Ethereum Price Prediction: A Textbook Knife-Catch Scenario

- Ethereum price follows classic smart money fakeout anticipated throughout the week.

- Ethereum price shows divergence between two impulse waves deeming the ETH price problematic to hodl.

- A second retracement into the $1,270 level remains on the cards. Invalidation of the impulsive rally is a breach of $1250.

Ethereum Weekly Recap

Ethereum price has finally validated the weekly forecast, endorsing a conservative 1.5-1 trade setup forecasted days in advance.

Ethereum Price Bullrun Recap

Since July 22, several outlooks have been issued to our subscribers to keep eye on a possible liquidation and sharp v-shape retracement opportunity commonly referred to as a "knife catch".

"Thus, placing an additional entry at the current time is unfavorable. A knife-catching opportunity could present itself within the $1,300-$1,350 zone in the coming days, with a bullish target in the $1,900 after the plunge. Invalidation of the uptrend scenario is now a breach below $1,270. "

ETH/USDT Knife Catch 101 Thesis 7/22

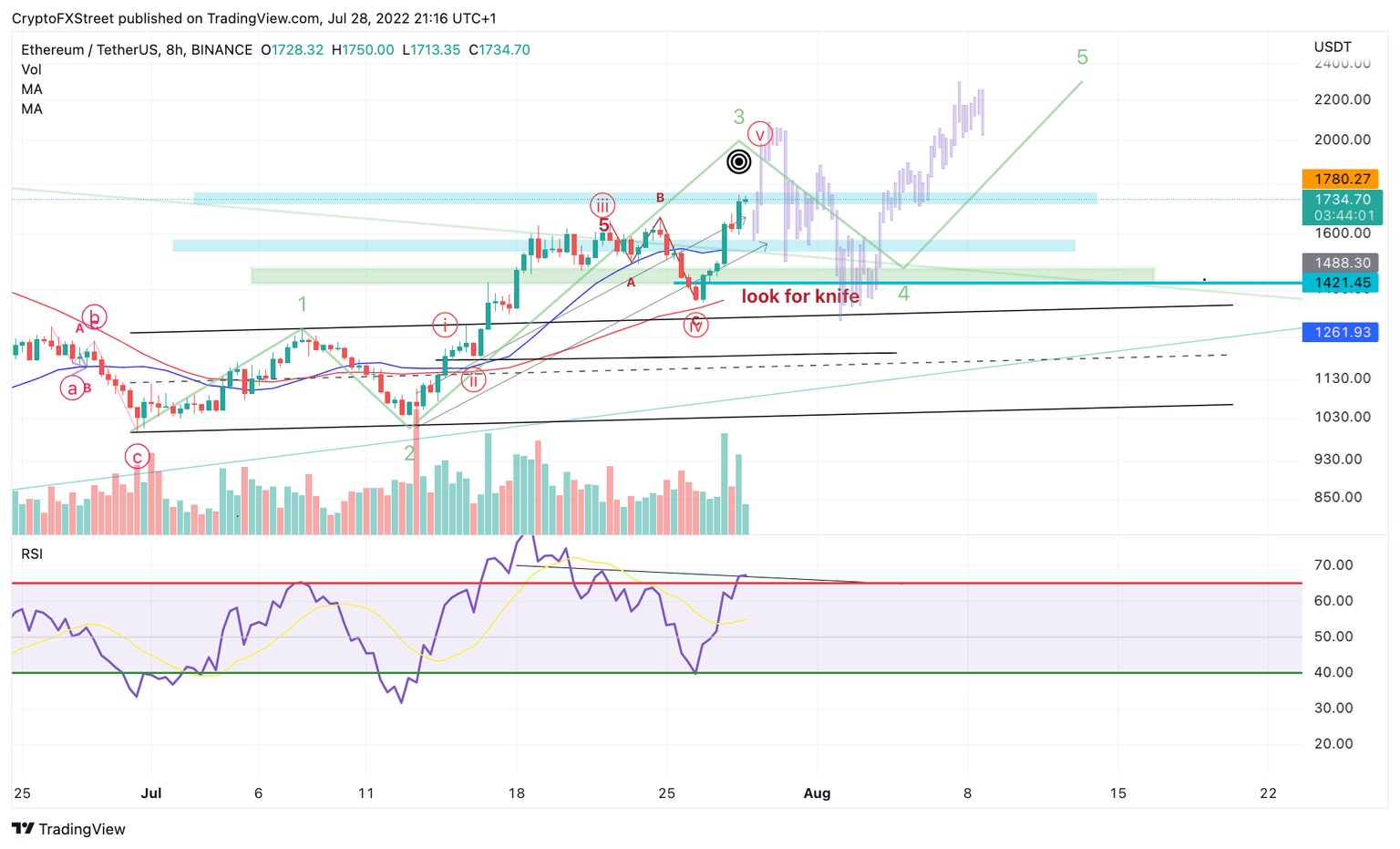

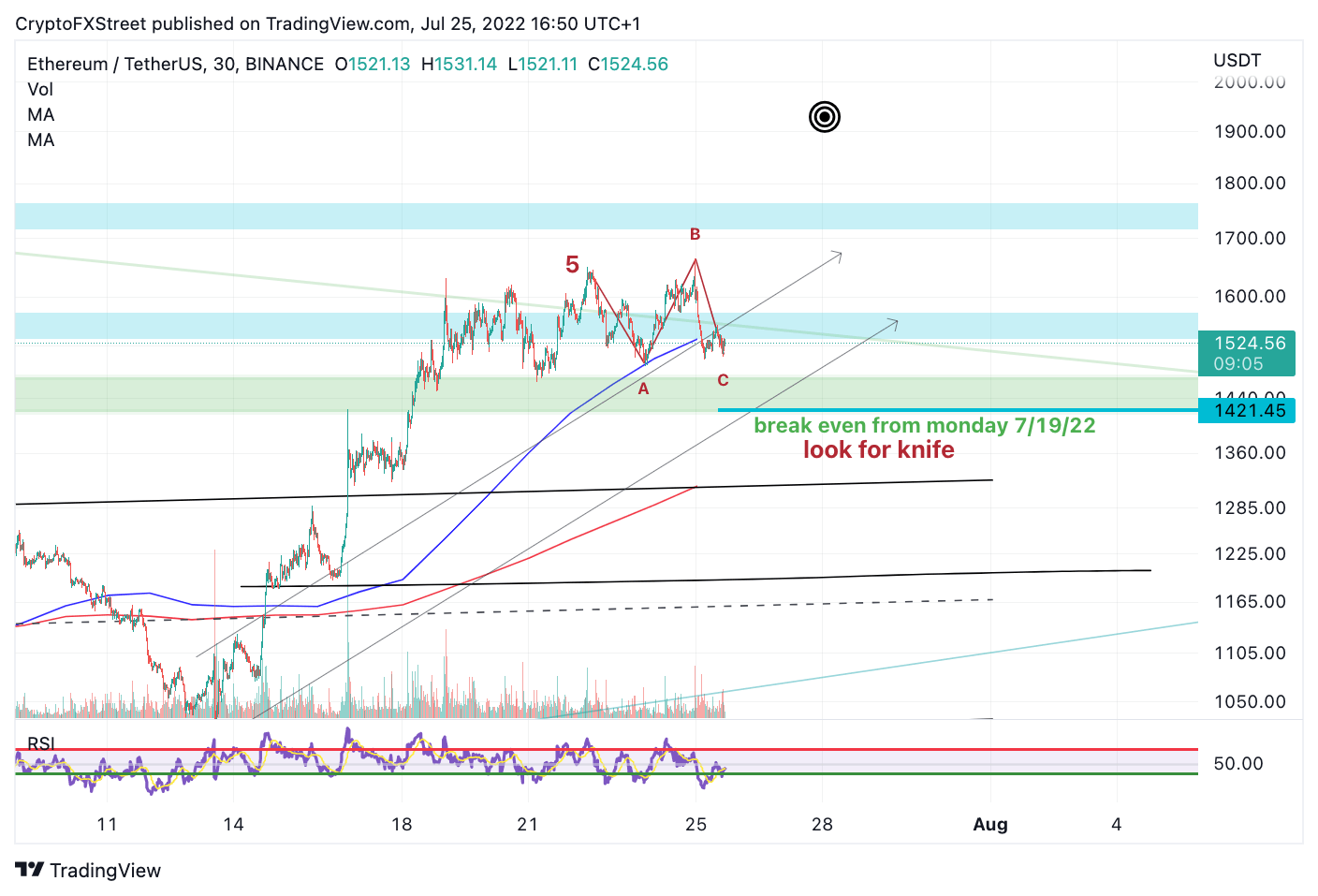

On July 26, the "look for knife catch" reminder was placed near the $1,360 zone based on a combination of Elliot Wave, Auction Market Theory and RSI divergences on smaller time frames.

ETH/USDT 30-min chart Ethereum bullish unless thesis 7/25/22

On the same day, a now or never statement was issued.

