- Ethereum has set the stage for a massive price increase in 2020.

- Institutional money will continue flowing into the ecosystem, supporting ETH price growth.

- DeFi and NFT industries are set to reinforce ETH use cases.

- A potentially deep downside correction early in the year will be followed by a move to an all-time high.

Ethereum is one of the world's largest cryptocurrency platforms, second only to Bitcoin both in terms of market capitalization and popularity among the industry players.

Launched in 2015, the project has evolved into a fundamental pillar and a citadel for many fast-evolving innovative technologies such as smart contracts, decentralized applications, NFT, to name just a few.

There are over 113 million tokens in circulation at the time of writing, with a total market value of over $62 billion. Over 1 million transactions are processed on the ETH blockchain on a daily basis with a total value of $16 billion. The pioneer cryptocurrency retains its power as a vital driving force in almost all major digital assets, including ETH. However, Ethereum's ecosystem is so unique and resourceful that it has the potential to decouple from BTC.

The year 2021 has a lot of exciting developments in store for the Ethereum project, including the deployment of ETH 2.0, growing institutional interest and a boom of innovations in the DeFi industry. How will all these events affect ETH price? What are the risks and opportunities investors should be aware of in 2021? Read on to know the answers.

Ethereum price: The year 2020 in review

After 2020 the world will never be the same. A new deadly virus, pandemic and global lockdowns left deep scars on the world's economy. The governments and central banks in the developed countries were forced to print their way out of recession and gamble on the future.

Social distancing and a fear of contagion moved many processes online and sped up the digitalization of our everyday life activities, including payments, shopping and entertainment. This trend brought blockchain and smart ledger technologies to the forefront, emphasizing the benefits of decentralization.

The Ethereum ecosystem was among the key beneficiaries of the trend. Over 3,000 dApps with nearly 100,000 daily active users are currently built on the Ethereum blockchain and their number is continually increasing.

