Ethereum price looks strong and ETH dares to dream of $2,700 again

- Ethereum price got a positive lift in the recovery of the global market.

- Bitcoin and other major cryptocurrencies were back in the news after attention from Musk, Dorsey.

- Some short-term profit taking is taking effect, but more upside is yet to come.

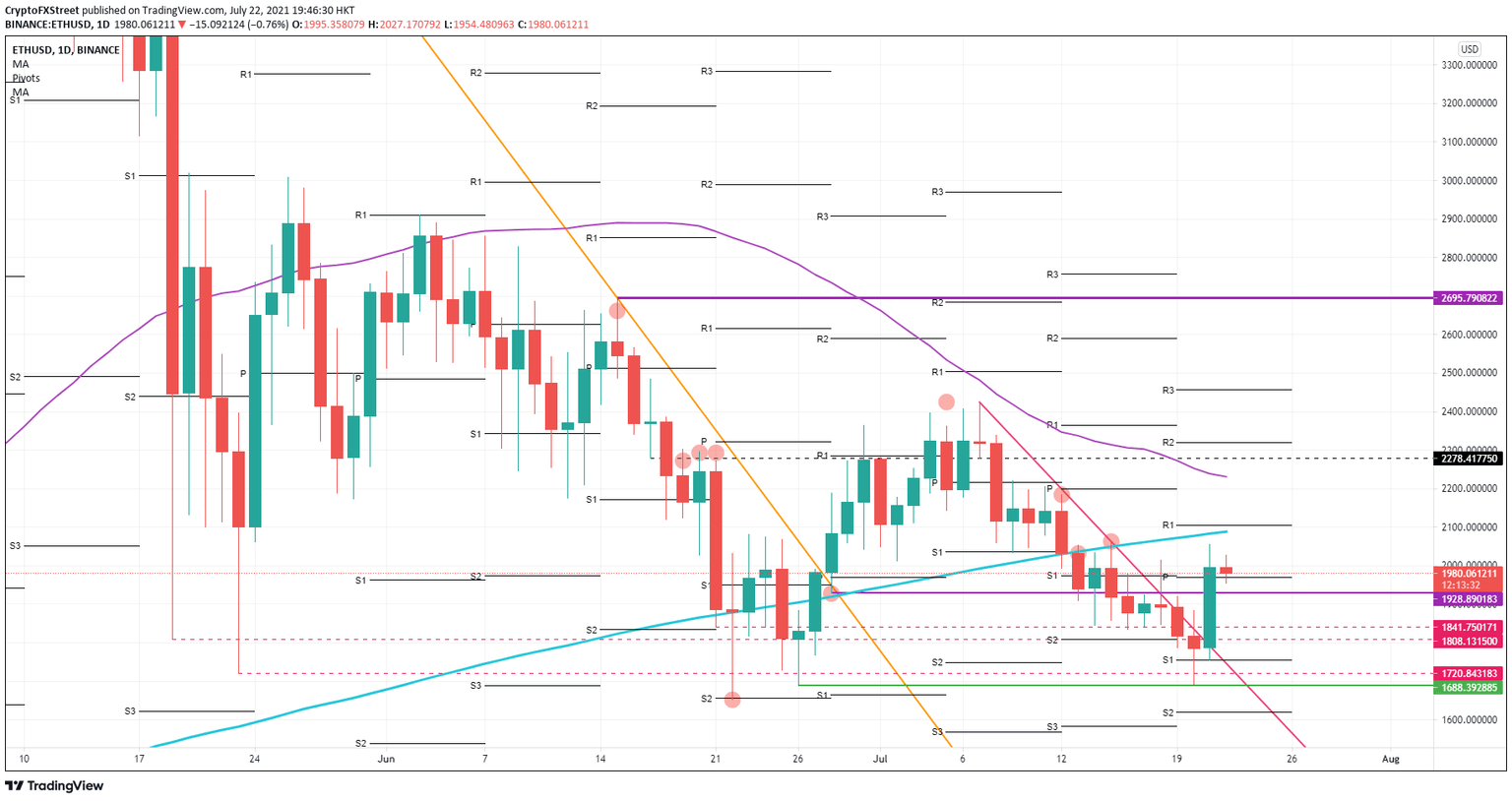

Ethereum price completed the fade-in trade a couple of days ago. The low from June 26 offered the best entry-level at $1,688.39. ETH recovered nicely and bounced off the S1 weekly support level at $1,755 to fully break the descending trend line and remove the horizontal resistance at $1,928.89. This critical level has already been spoken about as if ETH wants more profit days to come.

Ethereum price roars back with more upside

Price action today in Ethereum is even above the weekly pivot. It will be necessary now to see that ETH can withstand any selling pressure from short-term buyers looking to make a quick buck. A daily close above $1,969.68 is therefore vital if this rally does not want to be short-lived.

Further to the upside, the next profit level to look at will be the 200-day Simple Moving Average (SMA) that is coming in around $2,092. Just above there, Ethereum price has the weekly R1 resistance level at $2,104.91. This makes it two significant levels to be aware of.

Ethereum price will have its work cut out for it with this level if it wants to keep rallying higher.

On the upside, it will be necessary for Ethereum price if today it can close above $1,928 and the weekly pivot. Any further upside after that will depend on buyers who want to get another piece of the pie and jump in for more.

Sellers will undoubtedly look for that double top with the 200-day SMA and the weekly R1 resistance just above to build back some short positions. It will depend on whether the favorable tailwind remains present in global markets.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.