Ethereum Price Forecast: ETH could become deflationary again when blobspace gets saturated

Ethereum price today: $2,680

- Ethereum could see its burn rate increase again if demand for L2s grows.

- Bitwise CIO says Ethereum rally is more likely than Bitcoin's if Donald Trump wins the US presidential election.

- Ethereum could test its yearly high resistance of $4,093 if it flips $2,817 into a support level.

Ethereum (ETH) is up 0.5% on Wednesday and aims to tackle the $2,817 resistance in the coming days as the US elections draws closer. The top altcoin could even be set for more upside if demand for Layer 2s grows following a recent experiment by game developer Cartridge on the Starknet chain.

Ethereum could become deflationary again if L2 demand rises

Following an experiment by Cartridge on the Starknet L2, blobspace on Ethereum experienced its fourth price discovery since the Dencun upgrade in March. Blobspace is an additional storage for L2s embedded on the Ethereum Mainchain with cheaper transaction costs.

Ethereum developers introduced the blobspace feature in the Dencun upgrade in March to help minimize fees for Layer 2 networks. However, the fee reduction came at the expense of ETH experiencing a supply expansion due to a drop in its burn rate, making the top altcoin inflationary again. In addition, it also led to reduced fee capture on the Mainchain.

Blobs just experienced their 4th "price discovery moment" since Dencun (~7mo ago), and second in the span of a week.

— BREAD (@0xBreadguy) October 30, 2024

The time is close. Blobspace is reaching saturation.

Do L2s start playing games? Does ETH just get burned like crazy?

No idea - but I'll be watching.

Here's… pic.twitter.com/TXFNdlnxvK

As a result, a major talking point among crypto community members has been whether L2s are parasitic to Ethereum. However, the narrative looks set to change after Starknet posted a series of transactions — 857 transactions per second — from Cartridge's flippyflop game, which briefly saturated blobspace.

The test has led several community members to rethink their conclusion on L2s, with some acknowledging that blobspace could instead boost the ETH burn rate in the long term when demand for L2s grows, in turn boosting prices.

A simulation by Tim Robinson shows that if L2s scale Ethereum by 10,000 TPS in the future, the total amount of ETH burned per day could cross the $45 million mark if ETH's price is $3,000. Such a burn rate will fuel deflationary pressure for Ethereum, leading to soaring prices.

Many people arguing about blobs, but so far no one has simulated how they respond to demand... until now. TL;DR: Blobs are insanely bullish for ETH long term pic.twitter.com/7V3TEOF4q6

— Tim Robinson (@timjrobinson) October 29, 2024

Ethereum could outperform Bitcoin if Trump wins

Meanwhile, in an interview with Yahoo Finance, Bitwise Chief Investment Officer (CIO) Matt Hougan said Ethereum has huge upside potential over Bitcoin in the event of a Donald Trump win in the upcoming US presidential election. He highlighted how a Trump win could lead to a new Securities & Exchange Commission (SEC) that will help provide regulatory clarity for altcoins.

"I think the regulatory clarity you're talking about actually matters more for the so-called altcoins, for Ethereum on down," Hougan noted. "Those are more exposed to regulatory risks, so I would expect an altcoin rally, even more so than a Bitcoin rally in the event of a Trump win. But regardless, I think both are moving higher."

In other news, Ethereum exchange-traded funds (ETFs) recorded net inflows of $7.6 million on Tuesday, per Coinglass data.

Ethereum Price Forecast: ETH could test yearly high resistance if it reclaims $2,817 key level

Ethereum is trading near $2,680, up 0.5% on the day following $25.77 million in ETH futures liquidations. Long and short liquidations accounted for $12.28 million and $13.49 million, respectively.