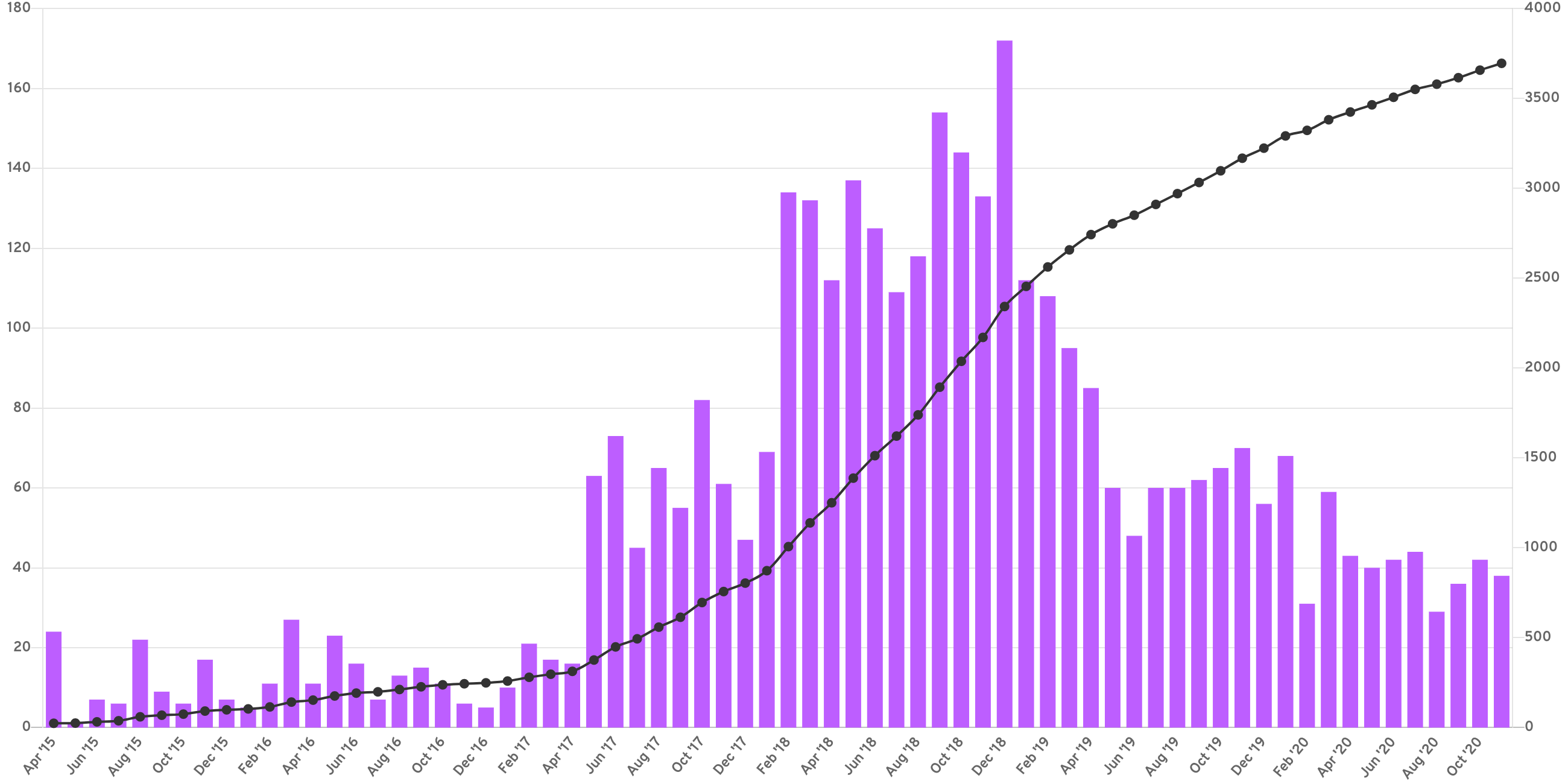

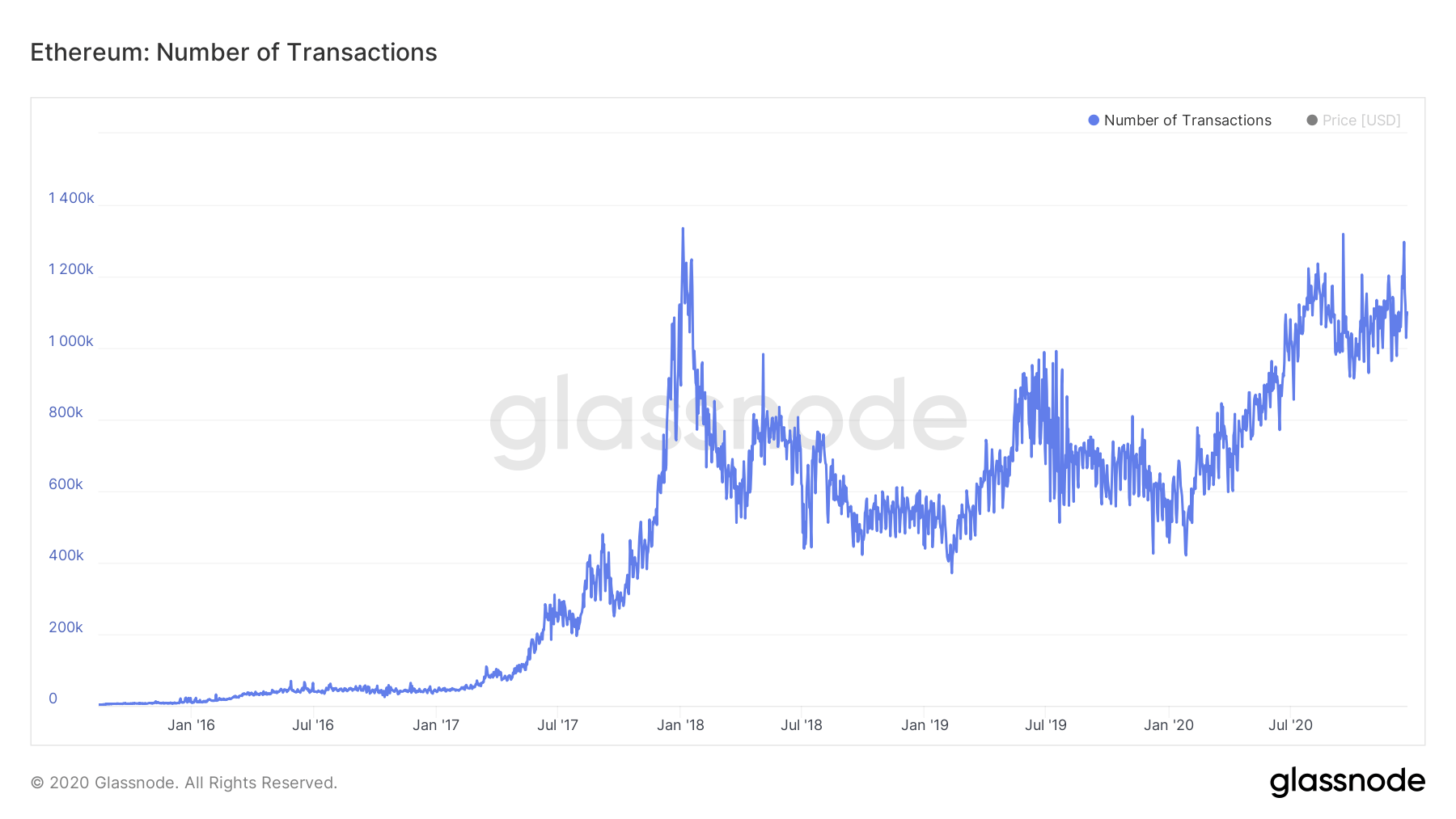

The number of ETH transactions more than doubled since the beginning of the year, while the number of new accounts created daily jumped by over 500%, from about 30,000 to 170,000, according to Etherstat's data.

