Ethereum Price Prediction: ETH bulls remain hopeful whilst above 21-DMA

- ETH/USD awaits a fresh catalyst for the next push higher.

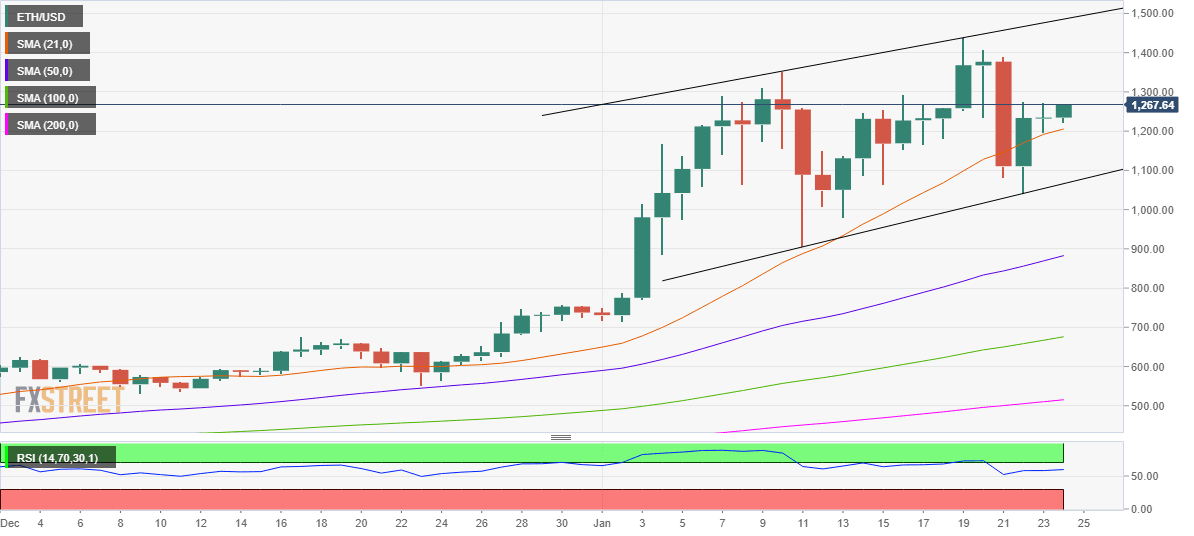

- The No. 2 coin wavers in a rising channel on the daily chart.

- Bulls need to crack $1275; 21-DMA guards the downside.

ETH/USD trades strongly bid, holding onto the $1200 level so far this Sunday, having closed Saturday modestly flat.

The world’s second-largest cryptocurrency fell sharply from the record highs of $1440 and hit nine-day lows at $1040 last week. The decline followed the former Fed Chair Yellen’s comments, citing that cryptocurrencies are mainly used for illegal activities.

Yellen, US Treasury Secretary nominee said: “Cryptocurrencies are a particular concern. I think many are used - at least in a transaction sense - mainly for illicit financing. And I think we really need to examine ways in which we can curtail their use and make sure that money laundering doesn't occur through those channels.”

Note that Ethereum has almost doubled its price since the start of this year from around $750 to break above the $1400 mark on Tuesday. The surge in prices to all-time highs comes ahead of the launch of Ethereum futures trading, kicking-off from February 8.

ETH/USD: Holding onto the recovery gains

ETH/USD: Daily chart

The daily chart of Ethereum shows that the price is in a gradual uptrend, wavering in a rising channel formation.

The technical setup appears constructive as long as the bulls hold above the 21-daily moving average (DMA) at $1205.

The 14-day Relative Strength Index (RSI) continues to hold higher above the midline, allowing more gains. The RSI is seen at 59.50, as of writing. Also, the No, 2 coin holds above all the major averages on the said timeframe, keeping the buyers hopeful.

Acceptance above the intermittent highs near $1275 is critical to extending the renewed upside, especially after the price formed a doji candlestick on Saturday.

The bulls could threaten the $1300 psychological magnate, as they likely resume their journey towards lifetime highs.

To the downside, the rising trendline support at $1066 could be tested on a sustained break below the 21-DMA cap.

A daily closing below the pattern support could confirm a downside break, opening floors towards the upward-sloping 50-DMA at $883, as the correction from record highs would pick up pace.

ETH/USD: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.