Ethereum price faces backlash from institutions after Fed refrains from raising rates

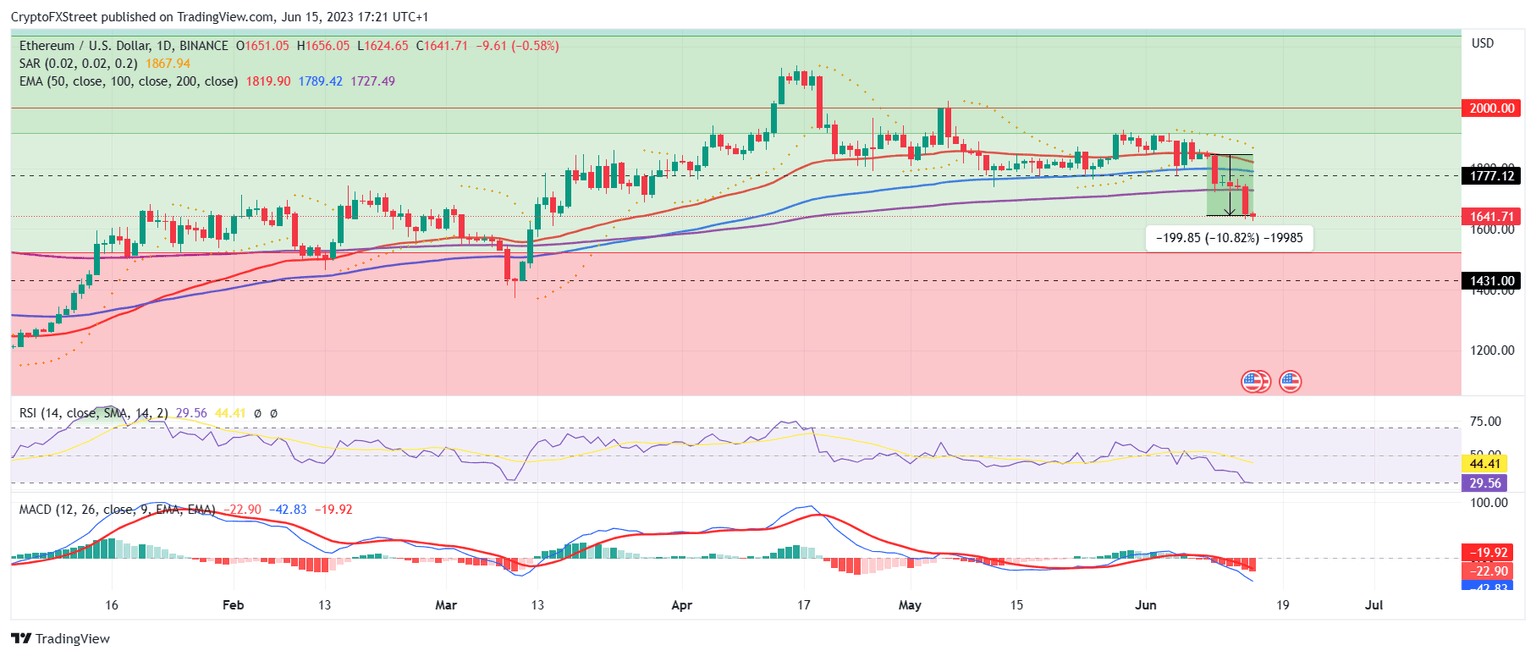

- Ethereum price is trading at $1,650 after declining by nearly 11% this week.

- Long-term holders were observed moving their supply around just as the Fed denied raising interest rates for the first time in a year.

- Institutions are expected to be the long-term holders that moved the supply as they already have been skeptical this month in regards to ETH.

Ethereum price, along with the leader of the cryptocurrencies, Bitcoin, noted a pullback despite the US Federal Reserve (Fed) keeping the interest rates steady this month. This bearishness is impacting the institutions the most, who are seeing fit to step back for now instead of keeping their hopes up for a recovery.

Ethereum price at a three-month low

Ethereum price slipped further on this week’s charts after losing the support of the $1,700 mark. Following the regulatory crackdown against Binance and Coinbase, the crypto market took a hit as the Fed kept the interest rate unchanged at 5% to 5.25%.

The status quo from the Fed should have resulted in a boost in the crypto market’s performance. However, the proclamation of two more rate hikes in the upcoming policies this year led to ETH falling by almost 11% in the span of a week, bringing it closer to the March lows of $1,431.

ETH/USD 1-day chart

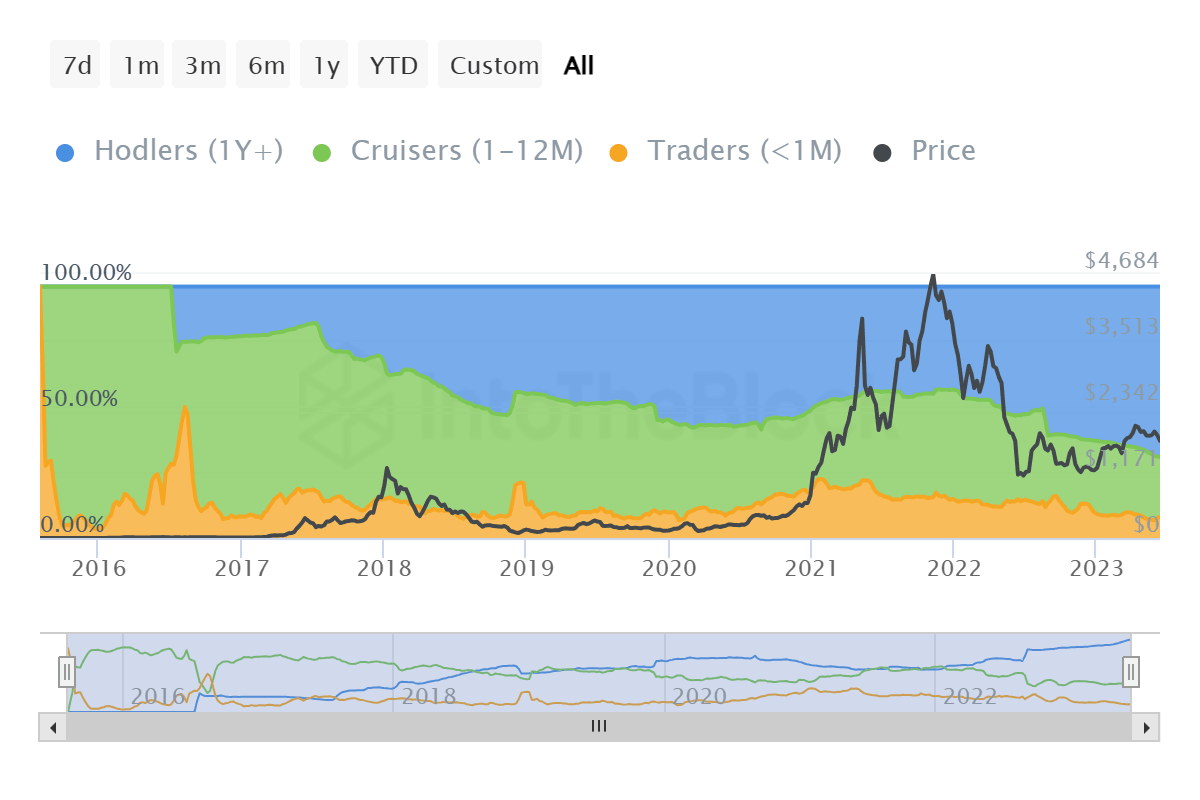

This seems to have spooked ETH holders significantly, as one of the most loyal cohorts of the cryptocurrency exhibited skepticism this week. The long-term holders that have had their supply untouched for a period of more than 12 months moved their supply this week. In doing so, they marked a spike in the coin age consumed which is a bearish sign for the altcoin during weak markets.

Ethereum age consumed

By the looks of it, this could have been an institutional move, as the spike took place just before the Fed scaled back on the proposition of raising interest rates. As it is, institutional investors have been dismayed, and this was visible in the outflows registered for the week ending June 9.

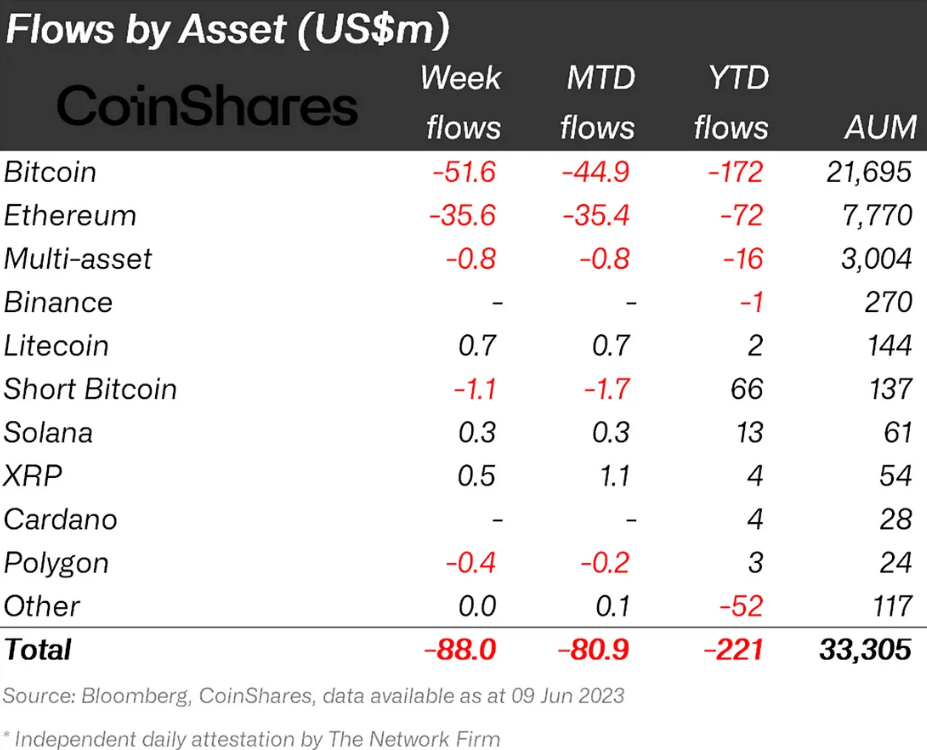

Ethereum outflows worth nearly $35.6 million were registered for the week ending June 9. These outflows ended up accounting for close to half the total outflows registered year to date in the case of ETH. Thus institutions might take a while to get back on the bullish side as, for now, a price recovery could be a while.

Institutional investors' net flows

Not much selling was observed by the long-term holders, however, despite a significant amount of supply being moved around. These investors dominate about 73% of the entire circulating supply of ETH, which has remained mostly unchanged despite the volatility this week.

Ethereum supply distirbution

Thus, ETH still largely has its investors’ support which could waver if the second-generation cryptocurrency ends up at the aforementioned March lows.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B19.25.14%2C%252015%2520Jun%2C%25202023%5D-638224445102115906.png&w=1536&q=95)