Ethereum's daily transactions data

Ethereum's daily transactions data

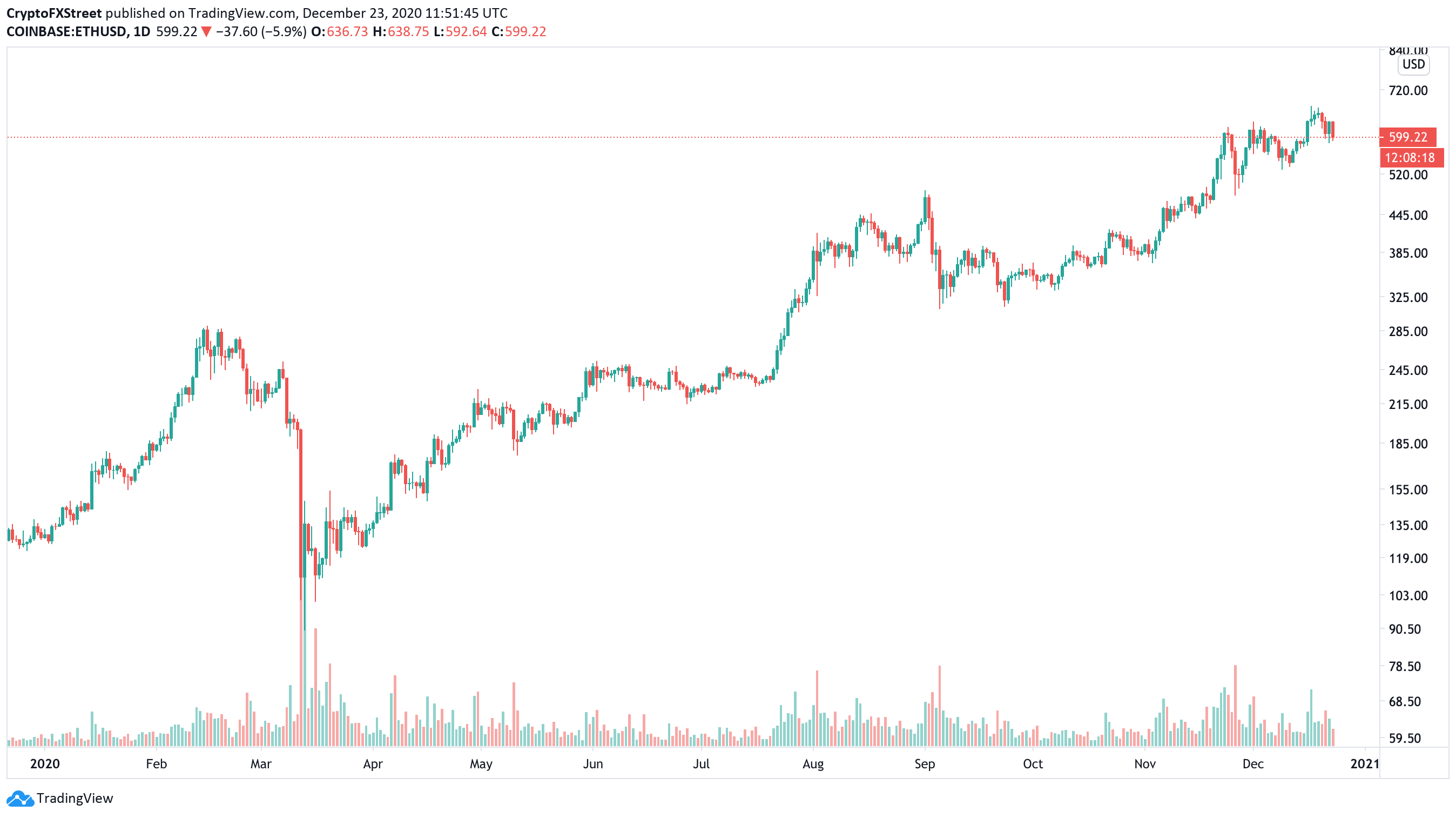

Meanwhile, Ethereum's market capitalization increased from $14 billion in January to $62 billion at the time of writing, which is nearly 350% growth. ETH hit the lowest level of 2020 at $90 amid the major crypto sell-off caused by the beginning of the COVID-19 pandemic and topped at $640 in December following the successful launch of Beacon Chain genesis block. The coin has returned to the levels of 2018 and recovered half of the losses incurred during the crypto winter.

