Ethereum Price Prediction: ETH consolidates, but on-chain indicators predict another blastoff soon

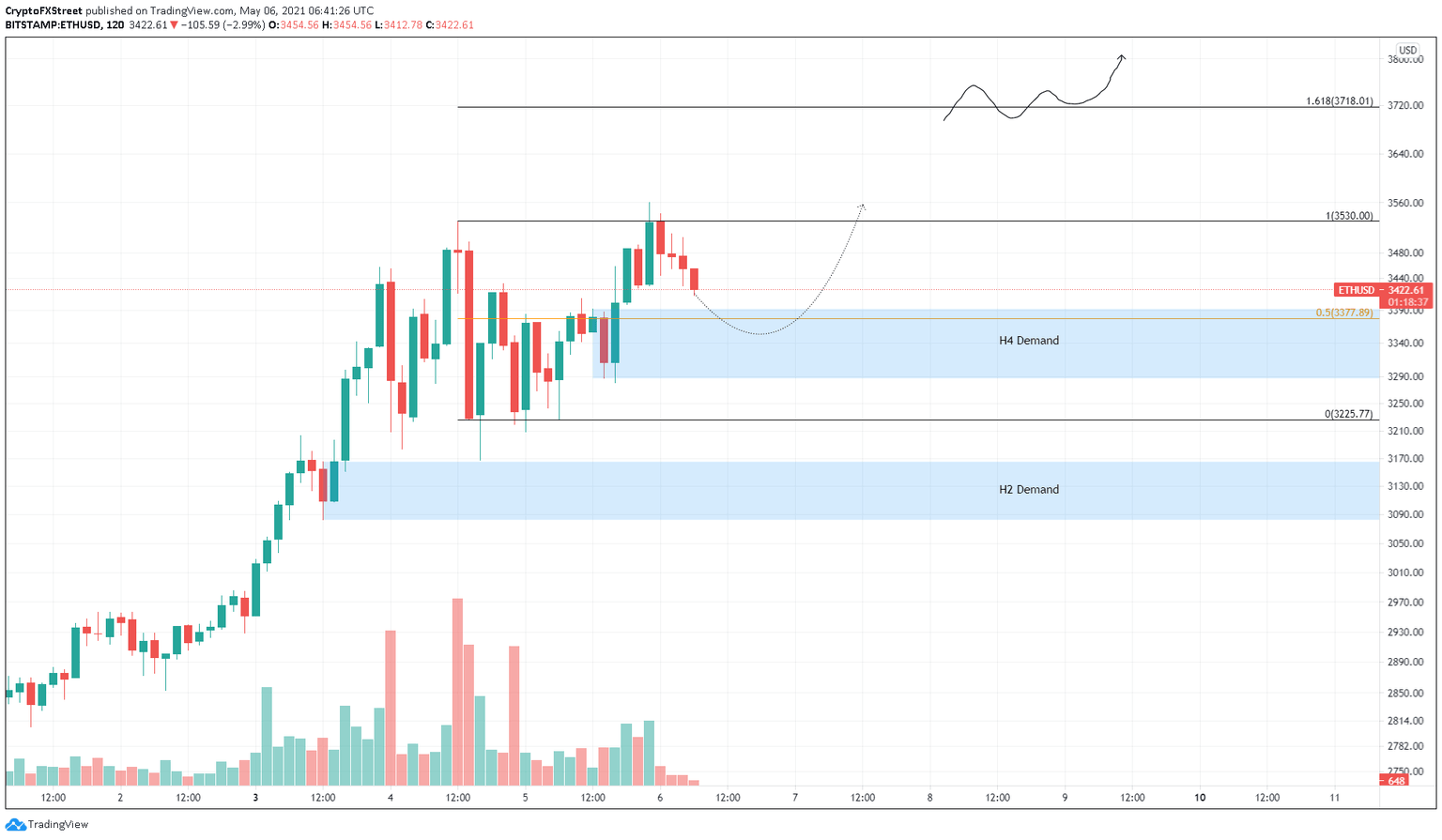

- Ethereum price shows a tight consolidation range in progress on the 4-hour chart.

- A minor retracement to the immediate demand barrier ranging from $3,287 to $3,392 seems likely.

