Ethereum Price Prediction: ETH bulls come to the rescue with a plan to revisit $1,500

- Ethereum price retraces 5.24% allowing sidelined buyers another opportunity to accumulate.

- A resurgence of buying pressure could propel ETH to the $1,500 psychological level.

- Invalidation of the bullish thesis will occur below the $1,195 support structure.

Ethereum price set up a local top after a quick run-up over the last week. This move was followed by a tight consolidation that resulted in a breakdown, allowing sidelined buyers to step up. As a result, ETH is primed for a quick run-up.

Ethereum price ready to explode

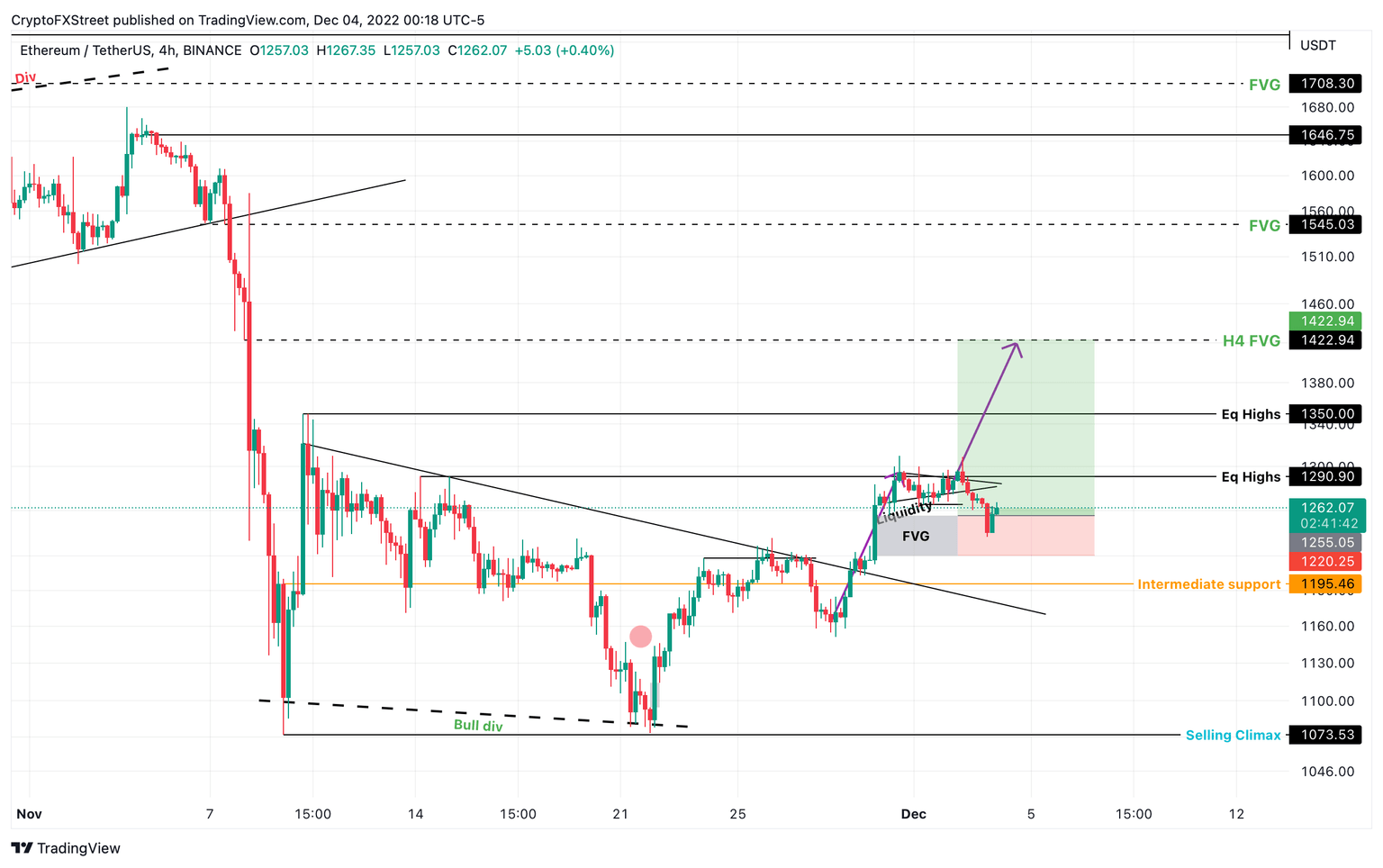

Ethereum price inflated by 13% between November 28 and December 2 and set up a local top at $1,309. The consolidation that ensued resulted in a downward breakdown, resulting in a retest of the imbalance, aka Fair Value Gap (FVG).

This move is an opportunity for investors willing to add more to their holdings or for the buyers that missed the initial run-up. A resurgence of buying pressure could send Ethereum price to collect the liquidity above $1,350.

Beyond this hurdle, ETH bulls can revisit the four-hour FVG at $1,422. While a local top could form here, the residual bullish momentum could see Ethereum price revisit the $1,500 psychological level.

ETH/USDT 4-hour chart

On the other hand, if the Ethereum price fails to manifest an upswing, it would indicate a weakness among buyers. If this development knocks ETH to produce a four-hour candlestick close below $1,195, it will create a lower low and invalidate the bullish thesis.

Such a situation could allow bears to take control of the Ethereum price and push it down to retest the next support level at $1,073.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.