Ethereum price may lose $2,000 level as ETH becomes deflationary again due to validator exit

- Ethereum price, trading at $2,038 on Tuesday, will likely fall below the crucial support level amid waning bullishness.

- ETH validators, for the first time since Shapella's hard fork, have begun exiting to the tune of 1,018 per day.

- ETH issuance has also taken a hit and, for the first time since December 2022, has recently had its growth rate decreased by 0.5% per day.

Ethereum price has been affected by the Shanghai hardfork since even before it was activated. But since the upgrade, this week marks the first instance when the market is witnessing the fear of unstaking come to life.

Ethereum price could take a bearish turn

Ethereum price has been hovering around the $2,000 mark since the beginning of the month. Trading at $2,038 at the time of writing, the second-generation cryptocurrency has failed to breach the resistance of $2,124 for the second time this month. While it did manage to break out of the downtrend over the past week, it is still vulnerable to a decline below the $2,000 support level.

The Relative Strength Index (RSI) is a measure of the speed and change of price movement. According to the indicator, there is still room for ETH to bounce back and reinitiate bullish momentum, given it is sitting above the neutral line at 50.0. The Moving Average Convergence Divergence (MACD) indicator is also exhibiting the dominance of bearish momentum in the market presently, owing to the red bars on the histogram and the lack of a potential bullish crossover.

Thus, all the fingers point at a likely downtrend, which might see Ethereum price touching the lows of $1,900 or testing the support at $1,795.

ETH/USD 1-day chart

But if the broader market cues turn bullish and ETH bounces back from $2,000, it could make another attempt at breaching the resistance marked at $2,124. A rise through that level would invalidate the bearish thesis, opening ETH up to tagging $2,200.

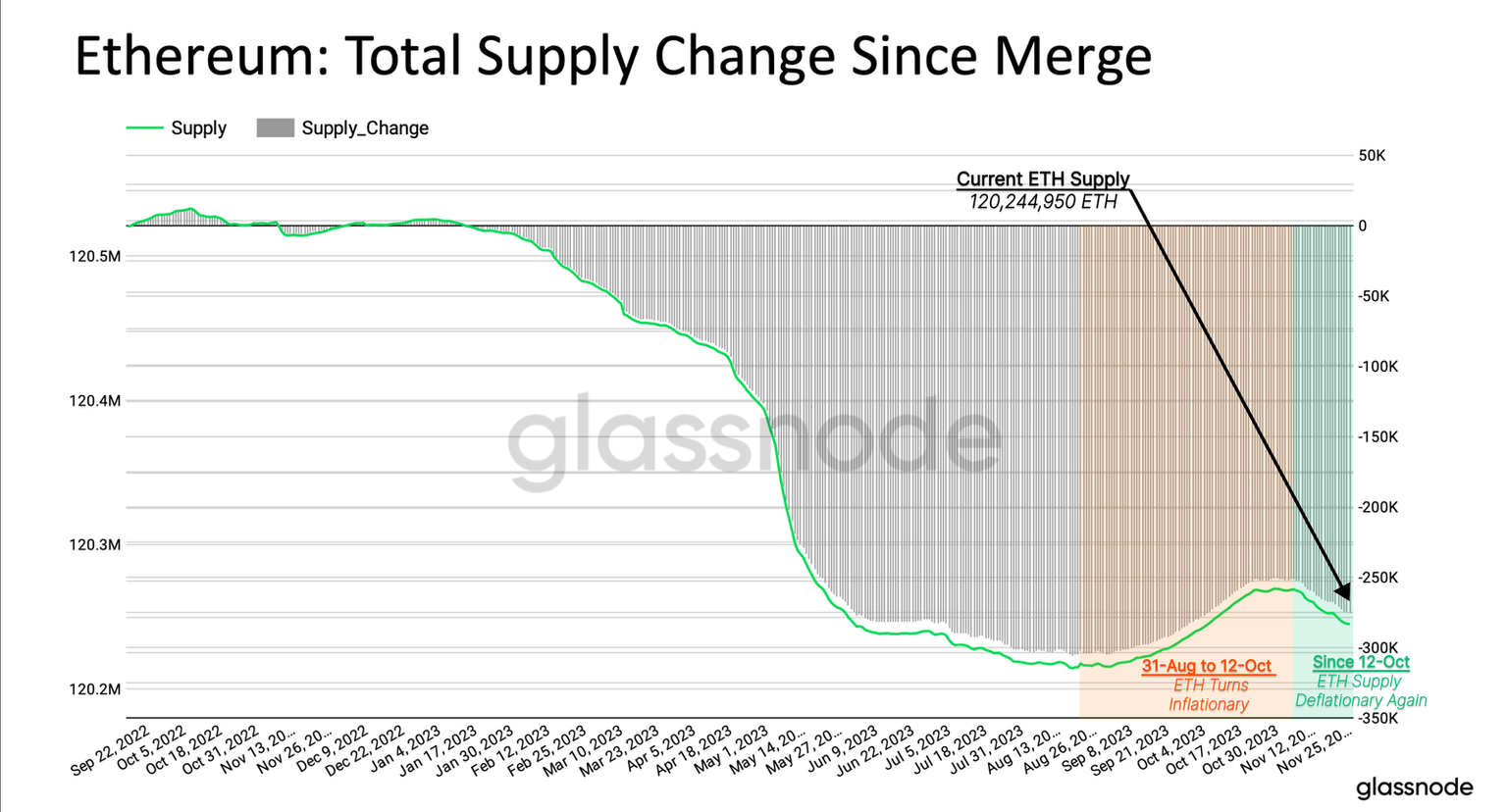

Ethereum turns deflationary again

The chance of a bullish turn of events is both likely and unlikely. It's likely because ETH is deflationary once again. An asset being deflationary simply means that it no longer has an infinite supply but that it will reduce over time. This generally is a bullish event since low supply plus high demand equals a rise in price.

