- Ethereum price is keeping investors on edge before the promised rally.

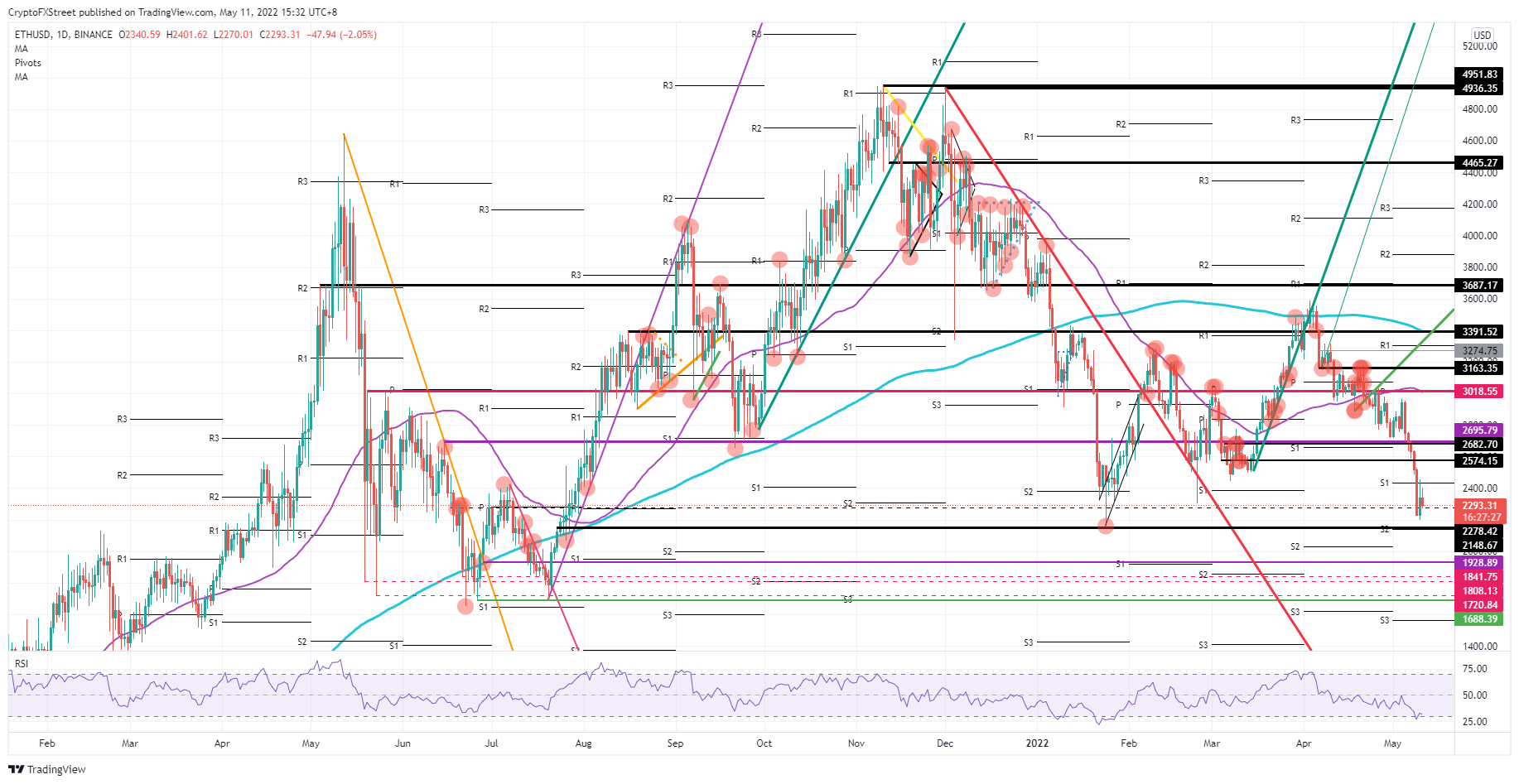

- ETH price consolidates with lower highs and higher lows, pointing to a possible drop to $2,278.42 before swinging back to $2,682.70.

- Expect to see that drop today with a double bottom strong enough to form a bullish border.

Ethereum (ETH) price is still set to rebound roughly 22% and erase the incurred losses from the past few trading days. But price action this morning during the ASIA PAC and European session is consolidating, with lower highs, and higher lows as bears and bulls are squeezed towards each other. Expect to see a pop higher with a bullish breakout either straight away after the consolidation or after a small drop and bounce off $2,278.42 with the double technical bottom in place.

ETH price underpinned by double technical floor

Ethereum price is keeping investors and bulls on edge after a full technical reversal of the incurred losses stalled in Tuesday's US trading session. Today, it looks like ETH price is under consolidation, with lower highs and higher lows pointing to bulls and bears being pushed together. Usually, this will result in a breakout trade, expected to the upside, as the Relative Strength Index (RSI) cannot get away from being oversold, which means that sellers have no decent room to the downside to make gains.

ETH price is thus on the cusp of popping higher, which could be via a breakout trade out of the consolidation that runs higher towards $2,685.70 or $2,695.79. Another scenario to keep in mind is a small drop to the downside to test the double floor, with the monthly S2 and the historic pivotal level at $2,278.42. A test and bounce off that level would see price action ramp back up towards $2,695.70, just shy of that $2,700 marker.

ETH/USD daily chart

Not only Ethereum price is consolidating, but the eurodollar as well with a fourth trading day of lower highs and higher lows. Here a break to the downside would reflect more dollar strength that would weigh on Ethereum price, which is valued in dollars. ETH price would drop below $2,278.42 and submerge below $2,000 towards $1,928.89, which is the first notable level on the way down.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin rebounds above $80,000 ahead of US CPI data release

Bitcoin price recovers slightly, trading above $80,000 on Tuesday after declining nearly 3% the previous day. US spot Exchange Traded Fund data continues to show weakness among institutional investors, with $278.40 million outflow on Monday.

Cardano eyes recovery as it retests key support, funding rate and bullish bets signal optimism

Cardano recovers slightly by 4%, trading around $0.70 on Tuesday after falling nearly 7% the previous day. On-chain metrics signal further recovery as ADA’s funding rate turns positive while its bullish bets reach the highest level over a month.

Bettors mount pressure on XRP amid signs of a price bottom in on-chain indicators

XRP dropped below $2 as heightened risk-off sentiment rocked the crypto market. XRP's 30-day MVRV Ratio indicates prices may have found a bottom. XRP could bounce off a descending channel's lower boundary if it fails to recover the support near $2.00.

The crypto market cap dips to $2.44 trillion while Mt. Gox moves 11,833 BTC worth $932 million

Crypto market capitalization reaches a low of $2.44 trillion on Tuesday, levels not seen since early November. The recent price correction triggered a wave of liquidations worth over $937 million in the last 24 hours.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.