ETH, daily chart

Three major ETH trends of 2020

From the fundamental point of view, 2020 brought us three significant trends that are likely to dominate Ethereum's agenda in 2021.

First, it is the boom of decentralized finances or DeFi. The new industry made financial services cheaper and faster, and more accessible by cutting out intermediaries and allowing people to borrow, loan and perform other transactions directly between each other. While the industry is still at the embryonic stage, its potential is enormous and it is going to gain ground in the future as it offers real use cases for crypto.

As the vast majority of DeFi projects are built on Ethereum blockchain, their growing popularity has been driving ETH prices higher through the second half of the year, attracting investment flows to the ecosystem.

Here comes the second critical trend – institutional interest in ETH. According to Michael Sonnenshein, managing director at Grayscale Investments LLC, large investors have expressed confidence in Ethereum. Many new customers of the company have chosen ETH-based trust to gain exposure to the cryptocurrency market.

The company reports that the investment inflows in Grayscale Ethereum Trust increased by $184 million in the third quarter of 2020 compared to the same period a year ago, with over 17% coming from new investors. As of December 8, there are 30.28 million shares in circulation from 5.2 million at the end of 2019. Moreover, Grayscale's ETH product is trading at with 140% premium over the spot price.

Sonnenshein said:

"The development of the asset class has continued to solidify itself. Ethereum has along the same lines of the staying power Bitcoin has."

The last but not the least bullish catalyst of 2020 is the successful launch of Ethereum 2.0. The launch of the second version of the Ethereum protocol, also known as Serenity, is considered the most significant event for ETH in 2020. The major upgrade will transform the protocol into a self-sustaining financial ecosystem with enough security and scalability to withstand the growing network load.

Five Ethereum trends to watch in 2021

The cryptocurrency community members believe that ETH is on the verge of tectonic shifts in market sentiments. Ethereum may outshine Bitcoin as the most successful coin in terms of return on investments and mass adoption rate.

Time will tell whether ETH will be able to dethrone BTC in 2021; however, the coin has a strong potential and a lot of bullish catalysts to succeed. Below are several trends that will be dominating Ethereum's agenda in 2021.

1. DeFi will continue to thrive

DeFi craze has already petered out, but the ecosystem will continue growing exponentially in 2021. The protocols will become more mature and less vulnerable to hype and security breaches.

Also, in 2021 the traditional financial industry may start embracing DeFi, making it a part of the existing financial infrastructure. This development will become a major boost to the industry. As ERC tokens have already become a synonym for DeFi, an inflow of money into these protocols will translate into the ETH price increase.

2. The rise of NFT

NFTs, or non-fungible tokens, are another big thing after DeFi. The concept encompasses things like digital art, gaming assets and other digital artifacts. These tokens are also based on the Ethereum blockchain and each of them is unique.

The history of the NFT industry started back in 2017 with CryptoPunks and CryptoKitties. However, the idea began catching fire only in 2020. By the end of October 2020, the segment accounted for over 14% of the Ethereum network usage, while the average daily trading volume surpassed $100 million, according to NonFungibel.com. Some NFTs are selling for thousands of dollars, with big players joining the industry every day.

Considering that art galleries and the property market are already taking note of the benefits associated with non-fungible, blockchain-based tokens, the market is set for a stellar 2021.

NFT industry adds another strong use case to Ethereum's portfolio. The spreading popularity of the NFT concept may become a powerful catalyst behind ETH price growth in the years to come.

3. ETH will become an investment opportunity

Unlike Bitcoin, the Ethereum blockchain is more than a unit of payment. In 2021 Institutional players will continue discovering ETH and its investment features. A steady price increase and relatively low volatility will continue attracting hedge funds, money managers and wealthy individuals who want to diversify their investment portfolios away from Bitcoin.

Now that BTC hit an all-time high, many market players consider it too expensive and potentially risky. They start looking for the next big thing and Ethereum fits the description.

Given that the coin is still about 60% below its all-time high, there is room for growth, while the above-mentioned factors create a positive fundamental environment.

