Ethereum Price Forecast: ETH dips as Bybit suffers $1.4 billion hack

Ethereum price today: $2,640

- Ethereum suffered a major pullback at $2,850 following Bybit's hack involving $1.44 billion worth of stolen ETH.

- Bybit CEO said the exchange has already secured bridge loans to match increased withdrawals following the hack.

- The RSI and MACD technical indicators need to cross above their neutral levels to pull ETH out of its range-bound movement.

Ethereum (ETH) saw a rejection at $2,850 on Friday after crypto exchange Bybit announced that an attacker hacked one of its wallet, stealing about $1.44 billion worth of ETH-based assets.

While crypto community members anticipated Bybit fueling demand for ETH by buying up a huge supply from the market to settle withdrawals, CEO Ben Zhou stated the exchange would instead leverage bridge loans.

Ethereum suffers pullback as hacker targets it in Bybit’s hack

Ethereum experienced a sharp dip from the $2,850 key level, declining 6% following crypto exchange Bybit's announcement that one of its ETH cold wallets was compromised for about $1.44 billion.

The attacker made away with 401,347 ETH (~$1.12B), 90,376 stETH (~$253.16M), 15,000 cmETH (~$44.13M) and 8,000 mETH (~$23M).

The hack's focus on Ethereum has sparked over $136.35 million in ETH futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations accounted for $66.35 million and $70 million, respectively.

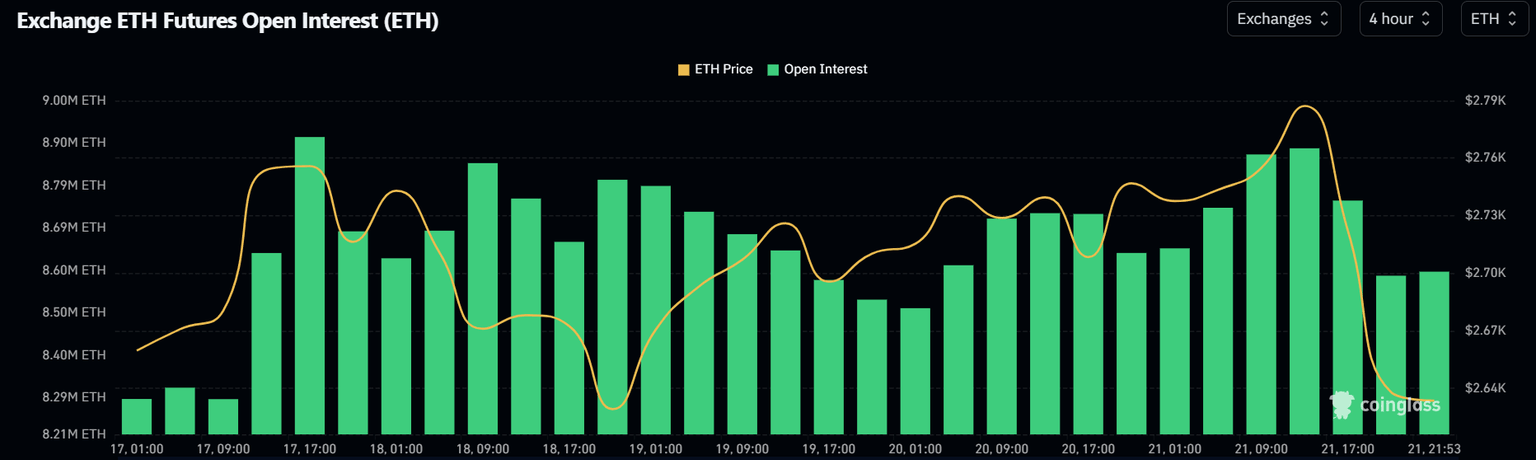

Before Bybit's hack shook the market, ETH was on track to recover the $2,900 level, primarily driven by a 250K ETH surge in open interest (OI) to 8.90M ETH. However, its OI has since dipped to 8.60M ETH

ETH Open Interest. Source: Coinglass data

Open interest is the total amount of unsettled contracts in a derivatives market. A rise in OI indicates more traders are opening new positions, while vice versa for a decline.

After the hack, many anticipated a recovery, speculating that Bybit would buy ETH to refund customers their holdings and, in turn, boost prices.

However, Bybit CEO Ben Zhou clarified in an X livestream that the exchange will not buy ETH but instead use bridge loans to facilitate customer withdrawals.

Bridge loans are short-term loans to help an individual or company satisfy current obligations with immediate cash flow.

"For immediate sake, we are currently reaching out to our partners to give us a bridge loan," Zhou said. "So, currently, we are not buying [Ethereum]. And even if we did want to buy, it is too big of [an] amount to be moving around."

"We actually already secured almost 80% of the Ethereum that's been stolen as a bridge loan to give us that liquidity, to help us with the liquidity crunch, so we can pass this crucial period," Zhou added.

Ethereum Price Forecast: ETH's technical indicators need to pull off key move to switch market trend

ETH looked to stage a breakout above a rectangular channel's critical resistance near $2,850, but bears waged selling pressure at the level.

The $2,850 level has historically proven to be a major sell zone for bears, considering that ETH suffered several setbacks near the level for four months, from August to November 2024.

ETH/USDT daily chart

ETH could find support near the $2,560 level if it fails to overcome $2,850.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) line could be key in determining a trend shift in ETH.

ETH could leap out of its consolidation if the RSI continues holding its yellow moving average line as a support and eventually crosses above its neutral level.

The MACD blue line has crossed above its moving average red line. A cross above its neutral level line while its histograms post green bars will signal a positive shift in momentum for ETH.

A daily candlestick close below $2,200 will invalidate the thesis and potentially send ETH toward the $1,500 level.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi