Ethereum price faces practically no resistance towards $1,000, despite recent pullback

- Ethereum price got rejected from its 2020-high at $676 but remains bullish.

- Several on-chain metrics continue to show the digital asset is poised for more.

Ethereum price hit a new 2020-high at $676 on Binance as the entire cryptocurrency market gained almost $100 billion in market capitalization in less than 48 hours. The smart-contracts giant had a notable pullback towards $625 but remains fairly bullish.

Ethereum price still aims for $1,000 in the long-term

Despite the recent pullback on the daily chart, the uptrend remains intact. The Eth2 deposit contract has received over 1.54 million ETH which are now locked inside. Surprisingly, the RSI is not overextended on the daily chart, which also indicates bulls still have more room for upside action.

ETH/USD daily chart

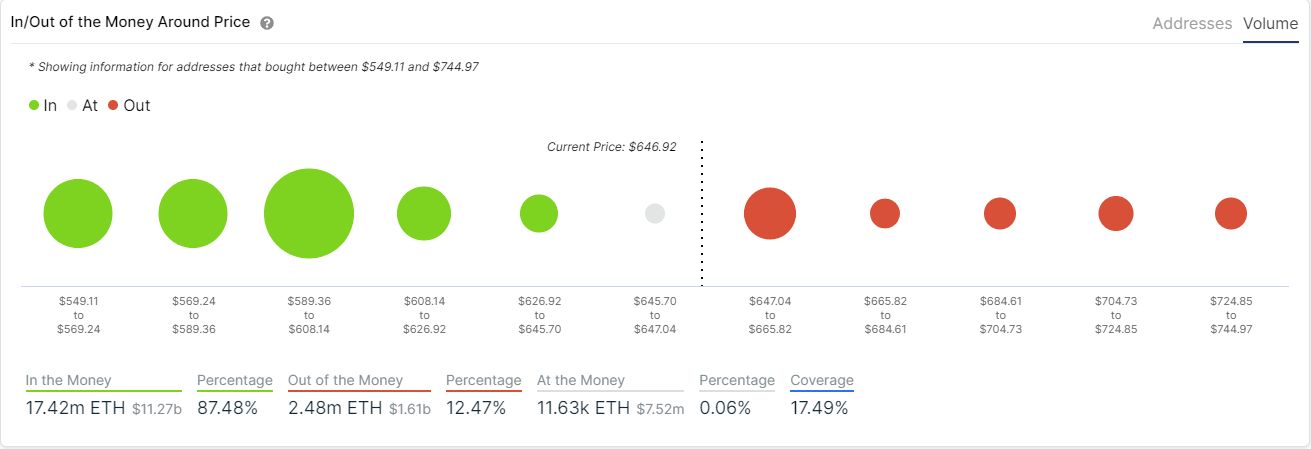

The In/Out of the Money Around Price (IOMAP) chart shows basically no resistance until $750 which would be the initial price target for the bulls. The most significant resistance area seems to be located between $647 and $665 but is far weaker than the support found below $647.

ETH IOMAP chart

Additionally, we have recently found out that the CME group plans to launch Ether Futures contracts on February 8, 2021. CME launched Bitcoin futures more than three years ago, and Ethereum is the second-ever cryptocurrency supported.

ETH Holders Distribution

It also seems that the number of whales holding between 10,000 and 100,000 coins has increased by 58 since November 11, despite the significant growth of Ethereum price. This indicates that large holders are not interested in short-term gains, decreasing selling pressure.

Ethereum network growth chart

However, the network growth of Ethereum has slowed down significantly in the past three days from its peak on December 13, which could indicate short-term weakness. Bears could potentially target the psychological level at $600 for a re-test.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.44.38%2C%252018%2520Dec%2C%25202020%5D-637438996876769833.png&w=1536&q=95)

%2520%5B15.48.13%2C%252018%2520Dec%2C%25202020%5D-637438996971613578.png&w=1536&q=95)