Two reasons why Ethereum price could make a U-turn to $2,100

- Ethereum price recovered from its slump and made a comeback above $1700.

- Analysts believe Ethereum price is on track to a bullish target of $10,000, according to Elliott Wave Theory.

- Exploring the connection between stablecoin DAI velocity and low levels of on-chain activity on Ethereum, analysts believe ETH is in hibernation.

Ethereum blockchain has witnessed a drop in on-chain activity. Despite the slump, Ethereum price recovered from its down trend and climbed above the $1700 level. Analysts are bullish on a breakout in Ethereum.

Ethereum climbs above $1,700

Leading cryptocurrency analyst Dr. Arnout Ter Schure applied the Elliott Wave Principle and set a target for Ethereum around the $2300 level.

The Elliott Wave Principle is an analysis of long-term trends in price patterns and helps identify and predict waves that reveal probable outcomes for future price movements. It reveals highs and lows, looking for patterns in prices. Applying this principle to Ethereum price trend, the analyst argues the altcoin is wrapping its last fourth and fifth waves. When the wave is complete, the analyst expects Ethereum price drop ideally to the $1,500 level and the end of the fourth wave is $2,150.

ETHUSD chart

Once Ethereum completes the last minute wave 5, it would technically complete the correction that started in November 2021. A break back above $2,150 would confirm rally to $10,000 level.

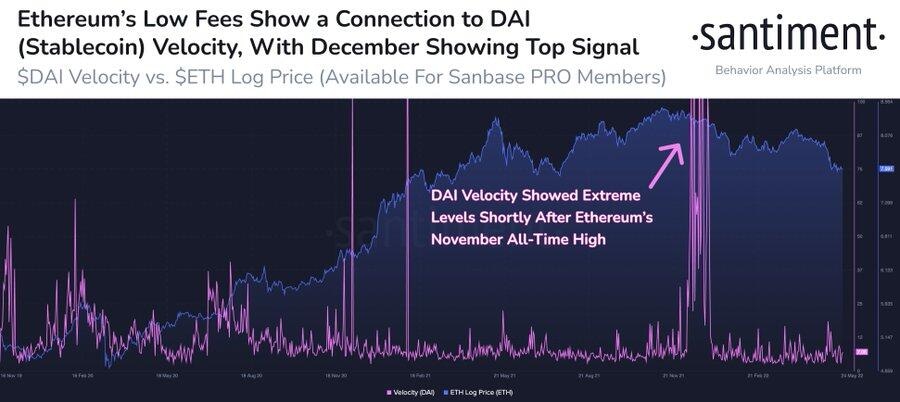

Ethereum records extremely low fees

After a bloodbath in the crypto market, Ethereum recorded extremely low fee levels. Based on a report from crypto intelligence platform Santiment, there is very little activity on the Ethereum network. Analysts have observed a connection between low levels of activity and stablecoin velocity.

Ethereum price- DAI velocity

Velocity is a measure of how quickly money is circulating in the crypto economy. The current level, stablecoin (DAI) velocity and low level of on-chain activity on Ethereum indicates hibernation. Analysts believe bears are asleep and waiting for a trigger.

To conclude, Ethereum bears are currently inactive and awaiting a trigger in the altcoin's price trend. A spike in DAI velocity can be considered a trigger for an Ethereum price rally.

@BitQueenBR, a crypto analyst and trader believes after a drop to $1400-$1500 level, Ethereum price could rebound. Until then, the analyst expects a downtrend in Ethereum price.

$ETH measured move reached, expecting a little more downside until we get a proper bounce arround $1400-1500ish. pic.twitter.com/Txisy61zGL

— BitQueenBR (@BitQueenBR) May 27, 2022

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.