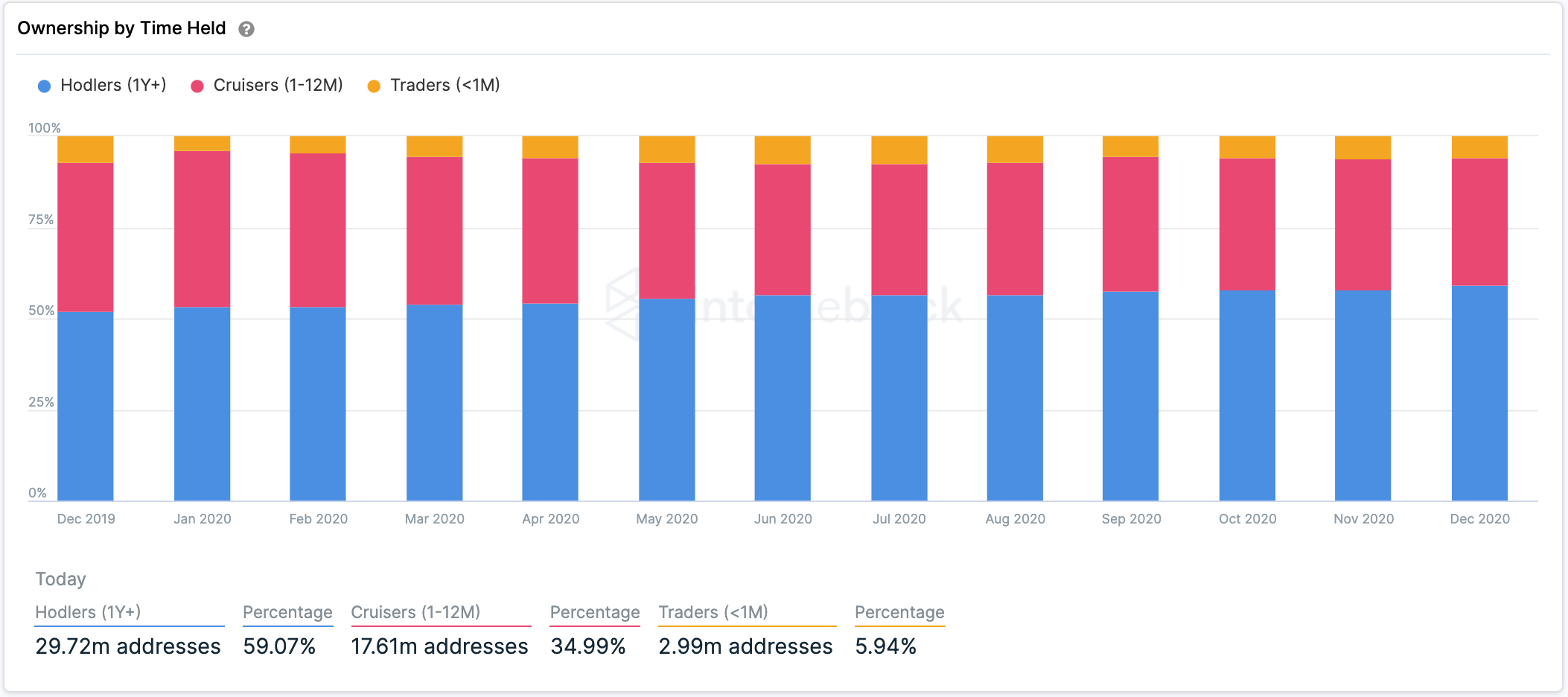

Since the beginning of 2020, the number of ETH addresses holding coins for over a year increased from 17.7 million to nearly 29 million. An average investment period improved from 2.3 years to 2.8 years. This data confirms that the ETH whales population is growing. The trend is set to gain traction in 2021.

ETH ownership by time held, (source: Intotheblock)

ETH ownership by time held, (source: Intotheblock)

4. ETH mining will die in 2021

Mining will be officially disabled on Ethereum blockchain in 2021 as the project moves on with rolling out the Serenity upgrade, also known as ETH 2.0.

Now that the developer team raised the financing required for ETH 2.0 development, the project is ready to transit from Proof-of-Work (PoW) to Proof-of-Stake (PoS) by the end of the year. According to the roadmap, Ethereum will move to Phase 1.5 in late 2021, meaning that ETH 1 will be merged with ETH2's Beacon Chain. At this point, Ethereum mining will be over.

The transition will remove the limitations associated with the PoW algorithm, making the network faster and more scalable. Also, the amount of ETH in circulation will increase by at least 4 million tokens.

ETH 2.0 looks very promising. If it works as expected, Ethereum will become one of the most powerful blockchains. However, at this stage, it is still a gamble as no one knows for sure how it will all pan out.

5. ETH will decouple from BTC

Massive institutional investment in Bitcoin has turned the asset into a financial instrument with lots of derivatives that affect its price movements. This trend sets ETH and other altcoins apart, allowing them to gradually decouple from the pioneer asset.

