Ethereum Price Forecast: ETH awaits imminent jump to $2,400 if key level cracks

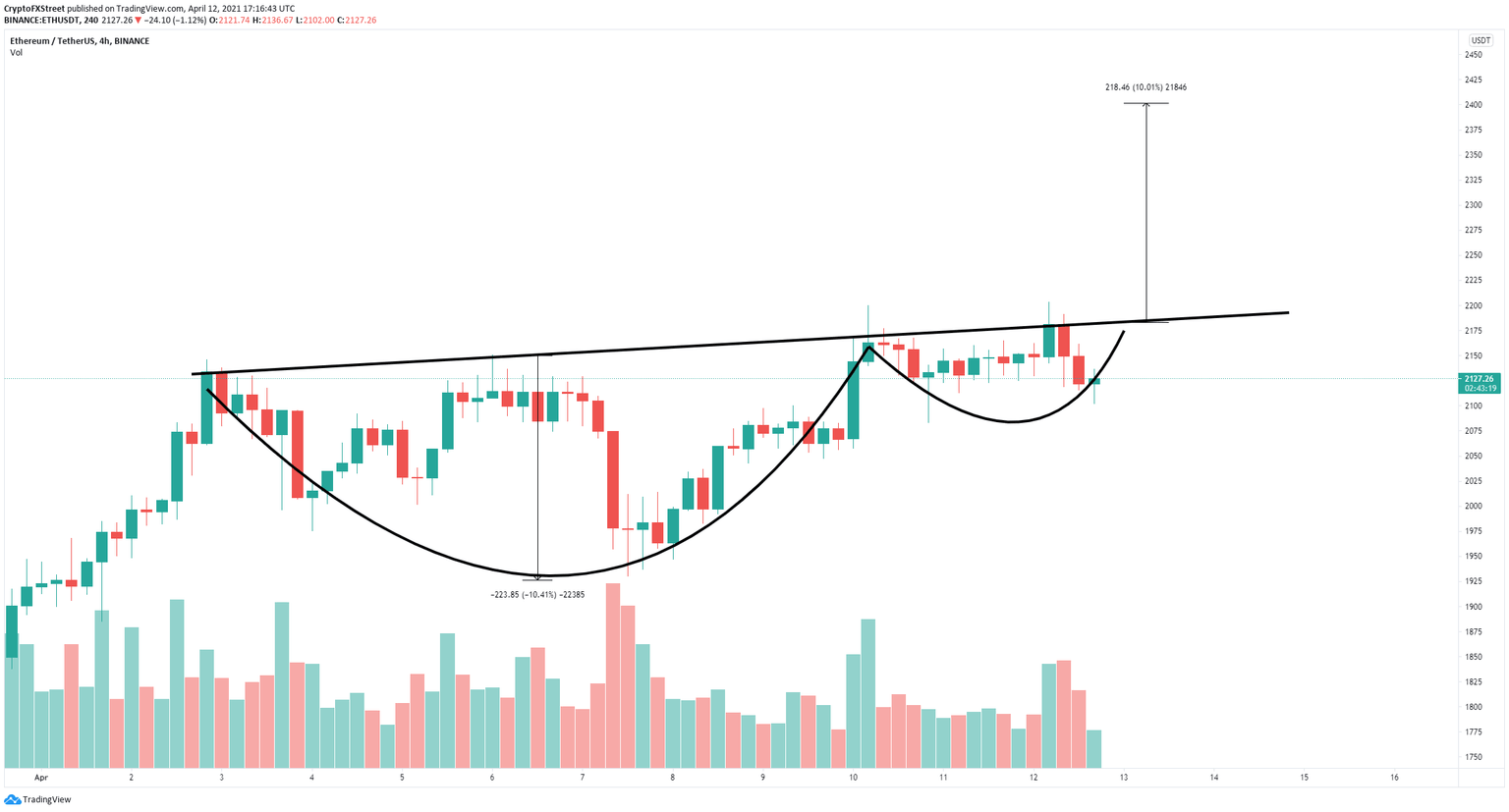

- Ethereum price has formed a cup and handle pattern on the 4-hour chart

- The digital asset is becoming scarcer every day, which should translate into an increase in value.

- About $60 billion worth of ETH is locked away and exchanges are running out of Ethereum.

Ethereum price hit a new all-time high at $2,203 on April 12 but seems to have formed a robust resistance trendline. However, most on-chain metrics show that ETH is bound for a significant leg up.

Ethereum price needs to crack this key resistance level

On the 4-hour chart, Ethereum seems to have formed a cup and handle pattern which as the name indicates, resembles a teacup. The resistance neckline is formed at $2,200, which means that a breakout above this point will drive ETH towards $2,400. A 10% move calculated using the height of the neckline to the bottom of the pattern.

ETH/USD 4-hour chart

Surprisingly, despite Ethereum price hitting new all-time highs, the supply of the coin on exchanges has dropped by 1% since March 28. This indicates that investors are withdrawing their ETH from exchanges to hold even longer.

ETH Supply on Exchanges

The total value of ETH locked in DeFi protocols peaked at $52.37 billion on April 10 and the value of Ethereum locked in the ETH2 contract reached $8.07 billion which means that a total of $60.44 billion worth of Ethereum are locked away.

ETH total value locked in DeFi

To invalidate the bullish outlook, bears will need to push the digital asset below the neckline of the handle sitting at $2,080. This would be a notable breakdown capable of driving Ethereum price down to the bottom of the pattern at $1,930.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B19.17.05%2C%252012%2520Apr%2C%25202021%5D.png&w=1536&q=95)

%2520%5B19.19.56%2C%252012%2520Apr%2C%25202021%5D.png&w=1536&q=95)