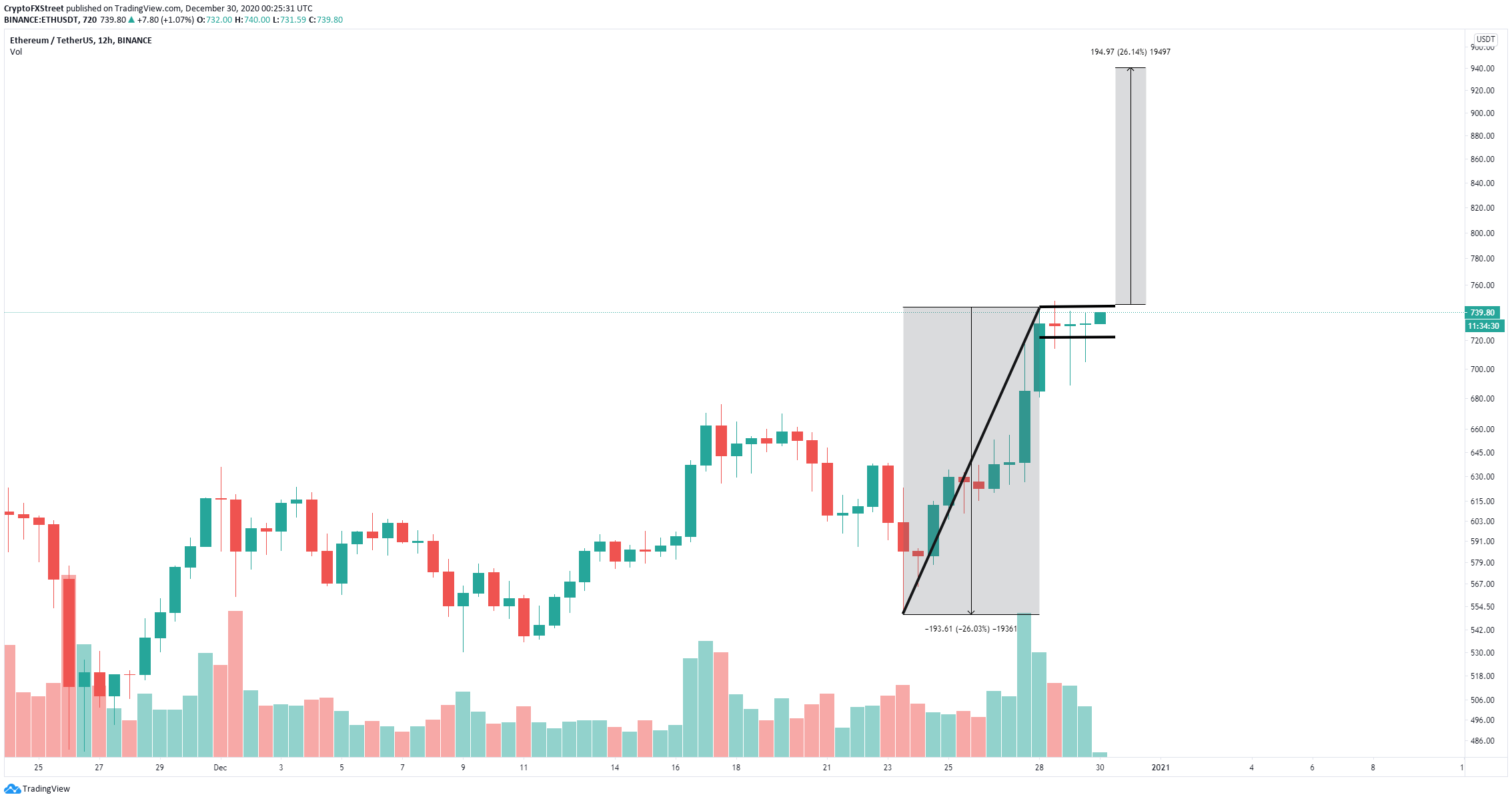

- Ethereum price seems poised for a massive move as it has established a bull flag on the 12-hour chart.

- Most on-chain metrics have turned in favor of the digital asset.

The interest in Ethereum seems to be stronger than ever as more users continue locking up their ETH coins inside the Eth2 deposit contract. The smart-contracts giant seems to be on the verge of a massive bullish move aiming for $1,000.

Ethereum price aims for $1,000 as bulls remain strong

Ethereum has formed what seems to be a potential bull flag on the 12-hour chart. The past two candlesticks have established long lower wicks which indicates the bulls are buying the dips.

ETH/USD 12-hour chart

The Eth2 deposit contract holds 2.12 million ETH coins which are worth close to $1.6 billion at current prices. Additionally, the number of whales holding between 10,000 and 100,0000 coins has spiked again by eight in the past 24 hours and has been in an uptrend since October.

ETH Holders Distribution chart

On top of that, the number of coins inside exchanges has continued to decline since October and hit a low of 22.6% for the first time since May 2019. These on-chain metrics give credence to the bullish outlook, not only in the short-term but also long-term.

ETH supply on exchanges chart

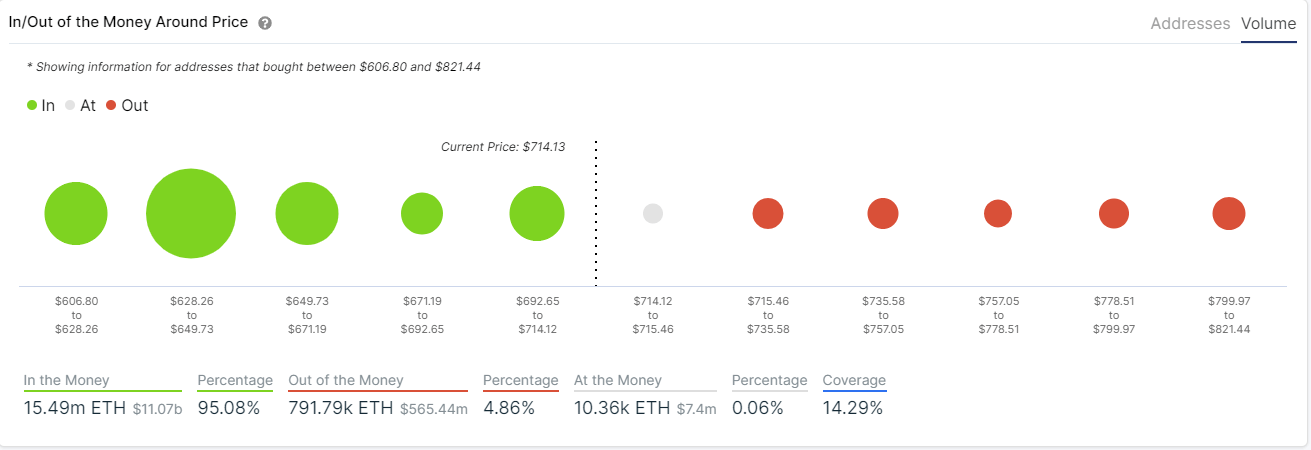

The In/Out of the Money Around Price (IOMAP) chart shows practically no resistance ahead, well until $820 and above. On the other hand, there seems to be significant support below in comparison.

ETH IOMAP chart

However, it’s important to note that the entire cryptocurrency market is heavily volatile and Bitcoin could be on the verge of a massive correction that could drag Ethereum down with it, which is basically the only bearish outlook for now.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[01.31.35,%2030%20Dec,%202020]-637448855800836520.png)

%20[01.30.55,%2030%20Dec,%202020]-637448855845214753.png)