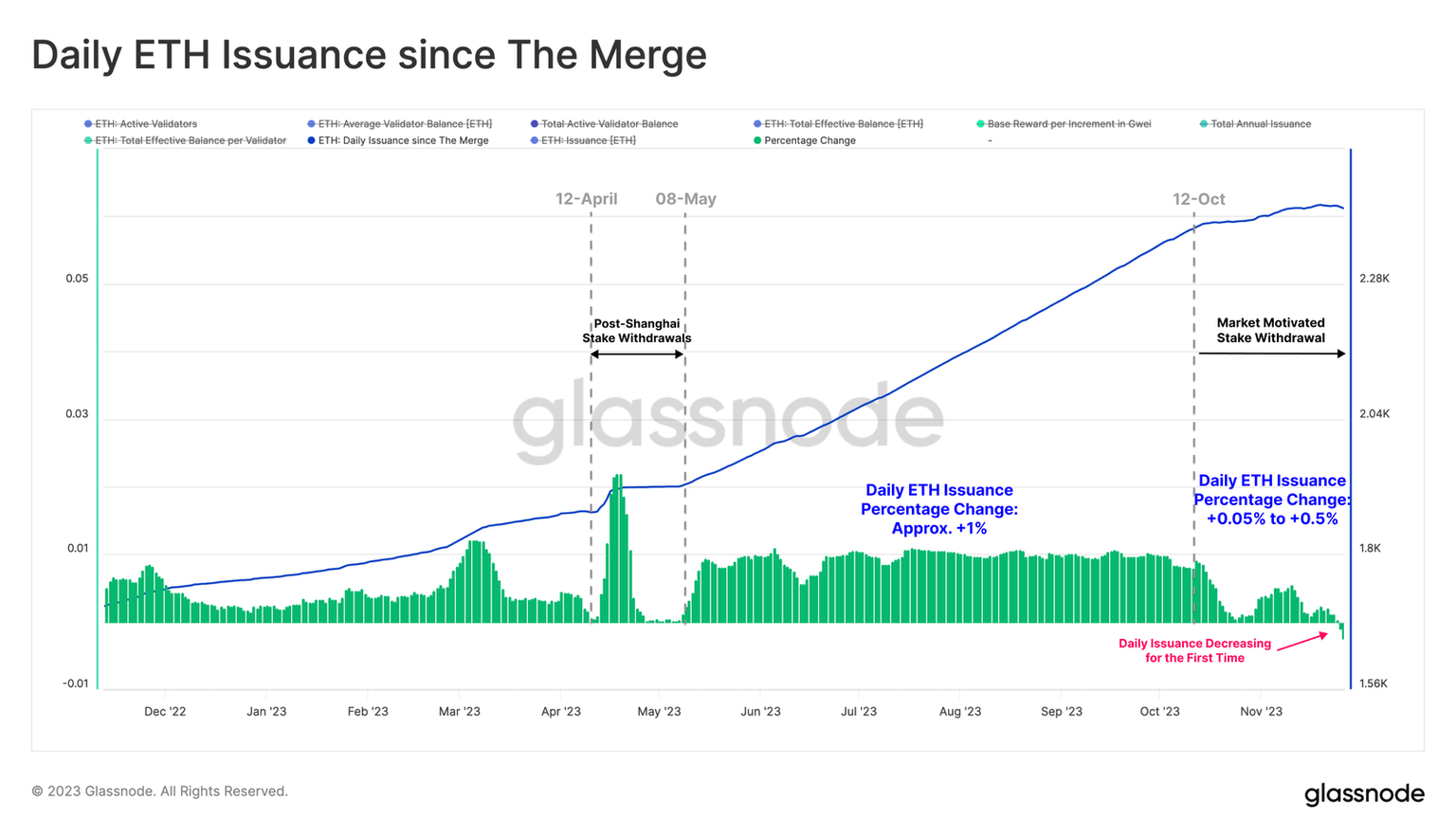

But the reason it could be unlikely in the case of Ethereum is that the conditions under which ETH is turning deflationary are unfavorable. According to blockchain analytics platform Glassnode, daily ETH issuance has experienced a slowdown. Over the last week, the growth rate of ETH issuance has slowed by up to 0.5% per day.

Ethereum daily issuance

This marks the first issuance decrease in nearly 12 months, and the reason behind it is the exit of validators. Unlike Bitcoin, Ethereum runs on the Proof of Stake consensus method, which requires node/block validators to stake ETH in order to qualify. Earlier, this staked ETH could not be withdrawn, but that feature was activated after the Shapella upgrade.

Since then, on average, 380 validators have exited on a daily basis. But this figure shot up by 168% in just a month, rising to 1,018 validators.

Ethereum validators

Consequently, the staked ETH has also noted a decline. The possibility of the validator exit could be due to one or more of these three possible reasons:

- Investors are opting to change their staking setup, for example, by transferring stakes from CEXs (centralized exchanges) to Liquid Staking Providers (perhaps due to ongoing regulatory concerns).

- Investors with access to US capital markets may be rotating capital toward safer assets, such as US treasuries, as interest rates remain elevated relative to ETH staking returns.

- Investors may also be seeking greater liquidity for held ETH in anticipation of an imminent market uptrend rather than less liquid-staked ETH.

Nevertheless, this is not a good sign for Ethereum as the validators are the backbone of the network, and their exit could prove to be rather negative.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.