Ethereum Price Forecast: Why accumulating ETH at $1,210 will lead to maximum returns

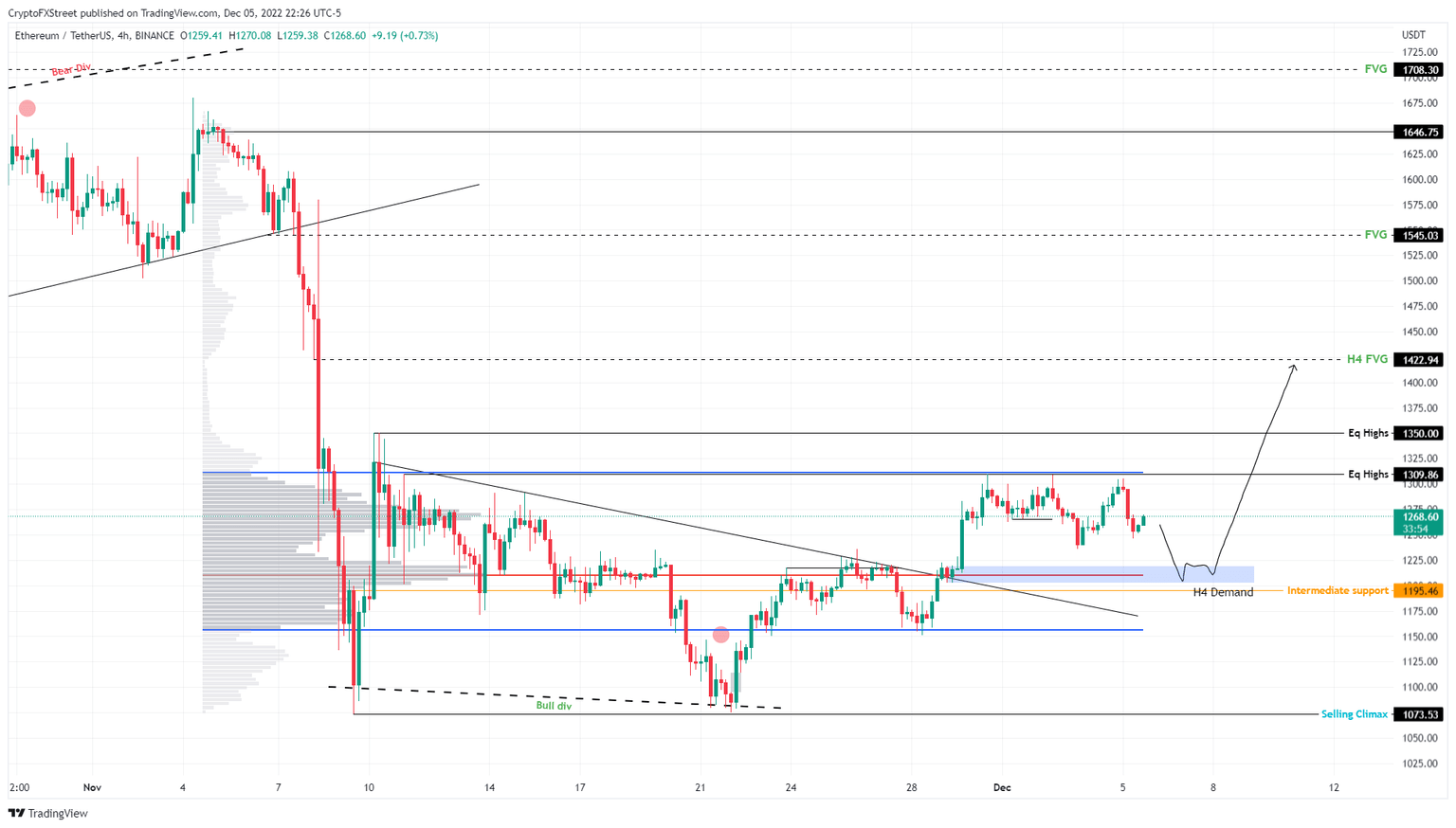

- Ethereum price is likely to undergo a retracement to the $1,202 to $1,218 demand zone to refill bullish optimism.

- A bounce from this level will allow ETH to sweep the buy-stop liquidity above $1,309 and $1,350.

- Invalidation of the bullish thesis will occur below the $1,195 support level.

Ethereum price shows a lack of bullish enthusiam, resulting in three failed attempts to overcome an immediate hurdle. As a result, ETH has slid lower and is likely to continue this path until it encounters a stable support level. This level will be a key area for interested buyers to accumulate the smart contract token for the next leg-up.

Ethereum price sets the stage for next rally

Ethereum price shows a triple tap at the $1,309 level, indicating a failure to overcome this minor hurdle. The latest attempt was on December 5, which resulted in a 4.5% downswing. While there seems to be an attempt at a bullish reversal, investors should pay attention to the four-hour demand zone, extending from $1,202 to $1,218.

This area is key in triggering a run-up since it contains the highest traded volume recorded since November 4 at $1,210, making this a solid support confluence. Interested buyers can accumulate ETH here.

The targets for a rally that emerges here include the $1,309 and $1,359 equal highs, resting above which is the buy-stop liquidity. Assuming Ethereum price sustains bullish momentum after these hurdles, there is a good chance it will revisit the $1,422 resistance level. This move would bring the total gain to 17%.

However, considering the volume profile indicator, there is no resistance level up to $1,545. So, market participants should consider holding their positions up to this level.

ETH/USDT 4-hour chart

While things are looking up for Ethereum price, a breakdown of the $1,202 level will be the first sign of weakness for bulls. If this outlook is followed by a four-hour candlestick close below $1,195, it will invalidate the bullish thesis.

In such a case, Ethereum price is likely to revisit the $1,156 support level to recuperate the losses and attempt the recovery rally again.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.