Invalidation of the uptrend scenario has been moved from $1,270 to $1,250 for wiggle room and accuracy. A more conservative approach would be to wait for a turn and breach above $1,460 before getting involved with the Ethereum price.

Ethereum "Gepetto Thesis "7/26/22

The conservative approach set up a 1.35 to 1 reward-to-risk ratio, which has already landed in the first target zone on July 28. Riskier knife catchers are already in profit, 2x the risk and counting.

ETH USDT 12-Hour chart. Conservative Risk

A Trader's Recap

Being a trader is never an easy task. You will never win them all and the big moves you miss or get wrong will probably hurt. Still as a trader, when opportunities present themselves you have to be ready to strike while practicing healthy risk management. That's all you can control.

Ethereum price has validated the uptrend scenario and can rally towards $1,900 in the short term. Traders in profit from the bullish setups this week should be aware that the Ethereum price shows divergence between two impulse waves, which deems the ETH price a difficult coin to hodl. A second retracement into the $1,270 level remains on the cards. Invalidation of the impulsive rally is still a breach of $1,250.

A fractal wave of Ethereum's previous auction market behavior has been put in place to keep aware of possible smart money traps that remain possible in the future.

ETH/USDT 6-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of inerest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.

-637946449039999632.png&w=1536&q=95)