the lookout for a buyable dip in the coming weeks. A tag of the 21-day simple moving average at the current time would result in a 15% decline into the $1,330 price zone.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.