- Ethereum stays depressed near 17-day low, keeps 50-day SMA breakdown.

- Bearish MACD, sustained break of the key SMA direct sellers towards the yearly support line.

- Buyers and sellers both have multiple barriers but trips for bears seem less bumpy ahead of immediate support line.

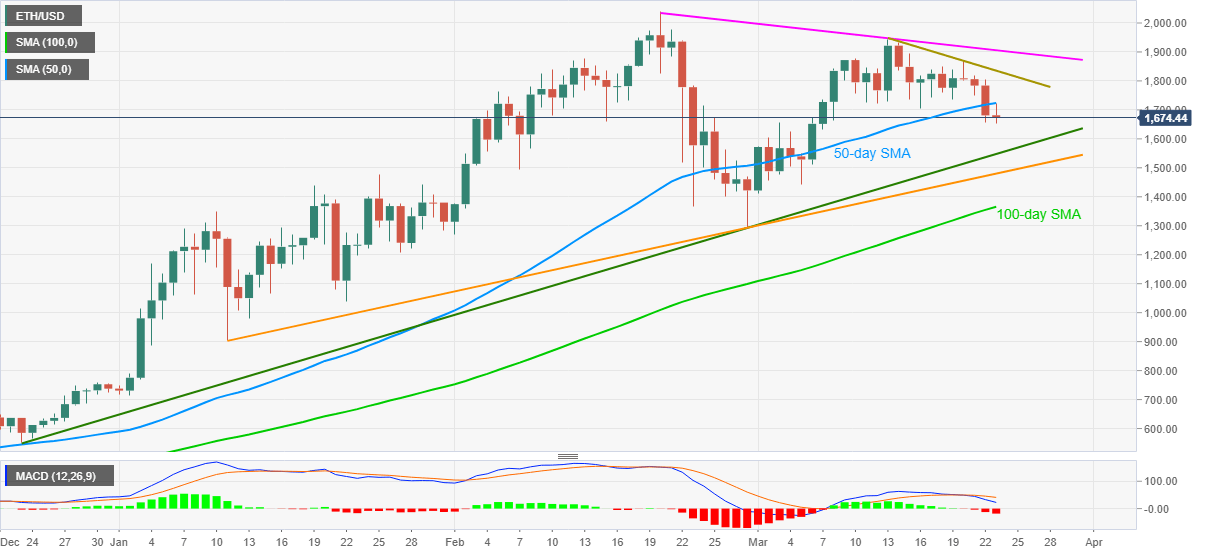

ETH/USD remains on the back foot around $1,670 during late Tuesday’s trading. In doing so, the altcoin keeps the downside break of 50-day SMA, amid bearish MACD, near the lowest levels last seen on March 07.

Given the clear break of the short-term key Simple Moving Average (SMA), coupled with downbeat MACD, Ethereum sellers look set to attack an upward sloping trend line from December 23, 2020, currently around $1,550.

However, any further downside will be questioned by an ascending support line from January 11 and 100-day SMA, respectively near $1,480 and $1,365.

Meanwhile, an upside clearance of 50-day SMA, at $1,723 now, will not be able to invite ETH/USD bulls as a 12-day-old resistance line and a falling hurdle, established since February 20, close to $1,835 and $1,905 in that order, will challenge the recovery moves.

If at all the Ethereum buyers cross the $1,905 resistance, the record top marked in February around $2,040 will be in the spotlight.

ETH/USD daily chart

Trend: Further downside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.