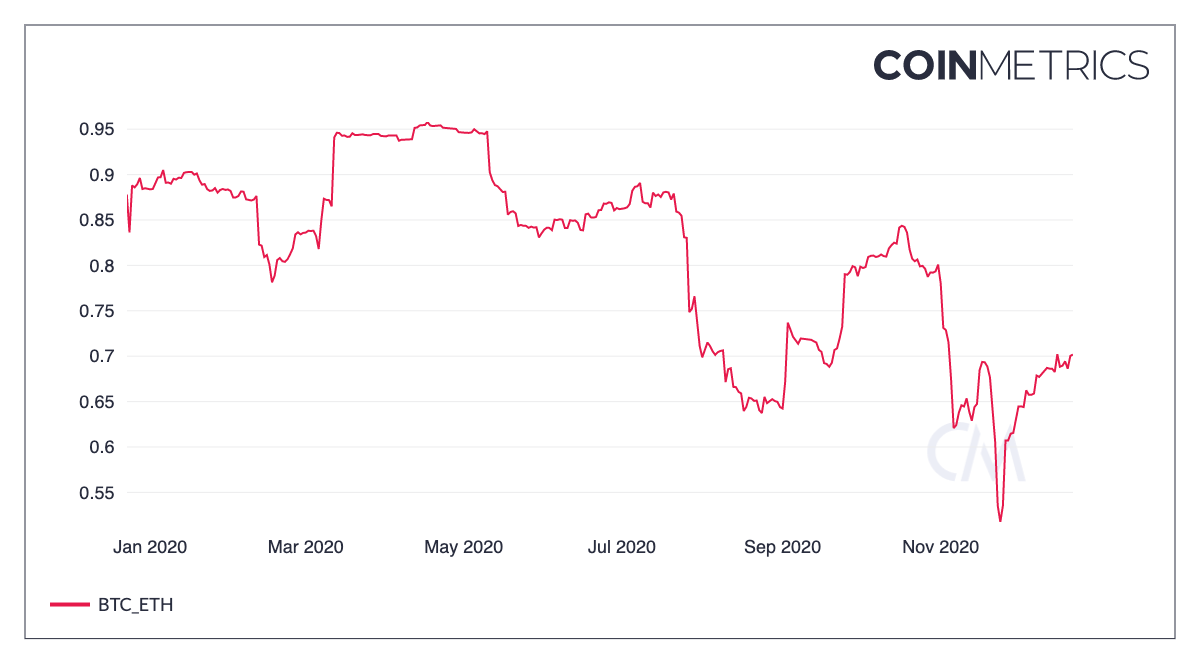

The data from Coinmetrics show that the BTC-ETH correlation is still strong at 0.77; however, it has been weakening gradually from the peak reached at 0.93 in summer.

BTC-ETH correlation chart

Bitcoin has been touted as a hedge against a drop in the purchasing power of the US dollar. Ethereum has the potential to become a hedge against Bitcoin's volatility as it serves different needs and evolves around different aims.

Ethereum price technical correction is unavoidable

The next year will likely be positive for the cryptocurrency industry and ETH is poised to lead the altcoin recovery. With a move above the $280 in summer, ETH broke from the post-bear trading range and set the stage for a sustainable recovery towards the all-time high at $1,400.

While the bigger picture bodes well for ETH bulls, the price may return to the $350-$300 area before another bullish wave takes it above $1,000 and to a new all-time high.

