Ethereum Price Forecast: ETH could bounce off $2,490 as it has recovered most of its TVL outflows

Ethereum price today: $2,550

- Ethereum L2s have captured 83% of the $6 billion outflows from its L1.

- Arbitrum, Optimism and Base lead all chains in TVL inflows in 2024.

- Ethereum could bounce off $2,490 support to retest key $2,707 resistance.

Ethereum (ETH) is down over 5% on Tuesday but could bounce off the $2,490 key support level as most of the total value locked (TVL) that left its Layer 1 chain has remained within the broader ETH ecosystem.

Ethereum hasn't lost most of its TVL outflows

Ethereum has recovered most of the value that flowed out of its Layer 1 through Layer 2 networks, according to Michael Nadeau, founder of The DeFi Report. While news of Ethereum seeing increased outflows in TVL and Solana gaining these flows into its blockchain has flooded crypto communities, Nadeau's analysis suggested otherwise.

He noted that Ethereum has seen $6 billion in TVL outflows year-to-date, but 83% of the flows went to L2s. This is evidenced in the TVL inflows across all chains in 2024, where L2s Arbitrum ($2.4B), Optimism ($2.2B) and Base ($1.6B) lead other chains, per Artemis data. Considering these L2s have their final settlement on the Ethereum Mainchain, Nadeau noted that they will ultimately drive value to ETH.

In conclusion, Nadeau stated:

"Solana is pulling some TVL from Ethereum, but it's quite modest. 42% of value that went to Solana from Ethereum made its way back to Ethereum this year. Most of the value that leaves Ethereum makes its way back to the most secure and decentralized L1. And most of the value that has left has gone to L2s (stayed in the ecosystem)."

Ethereum's TVL is at $50.4 billion as of the time of writing, per Artemis data.

No. Adding some context (and data) changes the story regarding flows to Solana from other chains

— Michael Nadeau | The DeFi Report (@JustDeauIt) October 30, 2024

Over the last month, @base is #1 in terms of net flows ($463m). @solana is #2 with $197m of net flows. @SuiNetwork #3 with $120m.

If we zoom out to Year-to-Date, @arbitrum… https://t.co/FXd7kqJ2YD pic.twitter.com/mqqfRnGxpc

Meanwhile, Ethereum exchange-traded funds (ETFs) recorded inflows of $4.4 million on Thursday, marking a second consecutive day of positive flows, per Coinglass data.

Ethereum Price Forecast: ETH could bounce off $2,490 support

Ethereum has seen $27.35 million in futures liquidations in the past 24 hours, with long and short liquidations accounting for $23.5 million and $3.85 million, respectively.

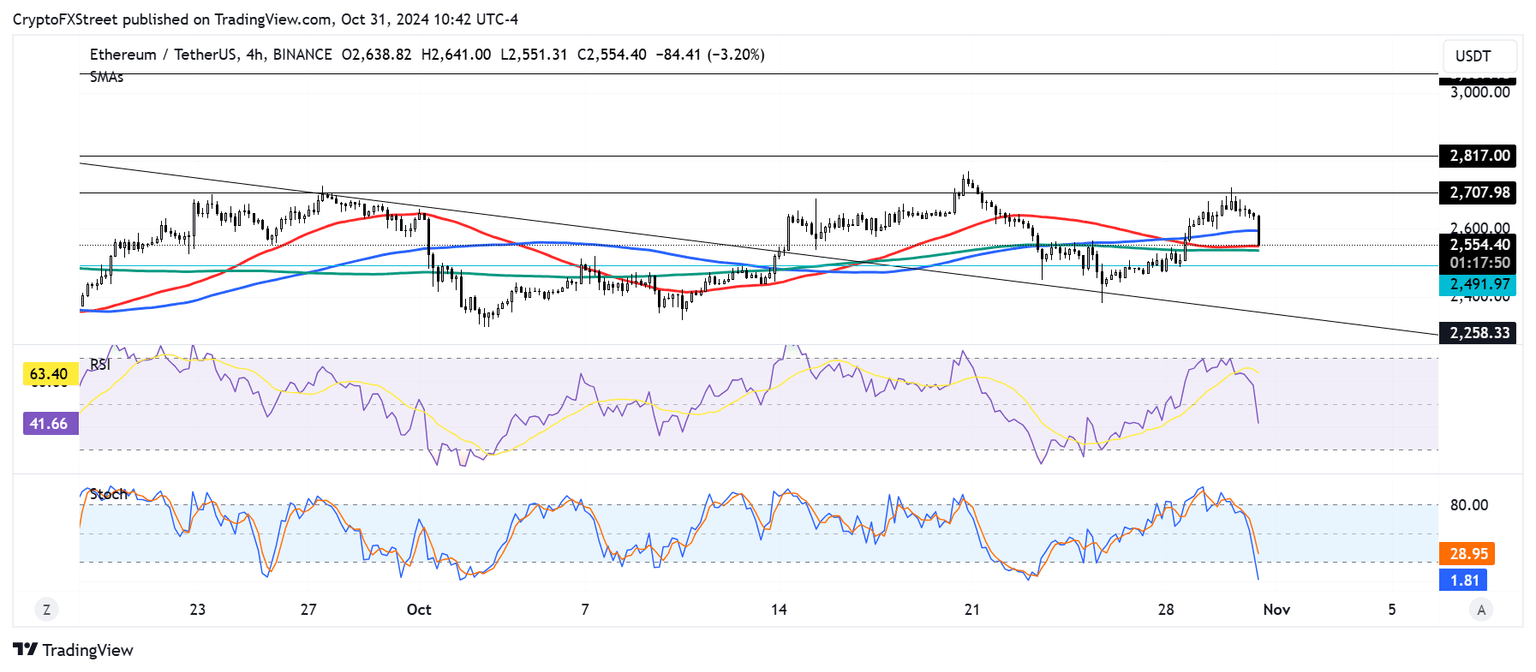

ETH took a 5% dive after seeing a rejection at the resistance level near $2,707. ETH has also crossed below the 200-day Simple Moving Average (SMA) and is now testing the support near the convergence of the 100-day and 50-day SMA.

ETH/USDT 4-hour chart

If ETH fails to bounce off these SMAs, it could find support near the $2,490 level. A bounce off $2,490 will see ETH testing the $2,707 resistance again.

The Relative Strength Index (RSI) is below its midline and trending downward, indicating dominant short-term bearish pressure. The Stochastic Oscillator (Stoch) is in its oversold region, indicating ETH could see a potential bounce off its next key support level.

A candlestick close below the $2,490 level will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi