Ethereum Price Forecast: ETH's declining supply could fuel bullish pressure toward $3,732

Ethereum price today: $3,220

- Ethereum's supply has been trending downward in the past three days following network activity.

- Ethereum ETFs will surprise people in 2025, says Bitwise CIO, after five-day inflows of $649.3 million.

- Ethereum needs to post a strong move above $3,307 to rally toward $3,732.

Ethereum (ETH) is trading near $3,220, down 2.5% on Wednesday after its supply began trending downward. The declining supply could fuel bullish pressure for the top altcoin, especially as institutional demand for ETH ETFs is also rising.

Ethereum has turned deflationary again

Ethereum's supply has flipped into a deflationary trend with the total amount of burnt ETH outpacing issuance in the past three days, per data from Ultrasound.money. If the trend continues, it could cause a notable increase in ETH's bullish momentum.

ETH 7-day supply | Ultrasound.money

The top altcoin's supply initially turned inflationary after the March Dencun upgrade, which introduced blobspace to help boost transaction speed and low fees in Ethereum Layer 2 networks. As a result, fees captured on the Main Chain were reduced, in turn lowering the ETH burn rate.

In addition, the crypto market began consolidating and even turned slightly bearish in August, reducing Ethereum's on-chain activities.

However, the Ethereum ecosystem has been seeing increased user engagement since Donald Trump emerged victorious in the US presidential election. This has caused gas fees to rise, leading to more ETH burns. As burns increase, ETH's scarcity rises, boosting its value and attracting more investors.

Leon Waidmann, Head of Research at Onchain Foundation, noted that the recent ETH deflationary trend has activated a "bullish flywheel."

"This cycle of increased demand, burning, and price appreciation creates a positive feedback loop, potentially propelling ETH's value even higher," wrote Waidmann in an X post on Wednesday.

Meanwhile, Ethereum ETFs posted a net inflow of $135.9 million on Tuesday, marking five days of consecutive inflows for the first time since its launch. This has taken its five-day net inflows to $649.3 million, per Coinglass data.

Bitwise chief investment officer Matt Hougan noted that institutional investors are showing an increased appetite for ETH ETFs and that the product's flows will surprise people in 2025.

This comes after Bitwise announced on Wednesday that it purchased Attestant, a non-custodial Ethereum staking provider with $4 billion in staked assets.

Ethereum Price Forecast: ETH needs a strong move above $3,307 to rally toward $3,732

Ethereum is down 2.5% on Wednesday following $95.51 million in liquidations in the past 24 hours, with liquidated long and short positions accounting for $63.05 million and $32.45 million, respectively, per Coinglass data.

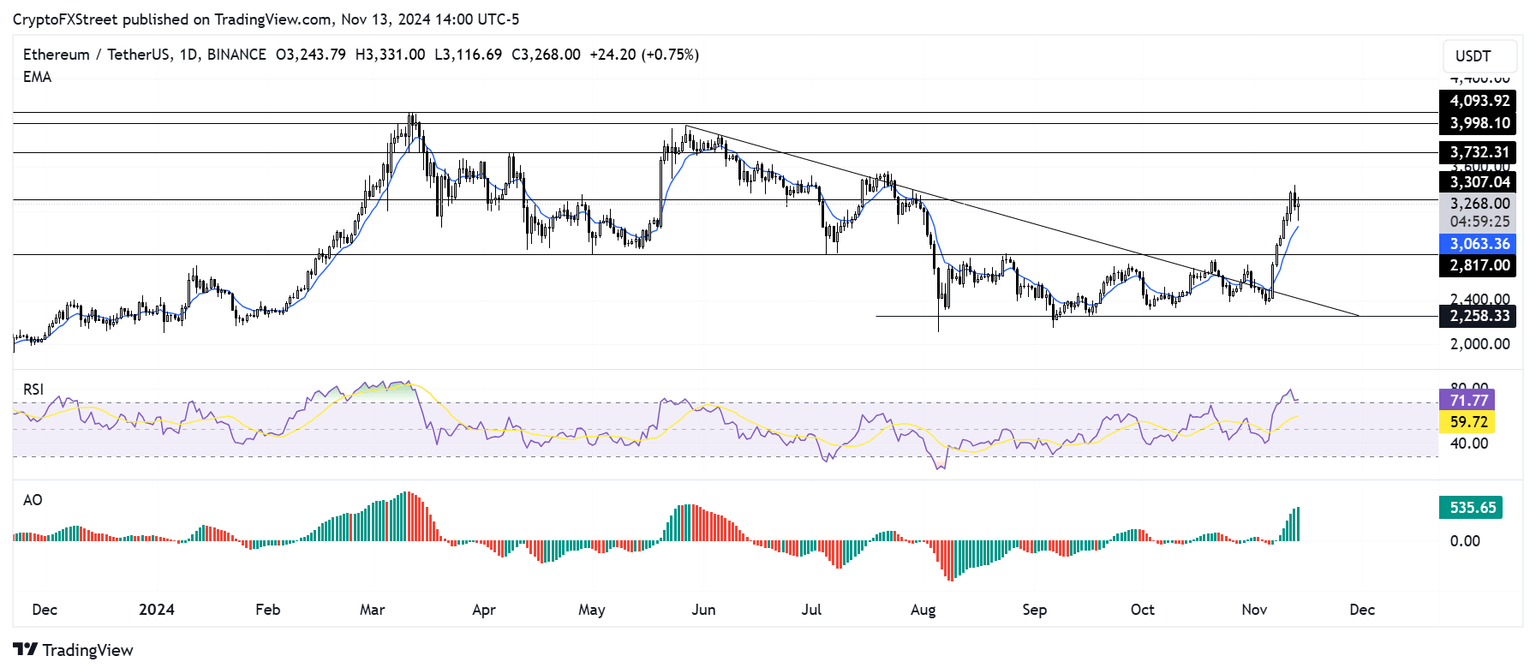

ETH is re-testing the $3,307 resistance on the daily chart after seeing a minor decline on Tuesday. If the top altcoin sustains a strong move above $3,307, it could rally to test the resistance level near $3,732.

ETH/USDT daily chart

A move above $3,732 will see ETH tackle its yearly high resistance of $4,093 and then aim for a new all-time high.

On the downside, ETH could find support near the exponential moving average (EMA) blue line. If the support fails, ETH could bounce off $2,817.

The Relative Strength Index (RSI) seems to have bounced off its oversold line, indicating heightened bullish momentum. A decline below this region could cause a price correction.

The Awesome Oscillator (AO) is also posting consecutive increasing green bars above its neutral level, signaling strong bullish momentum.

A daily candlestick close below $2,817 will invalidate the bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi