Ethereum price inches closer to $1,900 even after losing the daily DeFi battle to Binance

- Ethereum price trading at $1,850 is eyeing $2,000 as its next target, provided it can flip $1,900 into a support floor.

- Binance Smart Chain surpassed Ethereum in daily volume, registering $2.1 billion on May 22.

- DEXes domination is still threatened by Liquid Staking protocols, which have closed the gap by 40% in the span of a month.

Over the last few days, Decentralised Finance (DeFi) chains have observed a growth in their Decentralised Exchange (DEX) protocols. This category of Dapps seems to be making a comeback. However, the threat to its dominance still looms in the form of staking protocols.

Ethereum was surpassed by Binance

Binance Smart Chain (BSC) stepped over Ethereum in terms of 24-hour volume on May 23, with BSC noting $2.1 billion in volume, while the biggest Defi chain only registered $780 million. The biggest proponent for BSC turned out to be PancakeSwap. The DEX contributes to nearly half of the total value locked (TVL) on BSC with a value of $2.52 billion, noting a 14.5% increase in the past 24 hours.

DeFi chains’ 24-hour volume

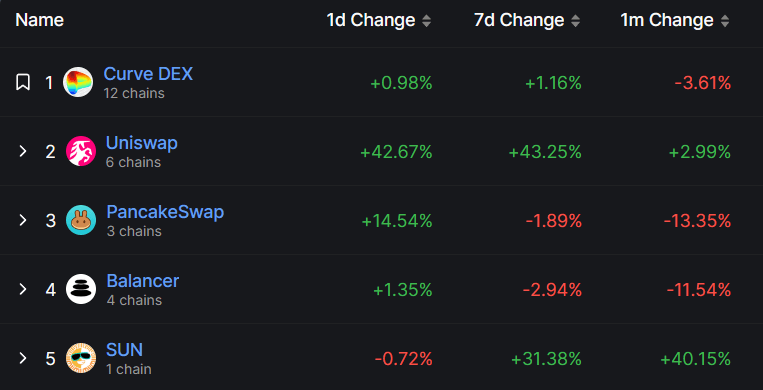

But PancakeSwap was not the only DEX to note such a growth as another such exchange on Ethereum also marked a similar growth. Uniswap observed a 42% increase in the last day, although its TVL noted no significant change at $4.1 billion. Furthermore, despite contributing to the chain significantly, Ethereum’s trading volume stood at a low as the growth was undercut by losses from other protocols.

DEX protocols’ 24 hour change

Decentralized Exchanges have noted much higher transaction volumes this month due to Centralised Exchanges (CEXes) losing volume. While in the previous month, CEX observed about $600 million in total traded volume, month to date, May has noted only $320 million.

However, despite the stellar growth of DEXes, their domination in the DeFi market continues to be threatened by Liquid Staking protocols. The latter has closed in on DEXes in order to topple it from its top spot.

In the span of a month, the difference between these two categories of protocols has reduced by 40% from $5 billion to $3 billion. At the time of writing, Liquid Staking protocols’ TVL came up to $17.9 billion, whereas DEXes TVL still stands at $20.8 billion.

DeFi market TVL distribution

Thus DEXes might need to see some more interest from users in order to keep its dominance unchallenged in the DeFi market.

Ethereum price continues rising

Ethereum price, unbothered by BSC surpassing in terms of daily volume, noted an almost 2% rise on May 22, rising to trade at $1,850. The green candlestick came after nearly two weeks of consolidation, but investors have not lost their expectations of a rise to $2,000 soon.

However, in order to make it to $2,000, ETH would first need to flip the $1,900 mark into a support floor. Coinciding with the 38.2% Fibonacci retracement of the downleg between $2,142 and $1,737, the altcoin needs to note another 2% rise to achieve the same.

This would also turn the 50-day Exponential Moving Average (EMA) into a support level, further preventing any severe decline in price. If Ethereum price breaks out and rallies beyond $1,900, it will face some resistance at the 50% Fib level at $1,940.

ETH/USD 1-day chart

Once this level is turned into a support level, too, the next target for Ethereum price would be $2,000. Reaching this would effectively undo the losses observed throughout the month caused by the 10% crash of early May.

Nevertheless, investors should also be prepared for the price to turn around and decline in case bearishness comes back, which could bring ETH back to $1,800.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.