- ETH/USD is attempting to climb above the daily 12-EMA and the 26-EMA.

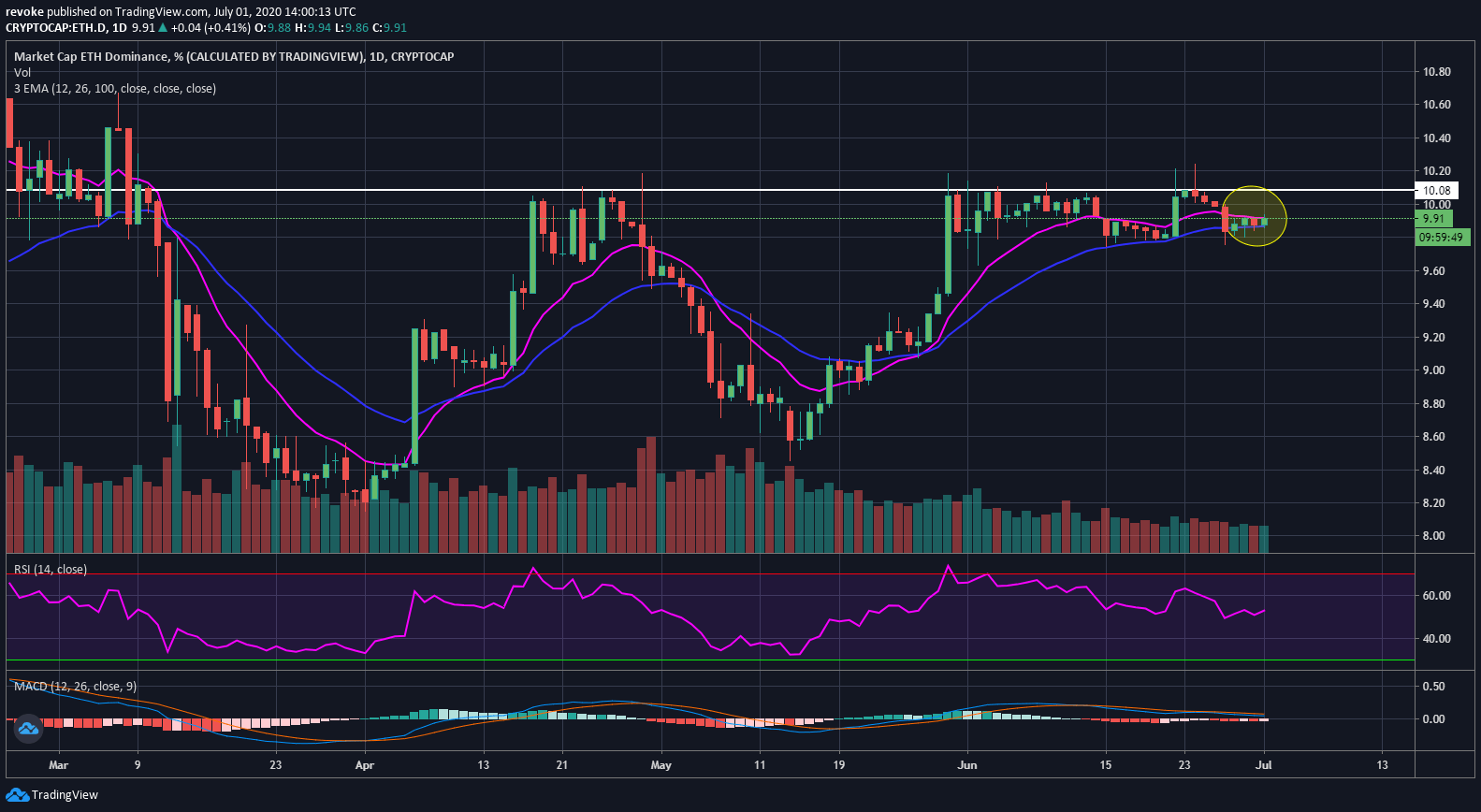

- Ethereum market cap dominance is close to a breakout.

