ETH price is storming toward a key resistance level, but pro traders are reluctant to add leverage for three important reasons.

Even though Ether (ETH) price bounced over 20% from the $2,300 low on Feb. 22, derivatives data shows that investors are still cautious. To date, Ether's price is down 24% for the year, and key overhead resistances lay ahead.

Ethereum's most pressing issue has been high network transaction fees and investors are increasingly worried that this will remain an issue even after the network integrates its long-awaited upgrades.

For example, the 7-day network average transaction fee is still above $18, while the network value locked in smart contracts (TVL) decreased 25% to $111 billion between Jan. 1 and Feb. 27. This negative indicator could partially explain why Ether has been down-trending since early February.

Ether/USD price at FTX. Source: TradingView

The above channel currently shows resistance at $3,100, while the daily closing price support stands at $2,500. Therefore, a 14% rally from the current $2,750 level needs to happen for the prevailing downward trend to be canceled.

Derivatives markets show fear as the prevailing sentiment

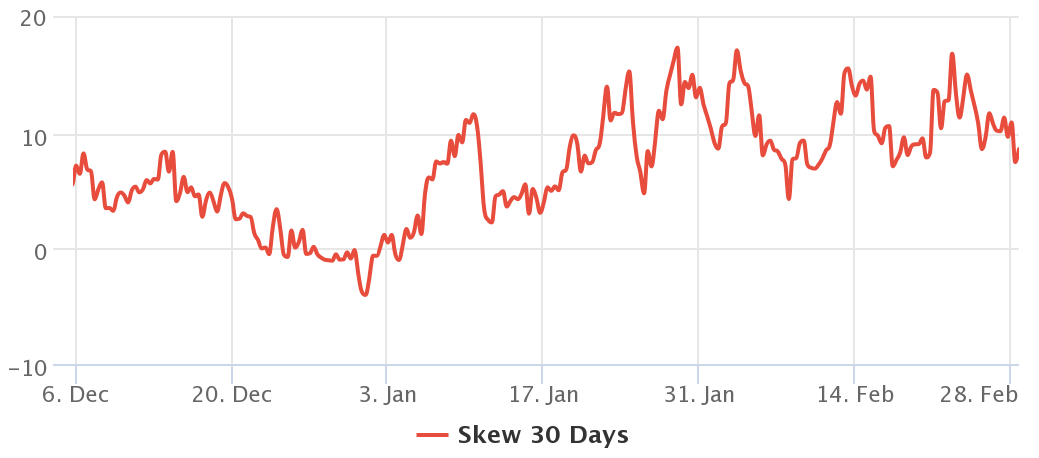

The 25% delta skew compares equivalent call (buy) and put (sell) options. The indicator will turn positive when "fear" is prevalent because the protective put options premium is higher than the call options.

The opposite holds when market makers are bullish, causing the 25% delta skew to shift to the negative area. Readings between negative 8% and positive 8% are usually deemed neutral.

Deribit Ether 30-day options 25% delta skew. Source: laevitas.ch

The above chart shows that Ether option traders have been signaling bearishness since Feb. 11, just as Ether failed to break the $3,200 resistance. Furthermore, the current 8.5% reading shows no confidence from market markers and whales despite the 7.5% price increase on Feb. 28.

