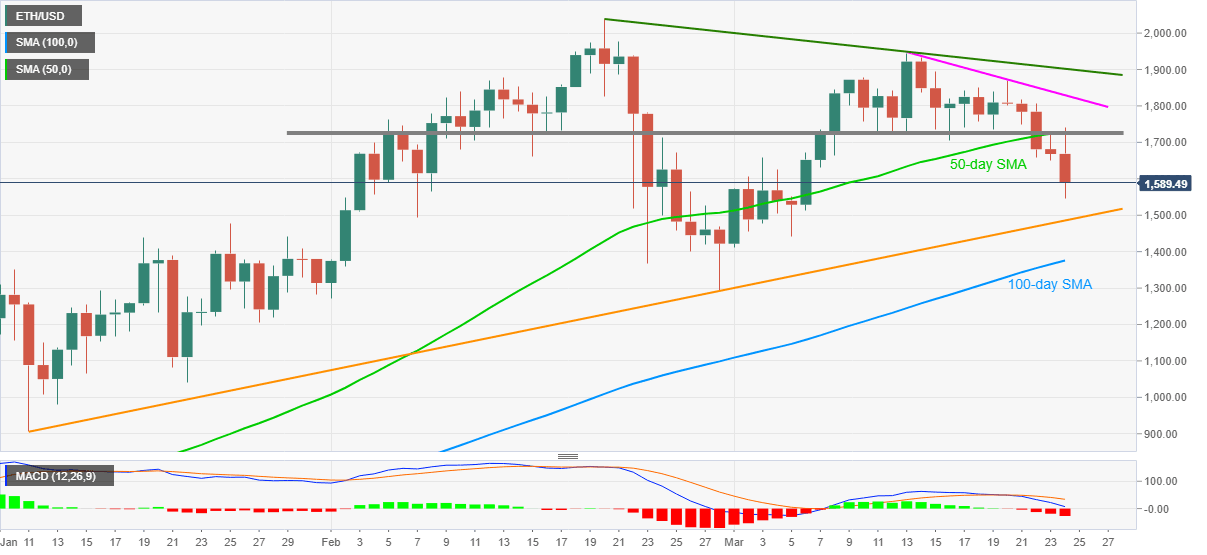

Ethereum Price Prediction: ETH bears eye key support line below $1,500

- ETH/USD stays depressed near lowest levels in three weeks.

- Bearish MACD, failures to regain 50-day SMA favor sellers.

- 100-day SMA adds to the downside filters, 12-day-old resistance line offers extra challenge to recovery moves.

Ethereum fails to bounce off early March lows while taking rounds to $1,590 by the press time of early Thursday. In doing so, the quote keeps a downside break of $1,720-30 horizontal resistance area, established since February 05 and comprising 50-day SMA off-late.

Not only the failures to rebound beyond the key resistance but bearish MACD also direct ETH/USD towards an ascending support line from November 01, 20220, around $1,485 by the time of writing.

Although Ethereum bears are likely to catch a breather around the key support line, failures to do so will highlight the $1,400 threshold and 100-day SMA near $1,375 as the following rest-points to watch.

It’s worth mentioning that the quote’s corrective pullback beyond $1,730 is a green pass to the ETH/USD bulls as multiple trend lines close to $,1830 and $1,900 will be challenging them afterward.

Overall, Ethereum isn’t the one that is likely to recall the bulls, for now. However, the further selling depends upon how well the quote drops below crucial nearly supports.

ETH/USD daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.