Ethereum price today: $3,010

- Ethereum investors realized over $100 million in losses following increased signs of panic selling.

- The 30-day MVRV Ratio decline below 10% indicates ETH may see a recovery soon.

- Ethereum could find support near the $2,800 key level after an 8% decline.

Ethereum trades close to the $3,000 psychological level, down 8%, following over $100 million in realized losses. The top altcoin could bounce off the $2,817 support level after the 30-day Market Value to Realized Value (MVRV) Ratio declined below 10%.

Ethereum investors book losses as MVRV indicates signs of a potential price bounce

Ethereum opened the week with a decline as signs of panic selling increased among investors. The Network Realized Profit/Loss metric showed that investors booked over $100 million in losses in the past 24 hours.

Ethereum Network Realized Profit/Loss & Mean Coin Age. Source: Santiment

Despite the slight increase in realized losses, the Mean Coin Age metric, which measures the average number of days all ETH tokens have remained in their addresses, has remained in an upward trend. This indicates a slight bias toward the buy-side, as spot traders may be scooping up the dip.

Additionally, ETH's 30-day MVRV Ratio — which measures the average profit/loss of all investors who bought the token in the past 30 days — declined below -10%. ETH may see a recovery as prices tend to bounce whenever the 30-day MVRV Ratio crosses below -10%.

ETH MVRV (30-day). Source: Santiment

Meanwhile, US spot Ethereum exchange-traded funds (ETFs) recorded their largest weekly net outflows since July after shedding a net $186 million last week, per Coinglass data. The outflows spanned across all major issuers, with BlackRock being the only outlier to record net inflows of $124.1 million.

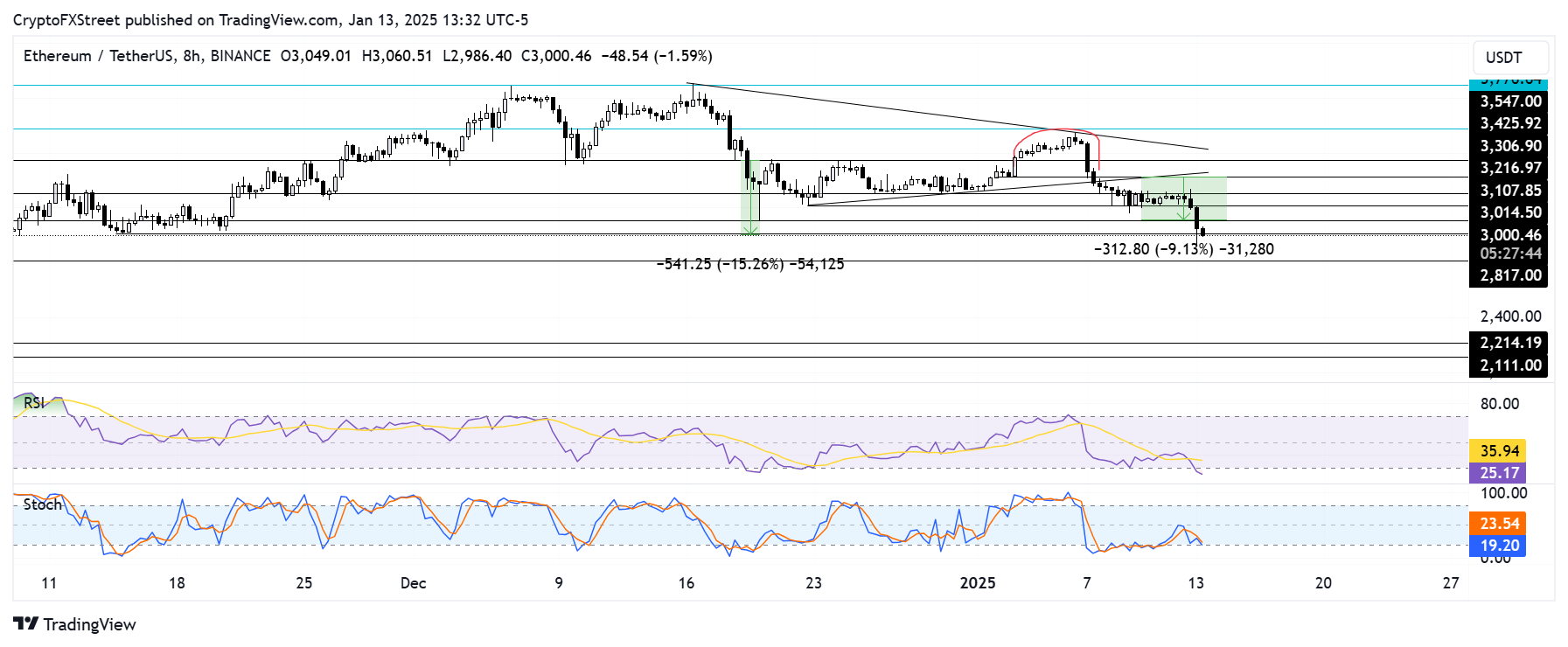

Ethereum Price Forecast: ETH could find support near $2,800 after 8% decline

Ethereum's 8% dive sparked over $182 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions reached $152.50 million, while short liquidations were $29.84 million.

The top altcoin completed the target of a rounding top and double-top pattern on Monday after briefly declining below the $3,000 psychological level. If ETH fails to find support at $3,000, it could test the $2,817 level, which was held as a key support between April and July.

ETH/USDT 8-hour chart

A daily candlestick close below $2,817 could send ETH toward the historically high demand zone of $2,100 - $2,500, where investors purchased over 61 million ETH, per IntoTheBlock's data. However, a bounce off $2,817 could help ETH reclaim the $3,300 level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in their oversold region, indicating ETH may recover soon.

A daily candlestick close above $3,550 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[18.19.58,%2013%20Jan,%202025]-638723922664378429.png)

%20[19.16.59,%2013%20Jan,%202025]-638723923093211993.png)