Ethereum Price Prediction: ETH aims for $2,000 as more than 10 million coins are locked

- Ethereum price has hit a new all-time high at $1,695 across all exchanges.

- The total number of Ethereum coins locked away has hit 10.33 million representing $16.8 billion.

- However, investors are concerned due to the high gas fees on DeFi protocols.

Ethereum is the most used and popular smart-contracts platform in the cryptocurrency market. On February 4, the digital asset hit a price of $1,695 reaching a market capitalization of over $187 billion for the first time ever.

Ethereum price eying up $2,000 but could see a pullback first

One of the main driving forces behind Ethereum’s current run is all the locked coins inside different DeFi protocols and the Eth2 deposit contract. In total, around 10.33 million ETH are locked away which are worth over $16.8 billion at current prices.

ETH Holders Distribution chart

Surprisingly, the number of whales holding between 10,000 and 100,000 ETH ($16,000,000 and $160,000,000) increased by 11 in the past 24 hours despite Ethereum price hitting new all-time highs, which indicates large holders are extremely interested in the digital asset and believe it will climb higher.

ETH Network Growth

Additionally, despite being the second most popular Blockchain in the world, the number of new addresses joining Ethereum exploded by 40% in the past week and the number of active addresses also increased by 25%. This is a strong indication that the bull rally has a lot of strength behind it.

ETH/USD daily chart

Ethereum price already hit the 127.2% Fibonacci level on the daily chart at $1,650. The next most important level is $2,000 which is the 161.8% level and a strong psychological level.

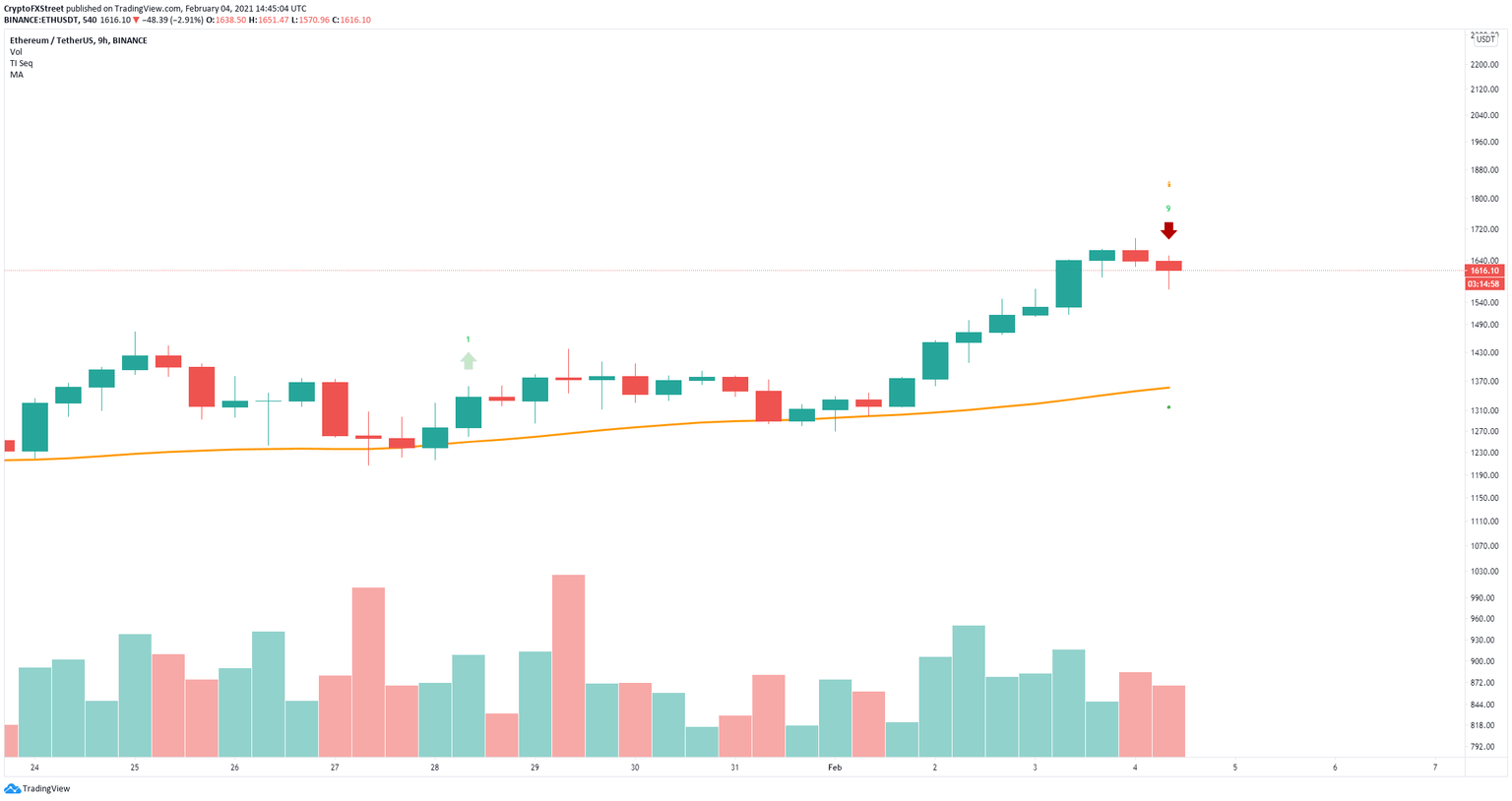

ETH/USD 9-hour chart

However, many Ethereum investors are worried about Ethereum fees which have hit astronomical numbers. Normal ETH transactions can cost up to $15 but interacting with DeFi protocols can cost as much as $150 per transaction. Considering that Ethereum’s price depends on the success of the protocols built on top of it, this is certainly not good for the digital asset.

On the 9-hour chart, the TD Sequential indicator has presented a sell signal. If validated, Ethereum price could fall towards the 50-SMA located at $1,360.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.39.12%2C%252004%2520Feb%2C%25202021%5D-637480467885791136.png&w=1536&q=95)