- Ethereum price shows a breakdown from an ascending triangle formation, hinting at a potential correction.

- While the theoretical forecasts hint at a 45% crash, the recent breakdown suggests bears are in control.

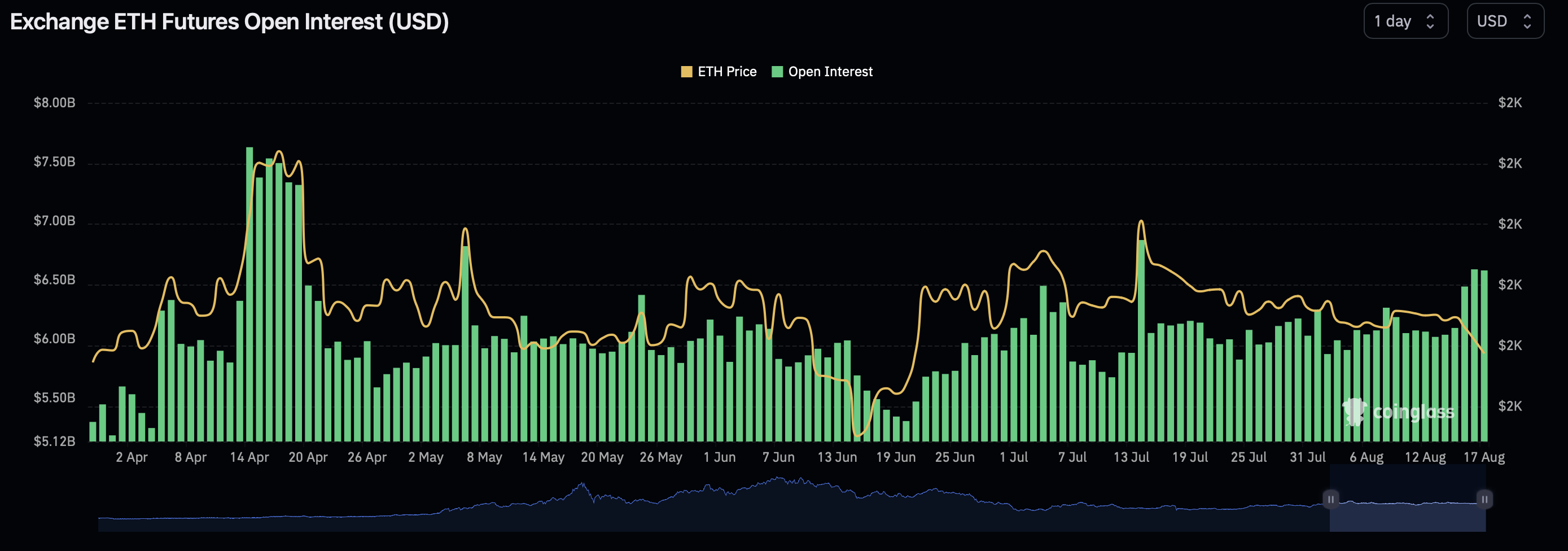

- Ether’s open interest has surged by nearly 500 million in the last three days, suggesting a renewed interest.

Ethereum price action is at an interesting point, which could trigger a steep move in either direction. With Bitcoin’s boring consolidation, crypto traders have been waiting for a volatile move to emerge. The lack of volatility could be ending soon, especially for Ether, as the open interest rose by nearly 500 million in the last three days from $6.09 billion to $6.58 billion. When the breakout does occur, one cap is likely to get caught in the wrong direction, causing liquidations in the millions.

ETH open interest

Also read: Fundstrat's Tom Lee's Bitcoin target is $180,000 if SEC approves first spot BTC ETF in the US

Ethereum price action hints at a massive move soon

Ethereum price set up an ascending triangle formation between May 28, 2022, and August 14, 2023. This setup contains three higher lows and nearly three equal highs, which are connected using trend lines.

This technical formation is a bullish one and the confirmation of a breakout would occur if Ethereum price flipped the $1,998 or $2,000 psychological level into a support floor. The ascending triangle pattern forecasts a 45% upswing to $2,915, which is obtained by adding the distance between the first swing high and swing low to the breakout point.

On the contrary, Ethereum price breached the setup to the downside on August 13 and is on its way to confirming the breakdown by producing a three-day candlestick close below it. If this outlook does play out, instead of the 45% rally, ETH could crash by 45% and revisit the next key level at $998. But in some cases, ETH could stop around or above the $1,000 psychological level, which is not too far away from the theoretical target.

ETH/USDT 3-day chart

However, if Bitcoin’s consolidation breaches to the upside, bears that shorted ETH thinking a bearish breakdown has occurred would be trapped. In such a case, Ethereum price could quickly climb higher and flip the $2,000 psychological level. This development could confirm a bullish breakout, forecasting a 45% move to $2,915.

In bullish cases, Ethereum price could revisit the $3,000 level that has not been tagged since April 20222.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.