Ethereum price falls below $1,500, have the bulls jumped ship?

- Ethereum price plummets to $1,480 in free-fall fashion.

- The volume profile indicator is still relatively low.

- Invalidation of the bearish thesis is a break above $1,750.

Ethereum price descends 15% over the weekend. Despite the attractive discount, the technicals suggest the ETH price could fall a bit further.

Ethereum price is losing value

Ethereum price concerns investors this weekend as the decentralized smart contract giant has lost support from the psychological $1,500 level. The sharp, declining bearish engulfing candle established by the bears is a moving freight train many investors will not want to jump in front of.

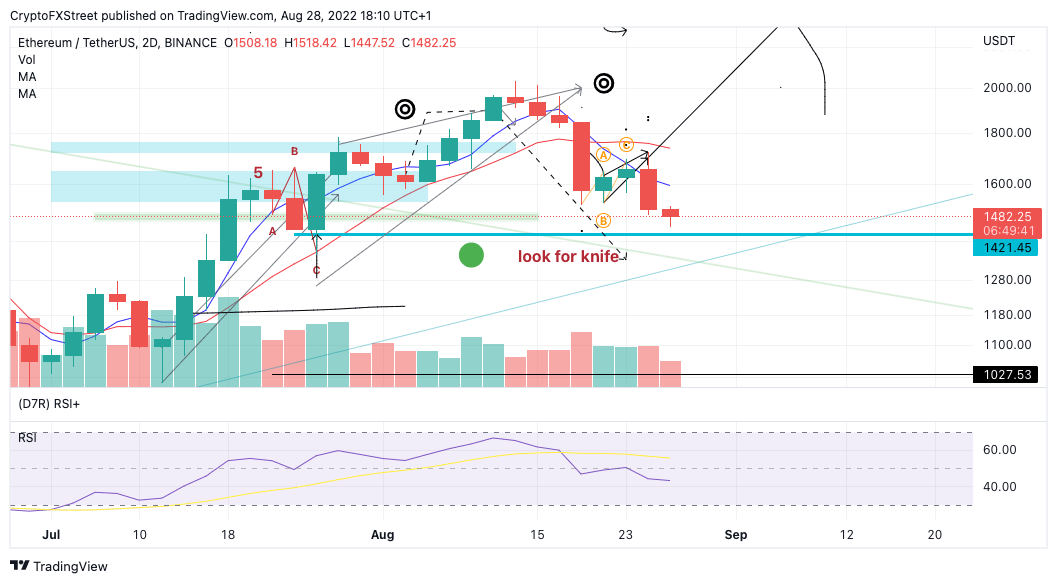

Ethereum price currently auctions at $1484 on Sunday, August 2028. The Relative Strength Index has a bit more cushion space to fall which confounds the idea that the market bottom is not yet in place amidst the sharp liquidation. Additionally, the Volume Profile Indicator showed an uptick last week on August 19. The bulls have not yet been able to match a retaliative trading day with equal or more volume.

ETH.USDT 2-Day Chart

Thus traders should align themselves with the bearish thesis until more evidence argues otherwise. The ETH price points to $1,400 and potentially $1320 if market conditions persist.

Invalidation of the bearish thesis is a closing candle above $1,750. If the bulls can breach this level, they may be able to rally back towards $2,000, resulting in a 36% increase from the current Ethereum price.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.