- Multiple on-chain indicators show strengthening fundamentals adding a tailwind to the bullish thesis.

Ethereum price is tightly wound as its range-bound movement continues after setting up an all-time high on May 5. ETH might retest its swing low before surging higher and potentially rallying to new highs.

Ethereum price coils up

On the 4-hour chart, Ethereum price is trading in a range that extends from $3,225 to $3,530. As ETH slides lower, it could either bounce off the immediate support area that stretches from $3,287 to $3,392 or dip toward the swing low and even deviate below it.

However, this drop will help long-term holders accumulate ETH at a discount, providing a short-term boost in buying pressure and keeping ETH prices from falling.

Therefore, investors can expect the smart contract token to eventually bounce from this point to retest its ceiling at $3,559.

If the bullish momentum is enough, Ethereum price will shatter through the resistance level and surge roughly 5% to tag a new all-time high at $3,718, coinciding with the 161.8% Fibonacci retracement level.

ETH/USD 2-hour chart

Supporting this bullish outlook is the supply distribution chart, which shows that whales holding between 1,000,000 to 10,000,000 ETH have increased by 9% since April 19.

The addition of one new whale to this category indicates that these investors are optimistic about Ethereum price performance in the future.

ETH supply distribution chart

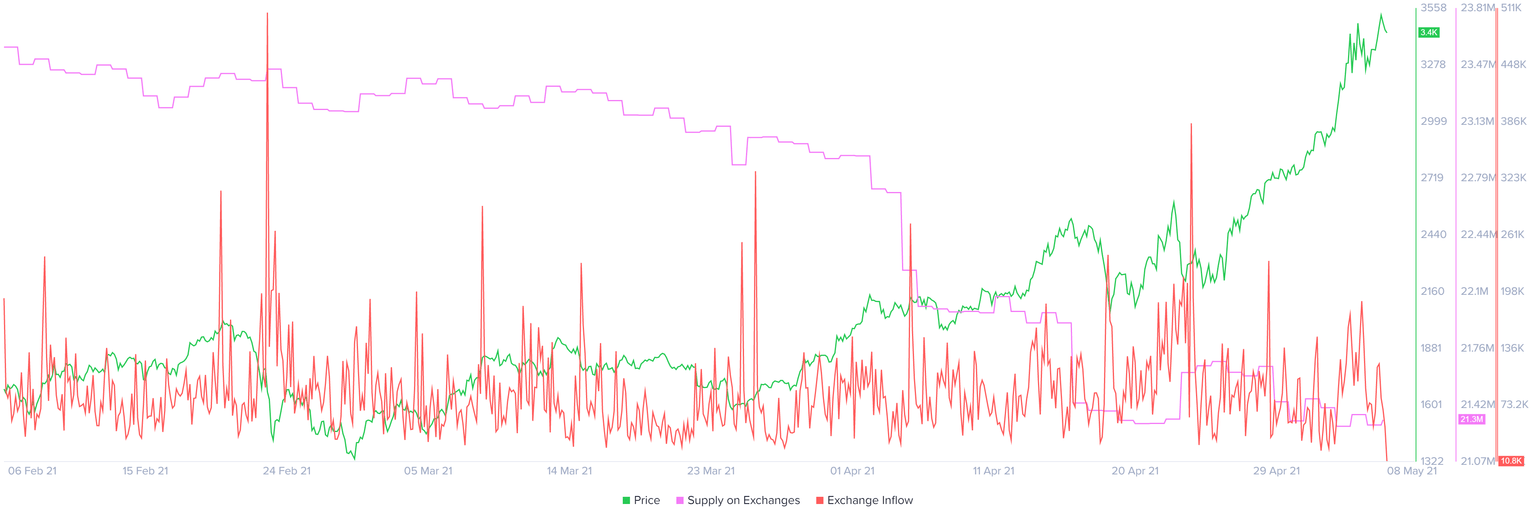

Compounding the confidence in an upswing is a rapid decline in the number of ETH held by centralized entities from 22.1 million to 21.3 million in the past month. This 3.6% collapse further reduces the sell-side pressure that arises primarily from exchanges, providing a path of little-to-no resistance for a potential uptick in Ethereum price.