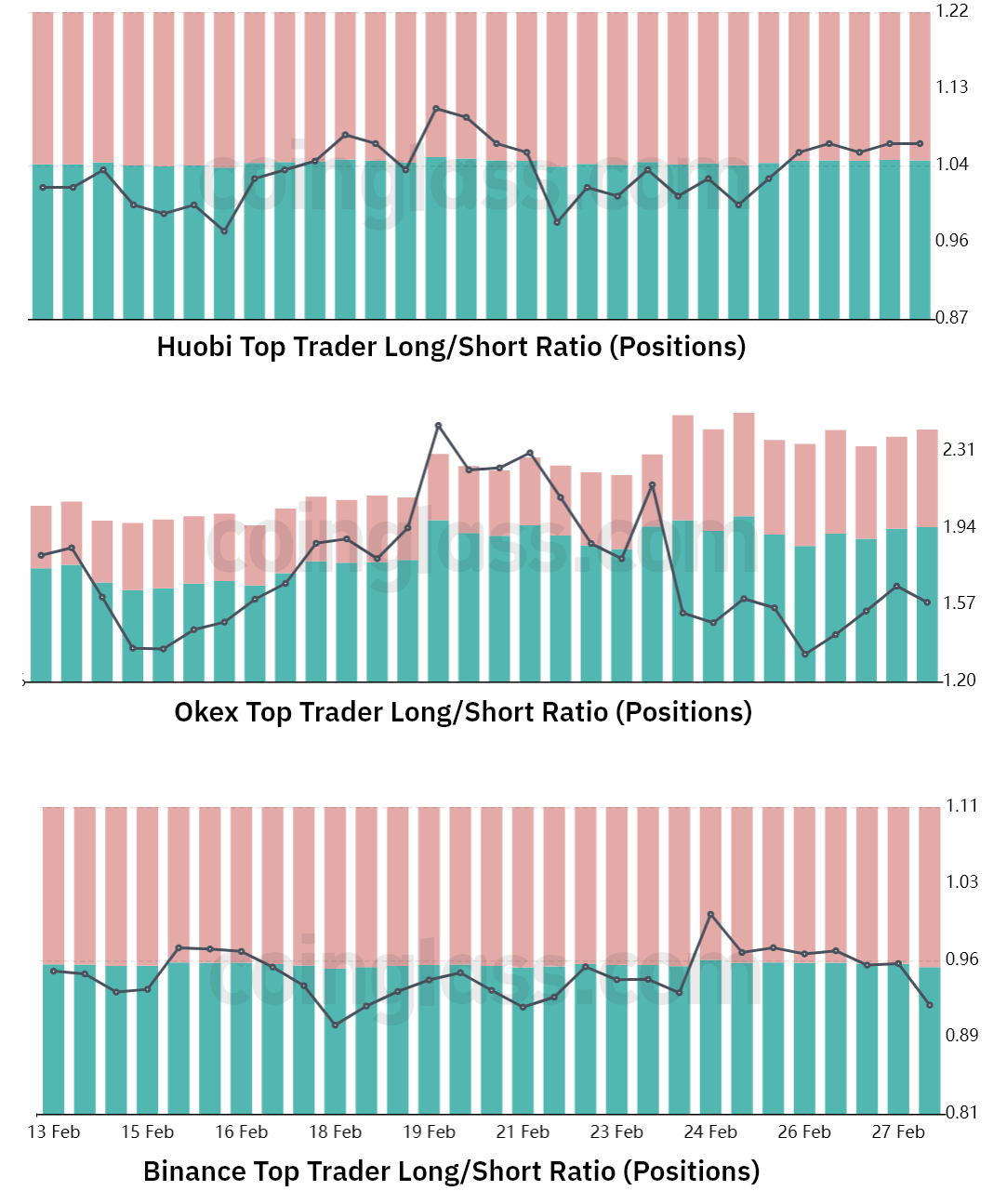

Exchange-provided data highlights traders' long-to-short net positioning. By analyzing every client's position on the spot, perpetual and futures contracts, one can better understand whether professional traders are leaning bullish or bearish.

There are occasional methodological discrepancies between different exchanges, so viewers should monitor changes instead of absolute figures.

Exchanges' top traders Ether long-to-short ratio. Source: Coinglass

Even with Ether's 21.5% rally since Feb. 24, top traders on Binance, Huobi and OKX have decreased their leverage longs. More precisely, Huobi was the only exchange facing a modest reduction in the top traders' long-to-short ratio as the indicator moved from 1.04 to 1.07.

However, this impact was more than compensated by OKX traders increasing their bullish bets from 2.15 to 1.58 from Feb. 24 to Feb. 28. On average, top traders decreased their longs by 8% over the past four days.

Top traders could be caught by surprise

From the perspective of the metrics discussed above, there is hardly a sense of bullishness present in the Ether market. Moreover, data suggests that pro traders are unwilling to add long positions as expressed by both futures and options markets.

Of course, even professional traders get it wrong, and a short cover should happen if Ether breaks the current downtrend channel $3,100 resistance. Still, it's also important to at least recognize that there's little interest in buying using derivatives at the current level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

EOS 22% pump steals the show unveiling Vaulta’s web3 banking ecosystem

EOS, the token behind the recently rebranded Vaulta network, has increased by a staggering 22% in the last 24 hours.

Curve DAO Price Forecast: CRV bulls could aim for double-digit gains above key resistance

Curve DAO (CRV) price is in the green, up 8%, trading above $0.53 on Thursday after rallying nearly 15% so far this week.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin (BTC) and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.