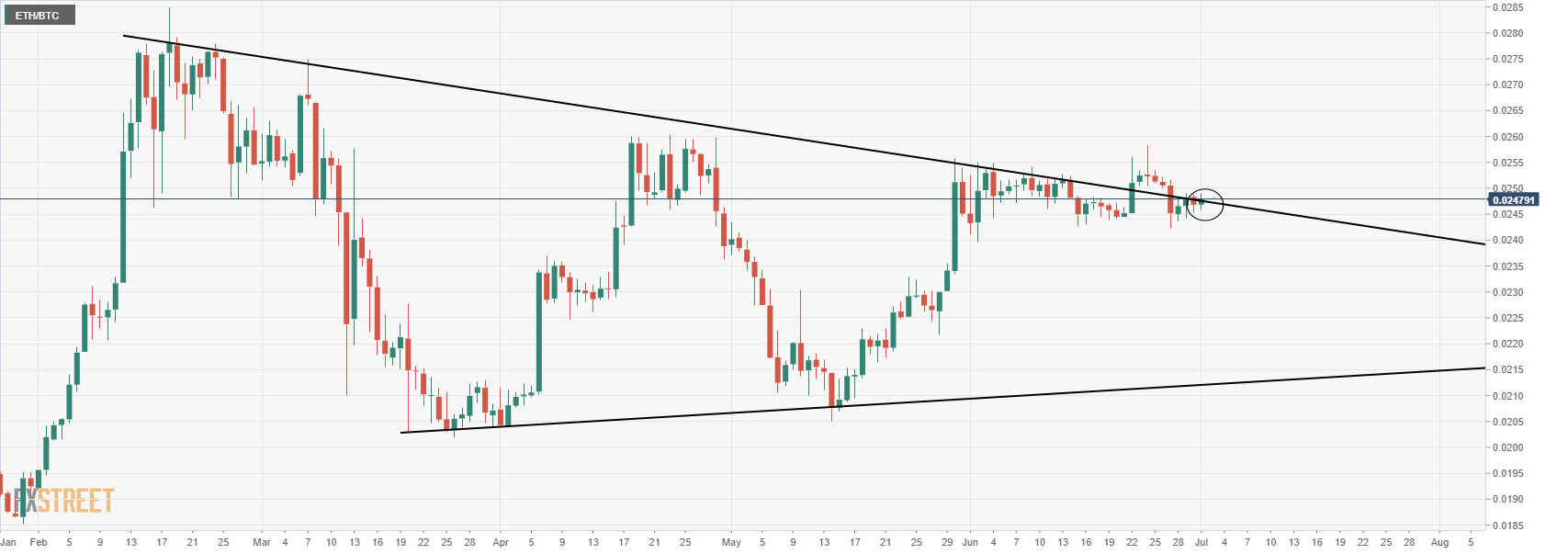

- ETH/BTC is also in favor of ETH and near a critical trendline.

We know that Ethereum outperformed Bitcoin during May by quite a lot. The digital asset was one of the few top coins to see a significant bull rally while everyone else was sleeping. ETH/USD managed to peak at $253.47 before entering a consolidation period. While Ethereum has been trading sideways for the past few weeks, the pair against Bitcoin has remained fairly strong.

These indicators and metrics can push Ethereum above $250 again

On the ETH/BTC pair, one significant factor has been present for the past two weeks. Bulls have defended the 26-EMA several days in a row, and they are currently attempting to climb above the 12-EMA. While this is not the first attempt to crack the upper trendline, the last rejection on June 24 was clearly not powerful enough to push Ethereum down to the lower trendline. This factor indicates that bulls are strong and bears are weak.

The dominance chart is fairly similar to the ETH/BTC chart. Ethereum is also trying to push for a clear breakout above 10%. Ethereum is close to two simultaneous breakouts which would also mean a crack of the daily 12-EMA and the 26-EMA on Ethereum’s daily chart.

Of course, we also have Ethereum 2.0 coming up, an event that will certainly help Ethereum’s price, however, no one truly knows when the actual upgrade will be live. We know Bitcoin and Ethereum balances on exchanges are going down significantly in the past two to three months. This clearly indicates an interest in holding both cryptocurrencies instead of selling them.

Another important metric that is exploding is the number of addresses with a balance of 1 or more Ethereum coins. Right before March, the number was 971,000 addresses compared to 1.046 million on June 1.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.