Ethereum price only needs to do one thing for ETH to reach $3,700

- Ethereum broke the purple ascending trend line that was used as the backbone for the rally since July 21.

- Buyers stepped in and picked up Ethereum quickly.

- Price action is forming a triple top at $3,391.

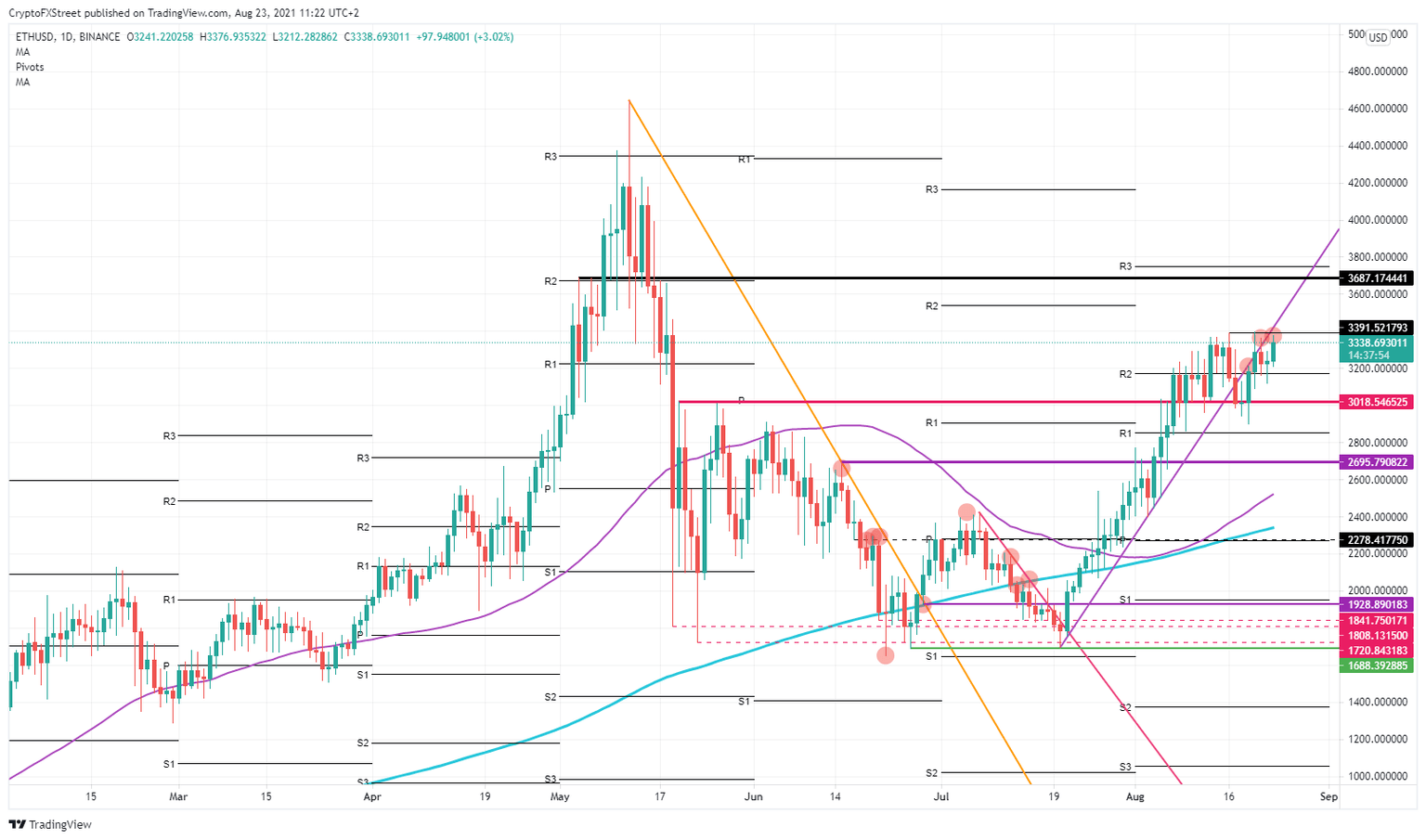

Ethereum was in a bit of a bumpy ride after the correction on August 16. Price action dipped after ETH hit the price of $3,391, forming a short-term cap on the price action. Buyers could not push price action beyond this level and got caught in a two-day correction below $3,018. That $3,018 was a significant level on May 20, May 26 and August 5, making it a triple top. Once buyers pushed ETH above there, this level acted as support.

Ethereum needs to get above $3,391

Since last week, Ethereum is now in a squeeze to the upside. We get higher lows on the candles, while to the upside, price action remains around $3,391 and cannot push above. Expect the price to get further squeezed against that level, making it a short-term resistance point. The fact that the level already got tested three times to the tick shows its importance.

A move above has its importance, but a daily close above will be of even greater importance. Either in the coming days, buyers can push price action above it or not.

If they do, expect some hesitant action as ETH will hit that ascending purple trend line from below. Buyers will need to ante up their efforts to push price action further up. If they succeed in that, then $3,687 should be in reach in the coming weeks.

Failing to break the short-term cap at $3,391 will result in a break lower, possibly back to $3,018 or even the R1 monthly resistance level at $2,853.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.