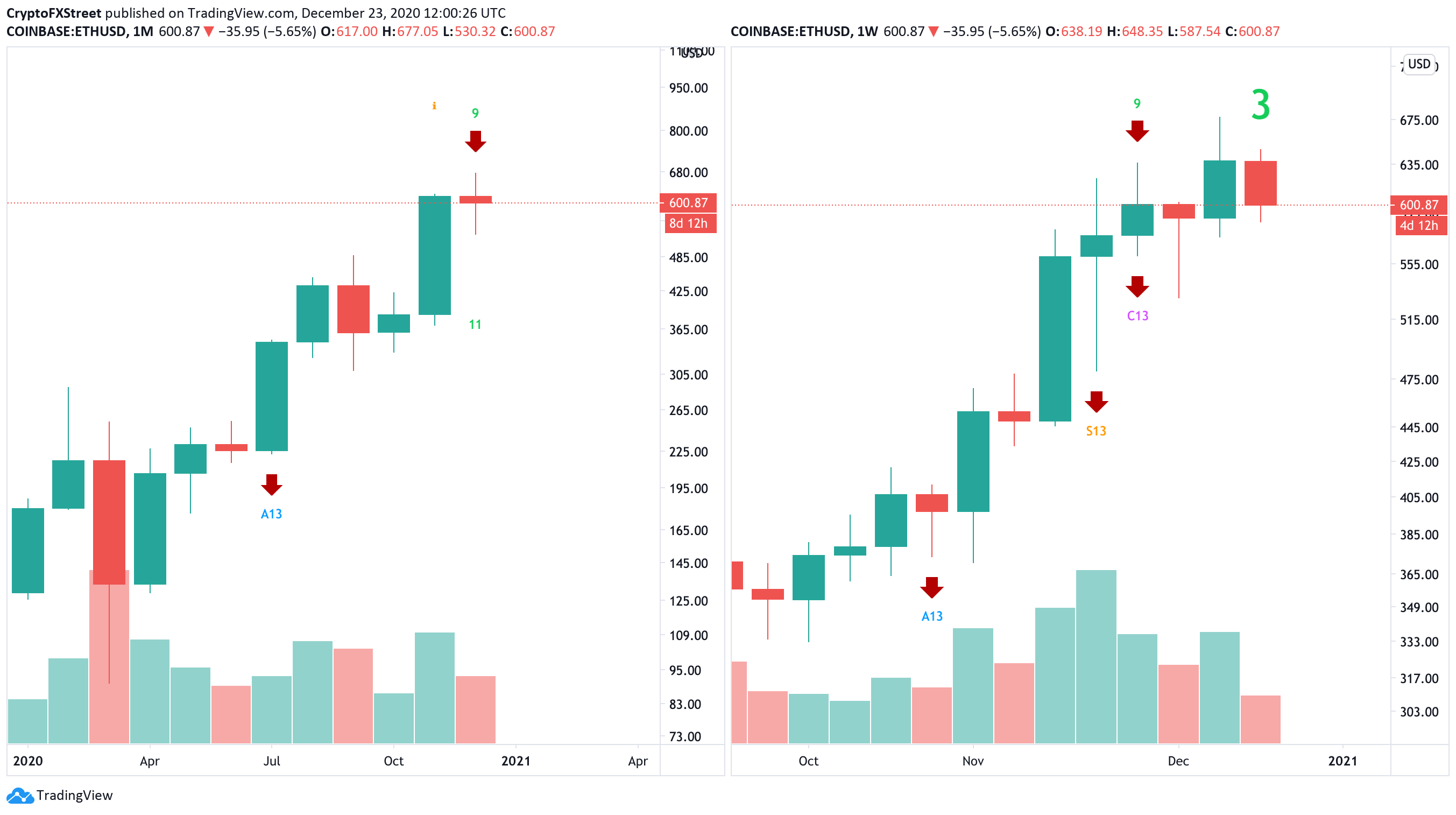

TD Sequential indicator sends selling signals on the form of a nine green candlestick both on the weekly and monthly chart, meaning that the price may move down for one to four candlesticks with the first correction target at $370 (November low) followed by $300 (weekly EMA200 and EMA50, monthly EMA50). This area should stop the bears and trigger a new buying interest. However, a sustainable move below this barrier will invalidate the optimistic scenario and bring $230 into focus. This support is reinforced by weekly EMA100.

On the upside, the local barrier comes at $750. It is created by 50% Fibo for the sell-off from January 2018 high to December 2018 low. Once it is out of the way, the upside is likely to gain traction with the next focus on $900 (61.8% Fibo for the same move) followed by the psychological $1,000. Considering the positive fundamental background, ETH can retest the all-time high of $1,419 during 2021.

Ethereum price prediction is looking positive for a year to come, but the upside move won't be linear. Bulls trend will be punctured with sharp sell-offs, which will be regarded as an investment opportunity. Considering the fact that large investors are entering the space, ETH should have strong support over the next several years.

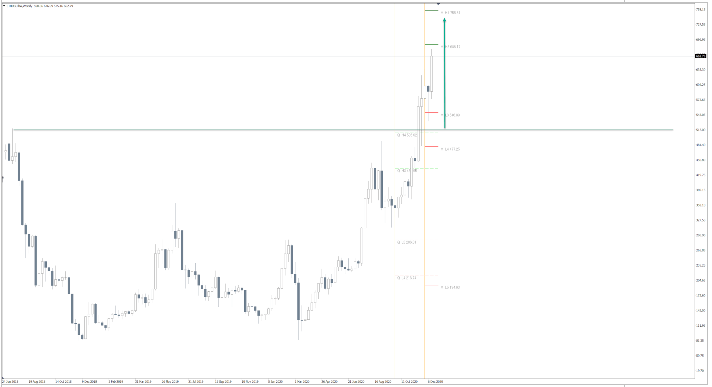

Nenad Kerkez projects the continuation of the Ethereum rally next year on his Camarilla Pivot Point analysis:

ETH/USD Camarilla Pivot Point Analysis

by Nenad Kerkez

by Nenad Kerkez

We can see the ascending scallop and there is potential for a move down then up. First I think 506 will be hit followed by 686 and 755. The ETH/USD is bullish, so after a retest of 506 we should see a move up.

