Ethereum Price Forecast: ETH transaction fees decline to an all-time low, bulls could force move above $2,850

Ethereum price today: $2,700

- Ethereum average transaction fees hit an all-time low amid decreasing network activity.

- The declining transaction fees could attract users back to Ethereum.

- Ethereum bulls could force a move above the $2,850 critical resistance if the support level at $2,560 holds strong.

Ethereum (ETH) recovered the $2,700 level on Wednesday despite its average transaction fees declining to an all-time low. The reduced fees could attract new users to the top Layer 1 (L1) blockchain and help bulls overcome the $2,850 critical resistance.

Ethereum low transaction fees weigh down prices

Ethereum's average transaction fee has recently dropped to an all-time low, according to CryptoQuant's data.

The last time transaction fees approached such levels was during the August 2024 crypto market crash ignited by Israel-Hamas war tension, after which ETH consolidated for four months.

The decline follows reduced Ethereum Layer 1 activity since the February 3 market crash. Coupled with this, the growing shift of network activity from Ethereum to Solana (SOL) and Layer 2 (L2) networks has further impacted fees on the top L1.

Ethereum Average Transaction Fees (7DSMA). Source: CryptoQuant

As a result, the low average transaction fees have affected demand for ETH, which fuels ecosystem activity in the Ethereum blockchain.

This trend also impacts ETH's supply side as lower transaction fees imply a lesser amount of burnt ETH, increasing Ethereum's total supply in the process.

The ETH burn mechanism, introduced in the August 2021 London hard fork, burns a portion of ETH transaction fees to keep its supply slightly deflationary.

While the combination of rising supply and low demand signals increased bearish sentiment for ETH, analysts at crypto analytics platform Santiment hold a contrary view.

"When users are not paying high prices to move their ETH or tokens, it is typically a good sign for mid-term and long-term price outlooks, [as] reduced costs make it easier for new buyers to enter the market," wrote the analysts in a Tuesday X post.

They argued that similar to how high transaction fees can sometimes spur a correction, the low transaction cost will attract users back to Ethereum, "allowing the network's utility to rise to a prosperous rate."

Meanwhile, US spot Ethereum exchange-traded funds (ETFs) posted net inflows of $4.6 million on Tuesday, per Coinglass data.

Ethereum Price Forecast: Bulls could force a move above $2,850 if the support at $2,560 holds strong

Ethereum futures traders saw $12.34 million and $17.89 million in liquidated long and short positions in the past 24 hours, per Coinglass data.

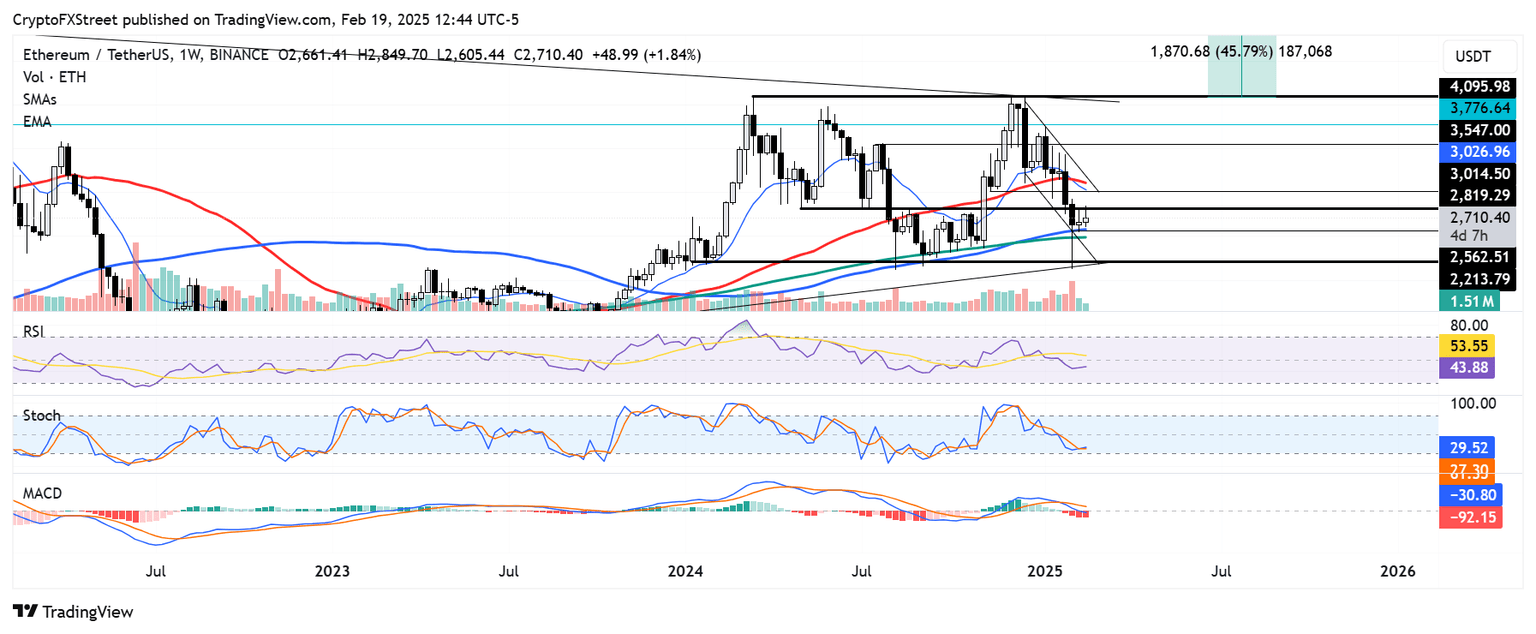

The top altcoin is trading in a rectangular channel on the weekly chart, where the $2,850 level continues to hold as a critical resistance due to risk-off sentiment among market players.

ETH/USDT weekly chart

While the market structure is slightly bearish, the 100-day and 200-day Simple Moving Average (SMAs) have proven to provide support near $2,560. If this support holds strong, ETH bulls could force a move above the $2,850 resistance.

However, such a breakout could be short-lived as the top altcoin faces a key resistance near the 14-day Exponential Moving Average (EMA) and 50-day SMA, which sits just above the $3,000 psychological level.

The Relative Strength Index (RSI), Stochastic Oscillator (Stoch) and Moving Average Convergence Divergence (MACD) histogram are below their neutral levels, indicating dominant bearish momentum.

A weekly candlestick close below $2,200 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

-638755852656174901.png&w=1536&q=95)