Ethereum price: Frog Nation ex-CFO 0xSifu longs ETH with a position size of more than $20 million

- Frog Nation’s former CFO 0xSifu has long ETH with position size of more than $20 million.

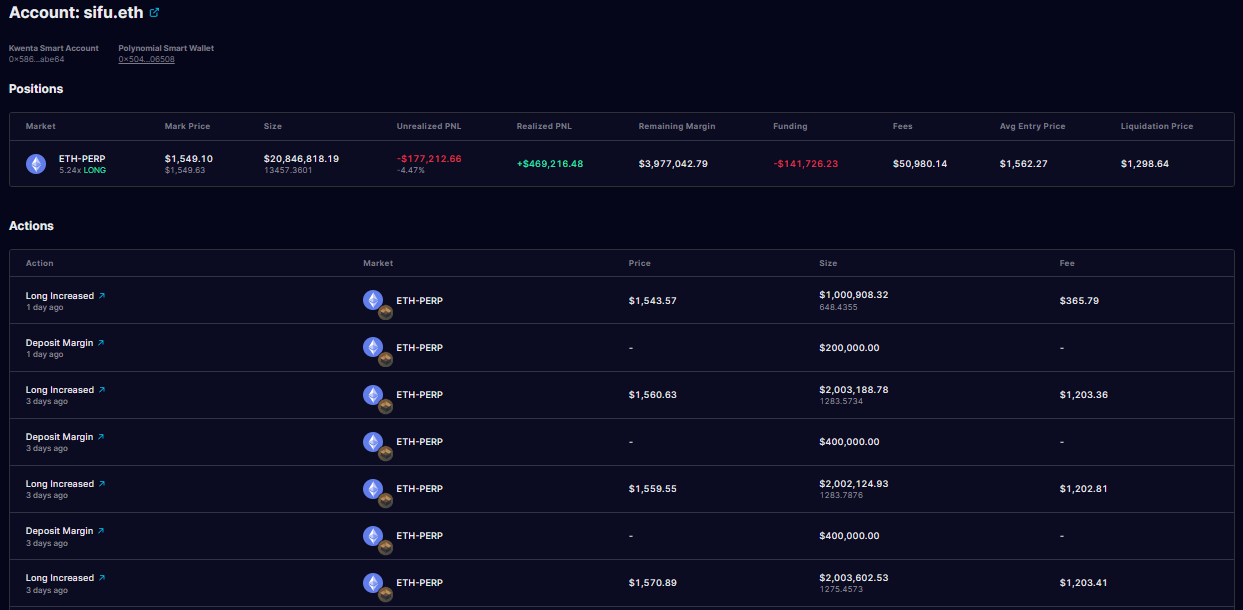

- The trader opened and gradually extrapolated his positions on Kwenta, data from Perps Watcher shows.

- Meanwhile, a strong bullish divergence remains in play for Ethereum price on the daily timeframe against USDT on Binance.

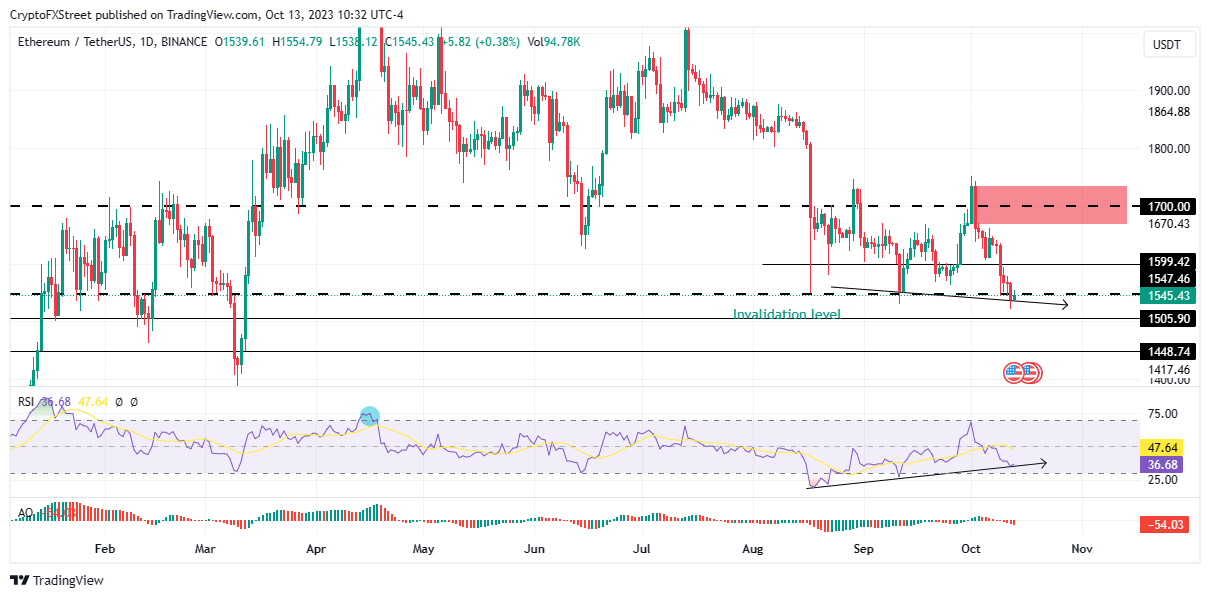

Ethereum (ETH) price remains on a downtrend, big picture, on the daily timeframe, in a move characterized by lower lows and lower highs. The largest altcoin by market capitalization is down around 12% so far in the month, but signs of a recovery seem to be presenting.

Ethereum price wagered to rise by Frog Nation ex-CFO

Ethereum (ETH) price could rise soon, according to Frog Nation’s ex-CFO, 0xSifu. The trader’s identity was recently confirmed to be Michael Patryn, a co-founder of the failed Canadian crypto exchange QuadrigaCX.

According to a report by Wu Blockchain, Perps Watcher detected 0xSifu made a balsy investment, longing ETH with a position size of more than $20 million. Based on the report, the trader “opened and gradually increased ETH long positions on Kwenta in the past three days,” proactively taking long positions for ETH at an average price of $1,562.27 and with 5.2X leverage.

Reportedly, Sifu.eth previously had a short ETH position open during the recent Ethereum price decline spanning the past two weeks or so. However, he gradually closed this short position, before switching to long three days ago.

Account Sifu.eth

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

What is staking?

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Ethereum price shows bullish divergence

Meanwhile, the Ethereum price has a bullish divergence in play for the ETH/USDT trading pair on Binance in the daily timeframe. As reported, the price has recorded lower lows since around August 18. Along with it, the Relative Strength Index (RSI) has recorded higher lows, interpreted as a strong bullish divergence.

The presence of an oversold condition on the RSI followed by the momentum indicator recording higher lows solidifies the outlook, suggesting underlying strength.

ETH/USDT 1-day chart

Nevertheless, it is imperative to note that conducting one's own research is imperative when trading, without sole reliance on the investment choices of others. Also, in line with the oldest precaution in industry, only trade what you are okay to lose.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.