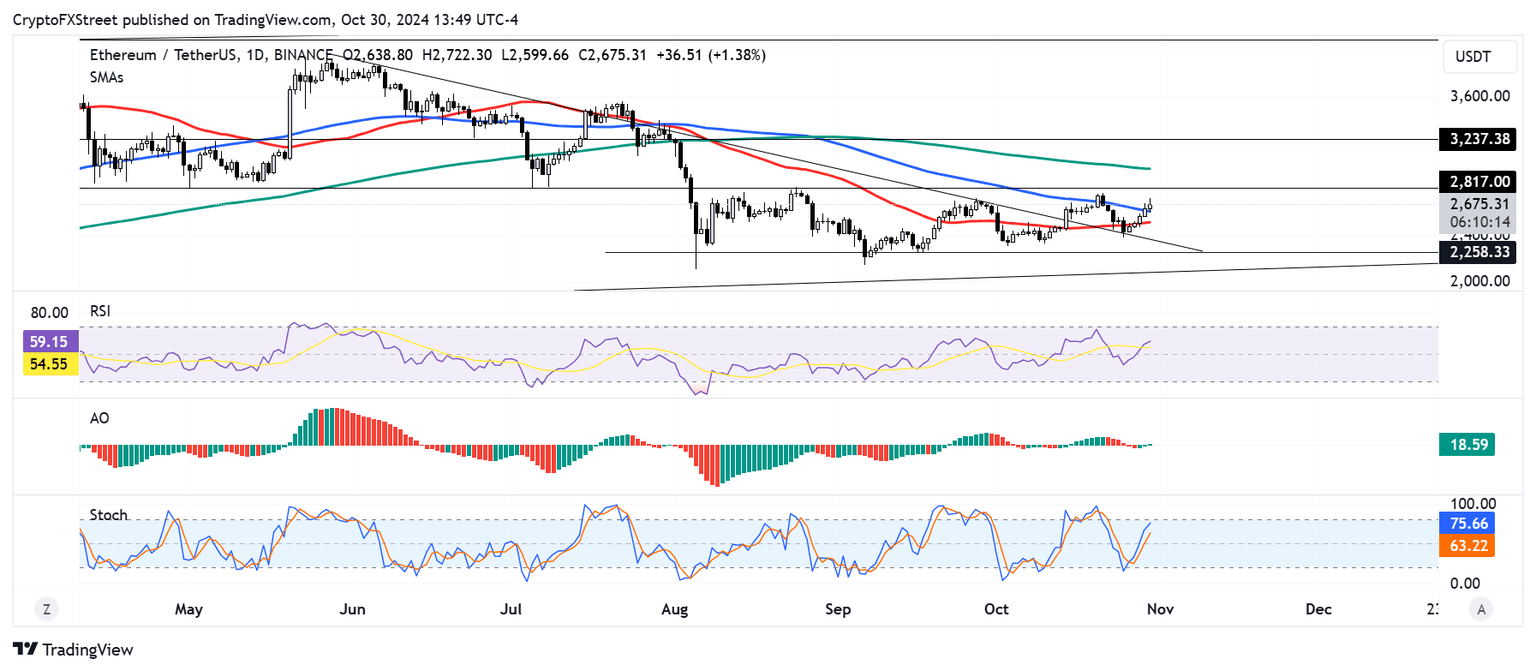

ETH has crossed above its 200-day Simple Moving Average (SMA) and is trending toward a key rectangle channel's $2,817 resistance level. If ETH flips the $2,817 resistance into a support level, it could extend its rally to cross above the 100-day SMA and test the $3,237 resistance level.

ETH/USDT daily chart

Notably, the $2,817 level served as a major support level for nearly four months before the crypto market crash in early August.

The 50-day SMA is also slowly tilting upward and approaching the 200-day SMA. A cross of the 50-day SMA above the 200-day SMA will indicate a strong bull market and potentially propel ETH to test its yearly high resistance of $4,093.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) are above their mid-levels, indicating rising bullish pressure. However, the Stochastic Oscillator is approaching its oversold region, indicating ETH could see a correction soon.

A daily candlestick close below the key descending trendline extending from May 27 will invalidate the bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi