Ethereum Price Forecast: ETH eyes yearly high resistance of $4,093 amid heightened interest among US traders

Ethereum price today: $3,600

- Ethereum CME open interest growth reaches new all-time high.

- Ethereum USDT supply sees its highest monthly growth of 27% in November.

- ETH could extend its rally to test its yearly high resistance of $4,093 after surging above a key descending trendline.

Ethereum (ETH) is trading near the $3,600 level on Friday and could stage a rally to test its yearly high resistance of $4,093. The rally is fueled by ETH Chicago Mercantile Exchange (CME) open interest growth and a rise in USDT supply on the Main chain.

ETH CME reaches new milestone, USDT supply on Ethereum surged by 27% in November

Ethereum CME futures open interest (OI) has been at elevated levels since the US presidential elections, rising alongside ETH in the past week. Ethereum CME open interest is an indicator of the interest of US investors in ETH derivatives.

In the past week, the ETH CME OI crossed $2.8 billion for the first time ever, indicating high interest among US traders in the top altcoin. The heightened bullish sentiment also sent ETH's CME futures premium as high as 14%.

Similarly, Ethereum ETFs have maintained a bullish momentum, recording net inflows of nearly $225 million in the past four trading days.

A potential reason for the concurrent growth in ETH ETFs and CME open interest could be investors capitalizing on the high ETH futures premium by leveraging the so-called "cash and carry trade" as a yield-bearing strategy.

This involves buying ETH on the spot market — often via ETFs — and shorting the equivalent on derivatives exchanges to achieve delta neutrality. In turn, the investor earn yield from the funding fees that short traders receive due to the high premium on ETH futures.

Meanwhile, on Friday, Tether minted another 1 billion USDT on the Ethereum blockchain. This follows a massive growth in the total USDT supply on Ethereum, rising by over 27% to $70.2 billion in November — its highest monthly percentage growth since 2021. As a result, Ethereum has flipped Tron for the first time since 2022 as the blockchain network with the largest USDT supply.

USDT Total Supply on Ethereum | CryptoQuant

Ethereum Price Forecast: ETH could test its yearly high resistance after surging above key descending trendline

Ethereum is trading near $3,600 following $26.87 million in liquidations in the past 24 hours, per Coinglass data. Liquidated long and short positions accounted for $12.76 million and $14.11 million, respectively.

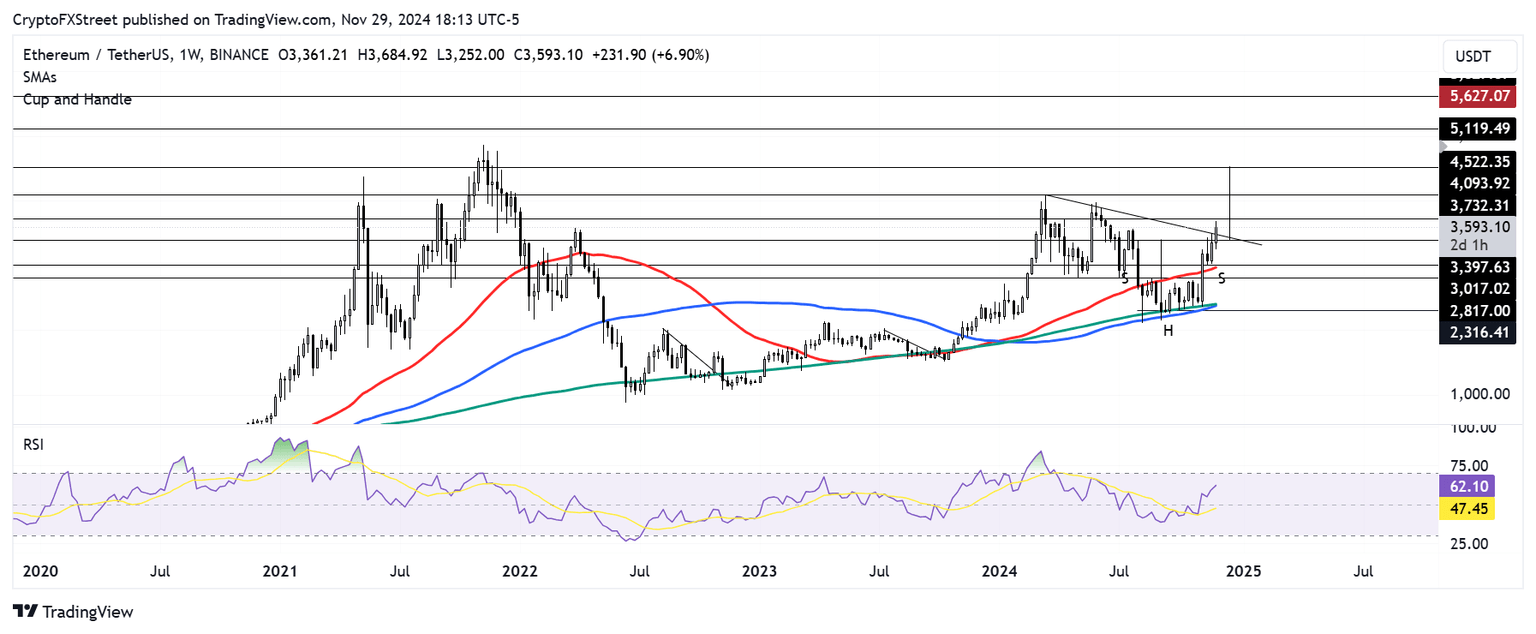

On the weekly chart, ETH has moved above a key descending trendline resistance extending from March 11. If ETH sustains this move, it could rally to test its yearly high resistance of $4,093.

ETH/USDT weekly chart

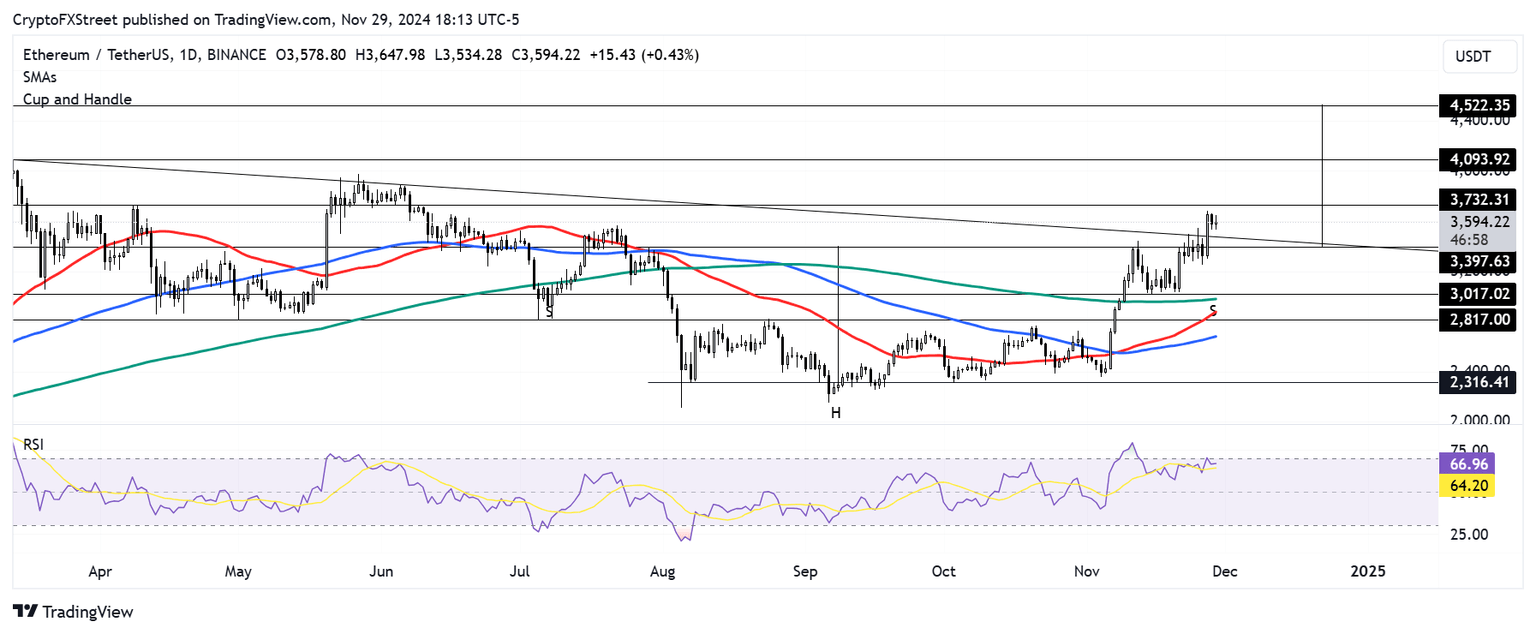

Meanwhile, ETH is approaching the $3,739 resistance on the daily chart. After validating an inverted Head-and-Shoulders pattern in the past week, ETH could rally to a new yearly high of $4,522 if it sustains a high volume move above the $3,739 resistance.

Investors may need to watch out for a potential bounce off the $3,400 level if the market flips bearish.

ETH/USDT daily chart

The daily chart's Relative Strength Index (RSI) momentum indicator is above its neutral level and trending upward, indicating dominant bullish pressure.

A daily candlestick close below the $3,000 psychological level will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520Total%2520Supply-638685195836295083.png&w=1536&q=95)