ETH held on exchanges chart

Typically, the number of users holding an asset falls off sharply after hitting a record level, mainly due to investors booking profit. Hence, taking a look at the number of daily active addresses and daily active deposits for ETH allows one to gauge if market participants are looking to sell their holdings.

Despite hitting a new record high, the number of daily active users for the altcoin pioneer has increased by 12% since April 30, suggesting a high network activity. On the other hand, the number of daily active deposits has seen a 7% increase. This minor uptick in daily active addresses, although not bearish, explains the sideways movement.

ETH daily active addresses/deposits chart

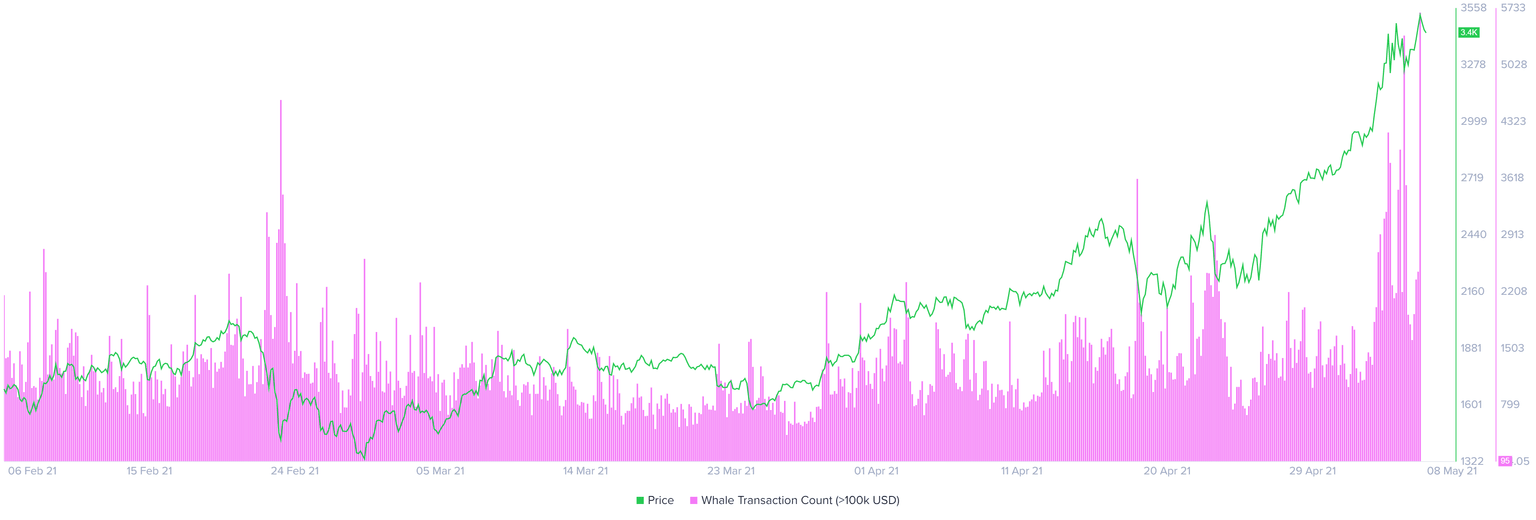

While most fundamental on-chain indicators suggest a bullish outlook for Ether, the number of transactions worth $100,000 or more has spiked twice today. Often, such upticks in large transfers coincides with local tops. Hence, investors need to be aware of a potential increase in selling pressure.

ETH large transaction chart

Adding credence to the bearish outlook is Santiment’s 30-day Market Value to Realized Value (MVRV) model, which indicates that Ethereum price is in the danger zone and could see a potential sell-off shortly.

This fundamental index measures the 30-day profit/loss of users who purchased ETH in the past month. Currently, ETH’s MVRV value is 29%, last seen in May 2019. Therefore, investors need to exercise caution.

ETH 30-day MVRV chart

Despite the bullish outlook, a breakdown of $3,082 will invalidate the bullish outlook since it would mean a lower low. Such a move could even spark a new downtrend that could push Ethereum price by 5% to the next support barrier at $2,924.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

-637558852295434144.png&w=1536&q=95)