Ethereum Price Prediction: ETH bulls down but not out as $3400 beckons

- ETH price challenges 21-DMA support amid selling resurgence.

- RSI turns south but holds above 50.00, keeping bulls hopeful.

- A rally towards $3400 remains in the offing if $3070 holds.

Ethereum, the no.2 widely traded digital asset, is feeling the pulling of the gravity once, extending its bearish momentum into the second straight day this Sunday.

With the selling resurgence, ETH price reverses half the rebound from weekly lows of $3050 reached last Friday. The sentiment around Ethereum still remains undermined by the software flaw in the Go Ethereum, although it is now fixed.

“The flaw in the most popular software used to verify transactions on the Ethereum network nearly triggered a crisis for the world’s most widely used cryptocurrency blockchain,” per reports.

Meanwhile, Bitcoin’s failure to find acceptance above the $50,000 mark seems to have recalled the sellers across the crypto board. As of writing, ETH/USD is trading close to $3150 posting a 3% loss so far.

Ethereum price pressured to the downside but for how long?

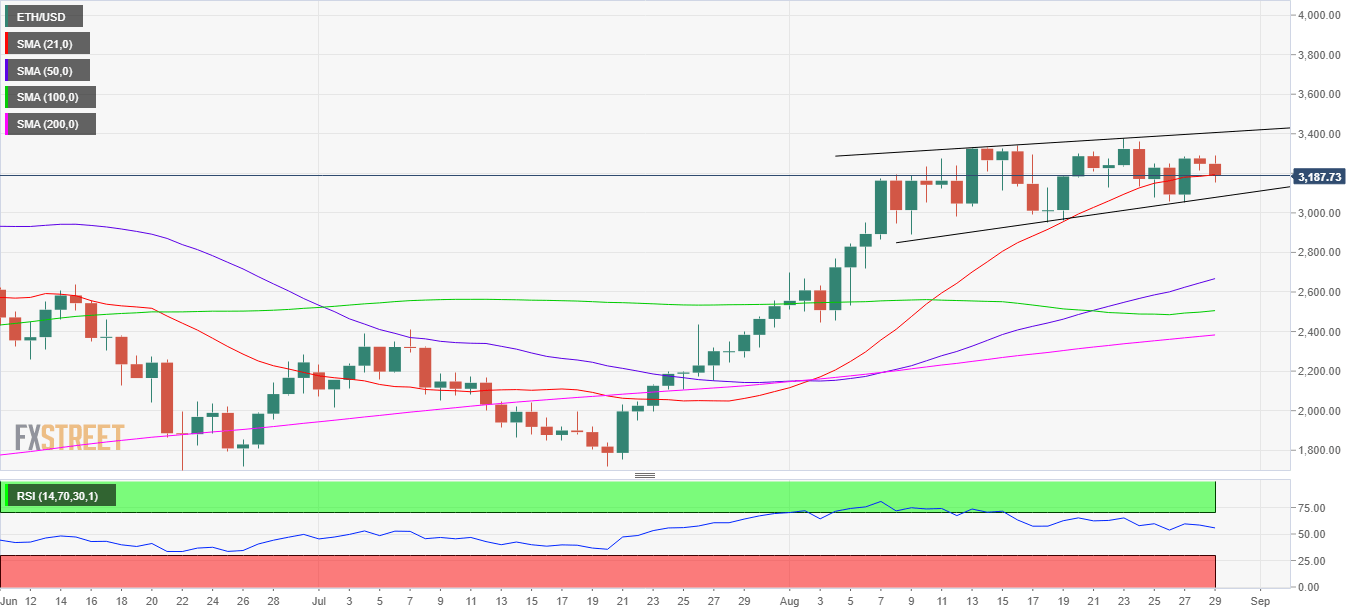

Ethereum’s daily chart shows that the price is pressuring the lower bound of Sunday’s trading range, having faced rejection just shy of the $3300 mark.

In doing so, ETH price has breached the 21-Daily Moving Average (DMA) at $3192, a daily closing below the latter could call for a test of the rising trendline support at $3070.

Note that Ethereum price is trending within a three-week-old rising wedge formation, with the bears now looking to challenge the lower boundary of the pattern.

If ETH price manages to find acceptance below the latter, then it will put a halt to the ongoing uptrend, triggering a fresh sell-off towards the upward-pointing 50-DMA at $2667.

ETH/USD: Daily chart

However, with the 14-day Relative Strength Index (RSI) still trending above the midline, ETH bulls remain hopeful for further upside.

Ethereum price needs to break through the $3300 near-term resistance to unleash the renewed upside towards the wedge hurdle at $3406.

A daily closing above that level will reinforce bullish commitments, initiating a fresh uptrend towards the $4000 level.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.