Ethereum Price Forecast: ETH could see a new all-time high as SEC may approve staking in ETH ETFs

Ethereum price today: $3,630

- Ethereum ETFs post their highest weekly net inflows since launch.

- Issuers could get approval to allow staking within ETH ETFs under Trump's upcoming administration.

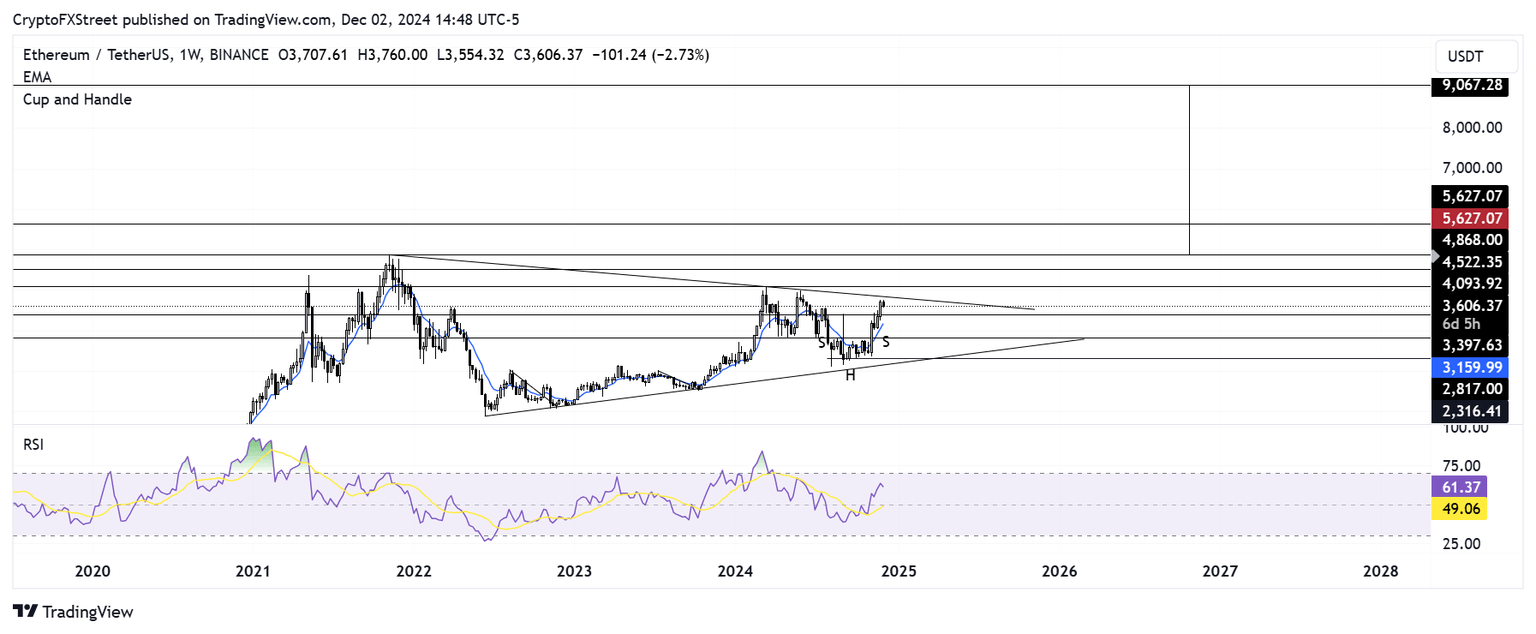

- Ethereum could see a new all-time high if it sustains a high volume move above a key descending trendline resistance.

Ethereum (ETH) is down 2% on Monday after seeing a rejection near a key descending trendline resistance. However, ETH could rally to a new all-time high if it overcomes this resistance and sees an interest surge from the Securities & Exchange Commission (SEC) potentially approving staking within Ethereum exchange-traded funds (ETFs).

Ethereum ETFs could get approval to incorporate staking

Ethereum ETFs noted their highest daily inflow on Friday after posting net inflows of $332.9 million, per Coinglass data. After seeing five consecutive days of positive flows, the products also recorded weekly inflows of $466.5 million last week — their highest since launch.

In contrast, Bitcoin ETFs saw $136.5 million in net outflows last week. The recent ETH outperformance of BTC has strengthened narratives of Ethereum sparking an altcoin season.

Meanwhile, in a recent memo to investors, brokerage firm Bernstein analysts noted that issuers could get SEC approval to incorporate staking into Ethereum ETFs.

"We believe, under a new Trump 2.0 crypto-friendly SEC, ETH staking yield will likely be approved," Bernstein analysts highlighted. As the Federal Reserve has begun cutting rates, ETH's average staking yield of 3% will prove attractive to investors and asset managers through better ETF economics, the analysts added.

With network activity on the Ethereum Main chain seeing an uptick in recent weeks, ETH's staking yield could rise as high as 4% to 5%.

Ethereum's weekly active addresses increased over 25% to 2.64 million in November. Blobs, the storage space for Layer 2 transactions on the Main chain, also witnessed price discovery several times in November. If the trend continues and pushes staking yield upward, issuers could pressure the agency with new updated filings.

Ethereum Weekly Active Addresses | Santiment

Ethereum Price Forecast: ETH could see a major rally if it surges above key symmetry triangle

Ethereum is trading near $3,600 after sustaining $74.4 million in liquidations in the past 24 hours. Liquidated long and short positions accounted for 54.39 million and $20.02 million, respectively.

In the early Asian session, ETH saw a rejection near the upper boundary of a symmetry triangle represented by a descending trendline extending from its all-time high of $4,878.

ETH/USDT weekly chart

If ETH can sustain a move above this trendline resistance, it could surge above its yearly high of $4,093 and test its all-time high resistance at $4,868. A high volume move above its all-time high resistance means ETH has completed a rounded bottom move, which could be a major catalyst to stage a long-term rally.

The Relative Strength Index (RSI) is above its neutral level, indicating bullish momentum is dominant in the market.

A weekly candlestick close below the $2,817 key level will invalidate the bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520%5B20.48.00%2C%252002%2520Dec%2C%25202024%5D-638687672971866960.png&w=1536&q=95)