Ethereum price today: $2,010

- Ethereum exchanges recorded their highest weekly net outflows last week.

- Traditional stock market players continue to weigh on the crypto market, stretching their crypto ETF outflows to $4.75 billion in the past four weeks.

- ETH could see a reversal as the Stochastic Oscillator hits extreme oversold conditions.

Ethereum (ETH) is down 2% on Monday, trading near the $2,000 psychological level despite increased exchange net outflows. The sustained negative market sentiment is potentially coming from crypto exchange-traded funds (ETFs) investors who have continued to scale down their holdings.

Ethereum's dip attracts crypto-native investors while ETF players continue selling activity

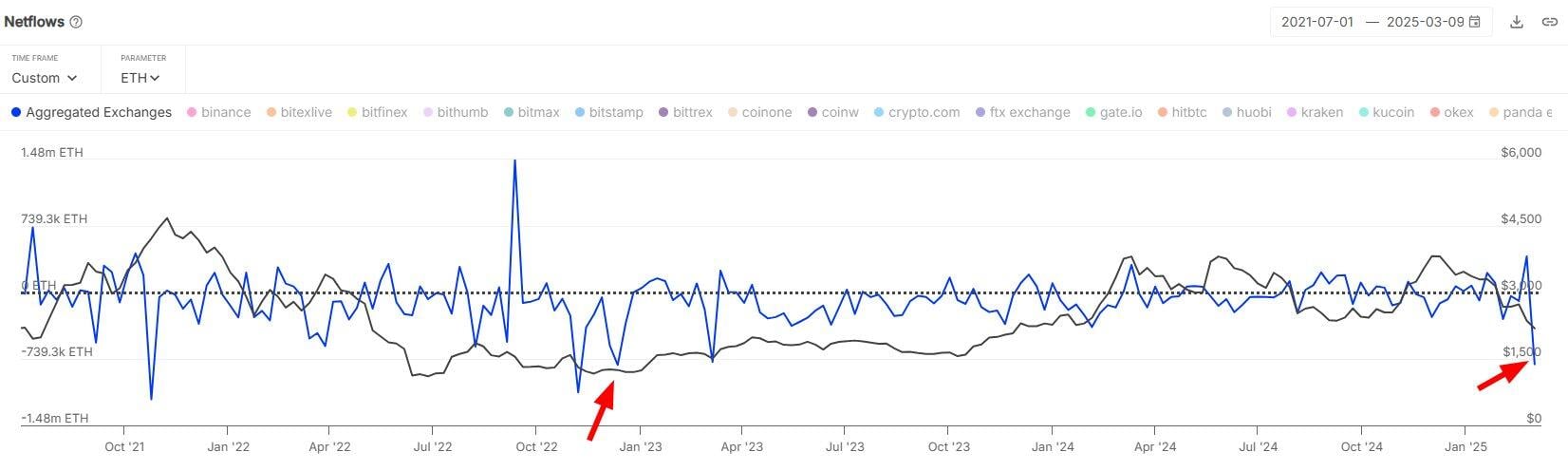

Ethereum saw one of its highest exchange weekly net outflows last week following its decline to the $2,000 psychological level. Crypto exchanges witnessed an ETH net outflow of about $1.8 billion last week, the highest weekly amount since December 2022, according to IntoTheBlock's data.

"Despite ongoing pessimism around Ether prices, this trend suggests many holders see current levels as a strategic buying opportunity," wrote IntoTheBlock analysts in an X post on Monday.

ETH exchange netflows. Source: IntoTheBlock

An increase in exchange net outflows indicates high buying pressure, while vice versa for inflows.

The increased buy-the-dip attitude near $2,000 suggests ETH could be primed for a recovery, but institutional investors' selling pressure is weighing on the crypto market.

While crypto-native investors are buying the dip, institutional investors are depleting their holdings. This is visible in US spot ETH ETFs' flows, which show a net outflow of about $94 million last week, per Coinglass data. Unlike exchange net outflows, rising ETF outflows indicate higher selling pressure.

A potential reason for the selling activity is crypto's rising correlation to traditional stocks and macroeconomic conditions. The S&P 500 has declined by over 450 points since hitting an all-time high on February 19, showing increased risk-off sentiments amid President Donald Trump's tariff decisions on US international trading partners.

With the same traditional stock players also treading the crypto market via Bitcoin and Ethereum ETFs, the prices of top cryptos may remain subdued by their investment sentiment. According to a CoinShares report on Monday, crypto ETFs have lost $4.75 billion in the past four weeks.

Ethereum Price Forecast: Oversold Stochastic indicates a potential reversal in ETH

Ethereum experienced $117.96 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations accounted for $81.01 million and $36.94 million, respectively.

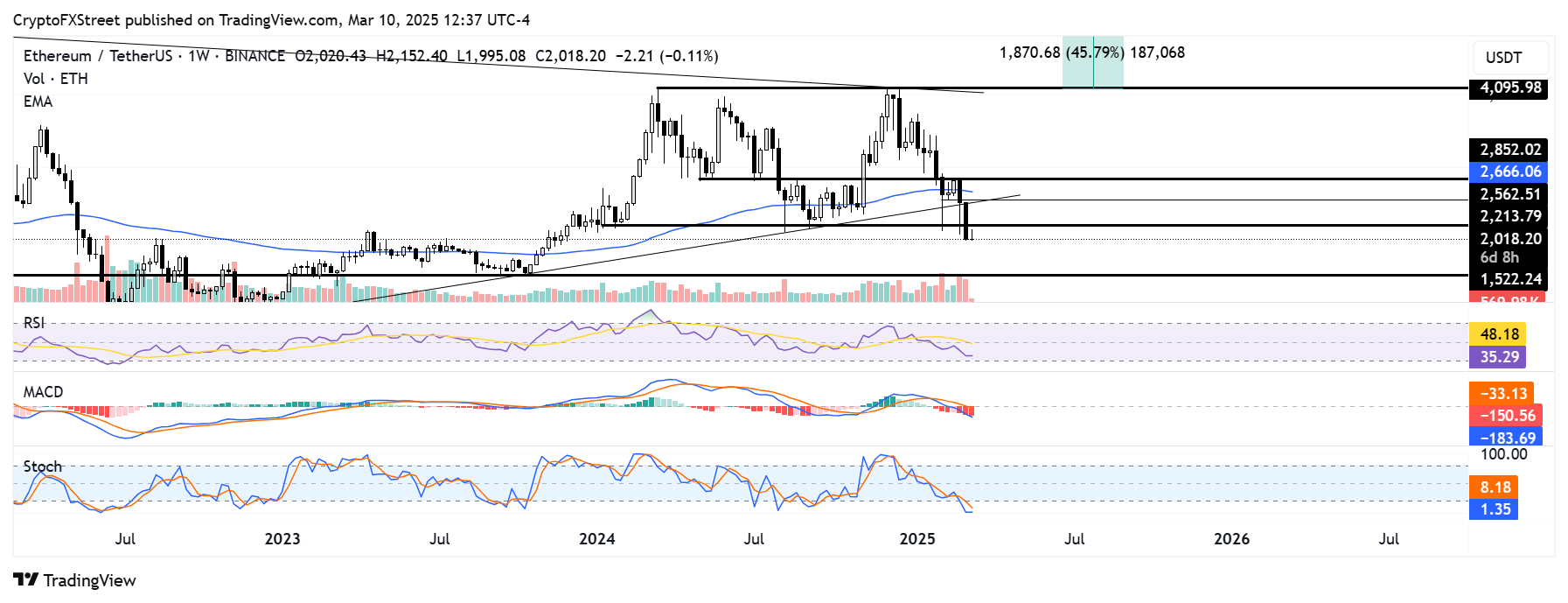

ETH is struggling to hold the $2,000 psychological level after sustaining a weekly candlestick close below the $2,200 critical level last week. If the bearish pressure extends throughout the new week, ETH could decline toward the next key support level at $1,500.

ETH/USDT daily chart

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are below their neutral levels, indicating dominant bearish momentum.

However, the Stochastic Oscillator (Stoch) is deep in the oversold region, signaling a potential reversal. As a result, ETH could flip the bearish pressure if it pulls a high volume move above $2,200 and smashes a key ascending trendline resistance.

A weekly candlestick close below $1,500 will invalidate the thesis and potentially send ETH below the $1,000 psychological level.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.