Forecast Poll 2021

| Forecast | Q1 - Mar 31st | Q2 - Jun 30th | Q4 - Dec 31st |

|---|---|---|---|

| Bullish | 36.0% | 24.0% | 50.0% |

| Bearish | 16.0% | 16.0% | 11.5% |

| Sideways | 48.0% | 60.0% | 38.5% |

| Average Forecast Price | 673.88 | 766.68 | 1018.92 |

| EXPERTS | Q1 - Mar 31st | Q2 - Jun 30th | Q4 - Dec 31st |

|---|---|---|---|

| Alberto Muñoz | 840 Bullish | 700 Sideways | 1175 Bullish |

| Alex Zha | 610 Sideways | 700 Sideways | 900 Bullish |

| Andrew Lockwood | 475 Bearish | 375 Bearish | 250 Bearish |

| Andria Pichidi | 550 Bullish | 480 Bearish | 900 Bullish |

| Brad Alexander | 700 Sideways | 800 Sideways | 500 Sideways |

| Dmitry Lukashov | 760 Bullish | 920 Bullish | 780 Sideways |

| Dukascopy Bank Team | 540 Sideways | 670 Sideways | 800 Sideways |

| Eliman Dambell | 800 Bullish | 650 Sideways | 490 Bearish |

| FP Markets Team | 950 Bullish | 650 Sideways | 1200 Bullish |

| Frank Walbaum | 500 Sideways | 650 Sideways | 1100 Bullish |

| Giles Coghlan | 800 Bullish | 1200 Bullish | 1500 Bullish |

| Grega Horvat | 800 Bullish | 600 Sideways | 500 Sideways |

| Jay Hao | 800 Bullish | 1200 Bullish | 1500 Bullish |

| Jeff Langin | 620 Sideways | 700 Sideways | 600 Sideways |

| JFD Team | 650 Sideways | 300 Bearish | 800 Sideways |

| Kaia Parv, CFA | 670 Sideways | 650 Sideways | 625 Sideways |

| Konstantin Anissimov | 1300 Bullish | 2200 Bullish | 4900 Bullish |

| Lennix Lai | - | - | 650 Sideways |

| Matthew Levy, CFA | 425 Bearish | 400 Bearish | 350 Bearish |

| Navin Prithyani | 485 Bearish | 600 Sideways | 800 Sideways |

| Paul Dixon | 600 Sideways | 800 Sideways | 1000 Bullish |

| RoboForex Team | 520 Sideways | 770 Sideways | 900 Bullish |

| Sachin Kotecha | 700 Sideways | 900 Bullish | 1400 Bullish |

| Theotrade Analysis Team | 400 Bearish | 500 Sideways | 800 Sideways |

| Tomàs Sallés | 752 Bullish | 952 Bullish | 1072 Bullish |

| Walid Salah El Din | 600 Sideways | 800 Sideways | 1000 Bullish |

While Bitcoin was able to reach a new all-time high this year, Ethereum has been sitting on the sidelines despite all the activity on its network. The launch of ETH 2.0 has been welcomed by cryptocurrency enthusiasts who have been locking a significant number of tokens on the deposit contracts, consequently, reducing the selling pressure behind it. Additionally, the emergence of a new market sector within the network, know as decentralize finance or DeFi, represents another price driver for Ethereum. The higher the demand for these projects the more gas is needed to support the transactions performed on the ETH’s blockchain; therefore, more Ether is needed to pay for transaction fees, which inadvertently increases the demand for this token. As selling pressure diminishes while demand rises, the only direction for the price of this cryptocurrency to go is up. As can be seen in the bull market, Ethereum took over a month to peak after Bitcoin rose to nearly $20,000. If history repeats itself, Ether could be reaching a new all-time by the end of Q1 2021 and possibly peak at a high of nearly $5,000 in December 2021.

It’s undeniable that the initiatives from banks and PayPal alike tradition forms cleared the final roadblock of the adoption of the bitcoin. I expect at a mere average 0.3% of major fund in the planet allocated to Ethereum.

by Lennix Lai

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EOS 22% pump steals the show unveiling Vaulta’s web3 banking ecosystem

EOS, the token behind the recently rebranded Vaulta network, has increased by a staggering 22% in the last 24 hours.

Curve DAO Price Forecast: CRV bulls could aim for double-digit gains above key resistance

Curve DAO (CRV) price is in the green, up 8%, trading above $0.53 on Thursday after rallying nearly 15% so far this week.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin (BTC) and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.